More U.S. adults are adding cryptocurrency to their portfolios, with ownership rising from roughly 21% in 2024 to 24%. Globally, over 560 million people, about 6.8% of the world’s population, now hold digital assets. In sectors from tech startups to wealth management, crypto’s inclusion in investment strategies is becoming strategic, not speculative. Explore how this shift is shaping financial decisions worldwide.

Editor’s Choice

- 28% of American adults, about 65 million people, own cryptocurrency in 2025, almost doubling since 2021.

- Global crypto ownership stands at 562 million individuals, or 6.8% of the world population.

- U.S. adoption rose from 21% in 2024 to 24% in 2025.

- Institutional interest grows; 59% of investors plan to allocate over 5% of AUM to crypto in 2025.

- Q1 2025 institutional crypto investments totaled $21.6 billion.

- Some hedge funds reduced Bitcoin ETF exposure in early 2025, though overall institutional demand remains mixed across different firms and strategies.

- Global crypto market cap surged to $4 trillion by mid‑2025.

Recent Developments

- The global crypto market cap hit $4 trillion by July 2025.

- BlackRock-managed funds, including Bitcoin ETFs, reportedly surpassed $100 billion in total AUM across crypto-related products by mid-2025, primarily due to Bitcoin ETF inflows.

- Crypto hedge funds, such as Tephra Digital, delivered up to 23% YTD gains, helped by a $700 billion market rally and $30 billion inflows into crypto products.

- Crypto companies like Circle ($35B valuation) and Bullish completed high-profile IPOs amid regulatory clarity.

- Surveys suggest around 30–35% of U.S. retail crypto investors made their first purchase in memecoins like Dogecoin or Shiba Inu, serving as entry points into the market.

- Proposed stablecoin regulations, such as the Genius Act, and other reforms are catalyzing institutional demand.

Global Crypto Ownership and Market Size

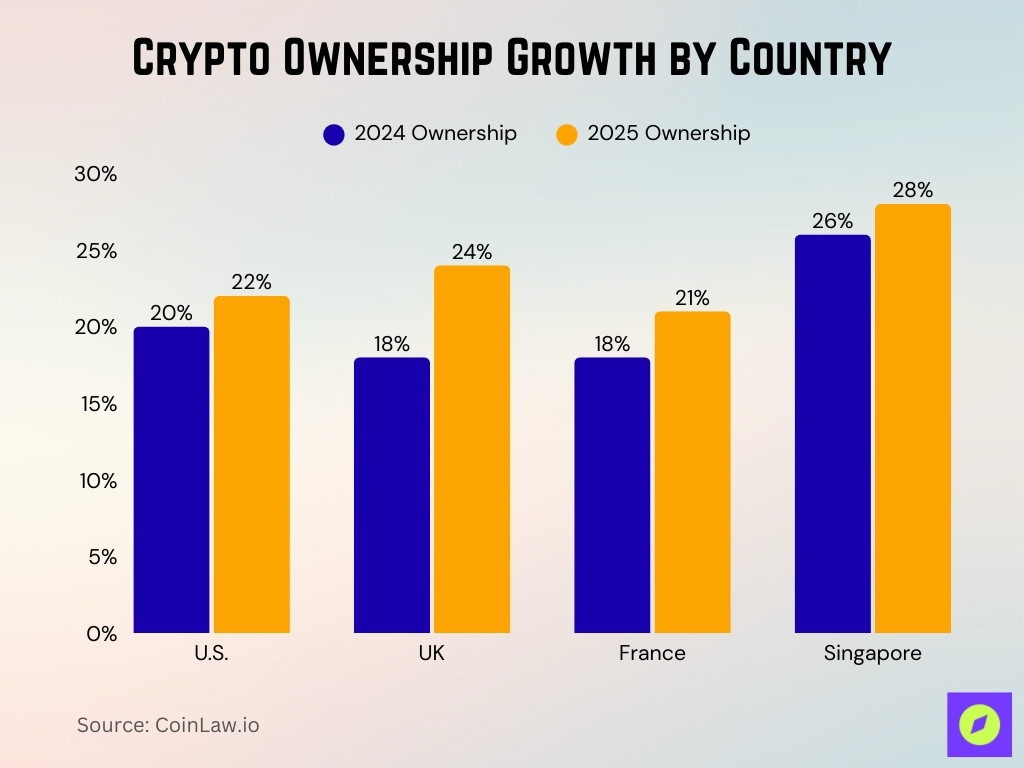

- Across major nations, crypto ownership grew from 2024 to 2025: U.S. 20% → 22%, UK 18% → 24%, France 18% → 21%, and Singapore 26% → 28%.

- Approximately 562 million individuals globally own cryptocurrency, representing 6.8% of the global population.

- The number of crypto owners has climbed 33% since 2023.

- In 2025, 28% of U.S. adults (≈ 65 million people) own crypto, up from 27% in 2024.

- Memecoins act as entry points; 30–35% of U.S. crypto owners first bought memecoins.

- Crypto ETFs are gaining traction; 39% of U.S. crypto holders now own ETFs, up from 37%.

- Ownership skews 67% male, 33% female, and the median owner age is 45.

Cryptocurrency Allocation in Investment Portfolios

- In 2025, 59% of institutional investors plan to allocate over 5% of AUM to crypto.

- 35% of institutions currently allocate 1–5% of portfolios to digital assets, 60% allocate more than 1%, and only 3% allocate above 20%.

- Q1 2025 institutional crypto investments reached $21.6 billion.

- Roughly 40–45% of private equity firms have some exposure to blockchain or digital assets as of 2025

- An estimated 15–20% of real estate investment companies are engaging in crypto through tokenized property or accepting crypto as payment, particularly in niche markets.

- Registered investment advisors and wealth managers hold a significant portion, approaching 50%, of Bitcoin ETF assets, as reported in early 2025.

- Retail investors dominate spot Bitcoin ETF flows, while institutional allocations remain below 10%, according to 13F filings and ETF analytics platforms.

Volatility and Risk Metrics of Crypto Portfolios

- Crypto markets remain highly volatile, evidenced by Bitcoin’s sharp price swings, such as rallies to nearly $112,000, then fluctuations.

- Institutional strategies are shifting, and hedge funds are reducing exposure, signaling responses to short-term volatility.

- Strategic allocations by advisors suggest a more risk-managed, long-term view of crypto assets.

- Regulatory clarity, such as ETFs and a stablecoin framework, is reducing perceived risk and boosting institutional comfort.

- Overall, crypto volatility is high, but evolving institutional frameworks aim to mitigate risk through structured allocation.

Public Perception of Cryptocurrency as an Investment

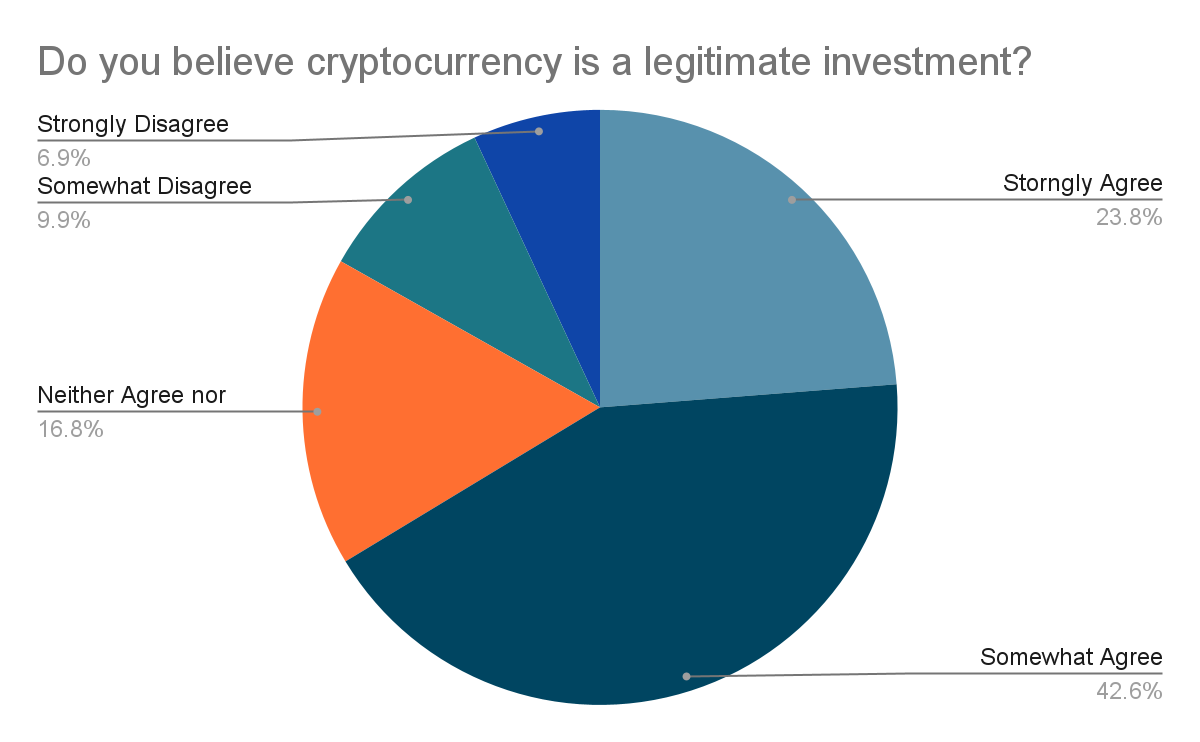

- 42.6% of respondents somewhat agree that cryptocurrency is a legitimate investment.

- 23.8% strongly agree, showing solid confidence in crypto’s legitimacy.

- 16.8% neither agree nor disagree, reflecting uncertainty in the market.

- 9.9% somewhat disagree, expressing moderate skepticism.

- 6.9% strongly disagree, rejecting crypto as a valid investment.

Risk-Adjusted Returns of Crypto-Integrated Portfolios

- Adding 1% Bitcoin to a traditional portfolio boosts Sharpe and Sortino ratios measurably, and even minimal exposure improves risk-adjusted returns.

- A model portfolio with 5% Bitcoin delivered a 26.33% cumulative return and a Sharpe ratio of 0.30, versus 18.38% and 0.17 without crypto.

- Bitcoin’s 10-year annualized return reached 77.65% with a volatility of 70.43%.

- Over the past 12 months, Bitcoin’s Sharpe ratio of 2.42 ranks it among the top 100 global assets, well above large-cap tech averages (~1.0).

- Some models show Sharpe ratios surpassing 4.0 during strong bull runs, underscoring exceptional risk-adjusted performance.

- Dynamic rebalancing strategies outperform static ones, enhancing both return and volatility control.

- Institutional adoption of Bitcoin improves overall portfolio risk-adjusted metrics, particularly when reallocating from equities.

Correlation Between Cryptocurrencies and Equity Markets

- Bitcoin’s five-year average correlation with the S&P 500 is approximately 0.38, rising to 0.70 during market turmoil like early 2025.

- Daily correlations from 2014 to April 2025 sit around 0.20, but increased through ~0.50 during 2020–2022, recently around 0.48.

- Corporate Bitcoin adoption correlates more closely with equities, studies find peaks up to 0.87 in 2024.

- Rolling correlations often spike during stressed markets, such as the early 2020 COVID sell-off, the Ukraine war in 2022, and early-2025 drawdowns.

- Bitcoin’s standard deviation remains 2–4× that of equities, yet correlations rise during turmoil, reducing diversification benefits.

- Coinbase’s inclusion in the S&P 500 (~0.11% weight) strengthens its ties to equities and may marginally increase crypto’s exposure in index funds.

- While crypto began as a hedge, increasing correlation suggests its role as a diversifier has weakened over time.

Ideal Age to Start Saving for Retirement

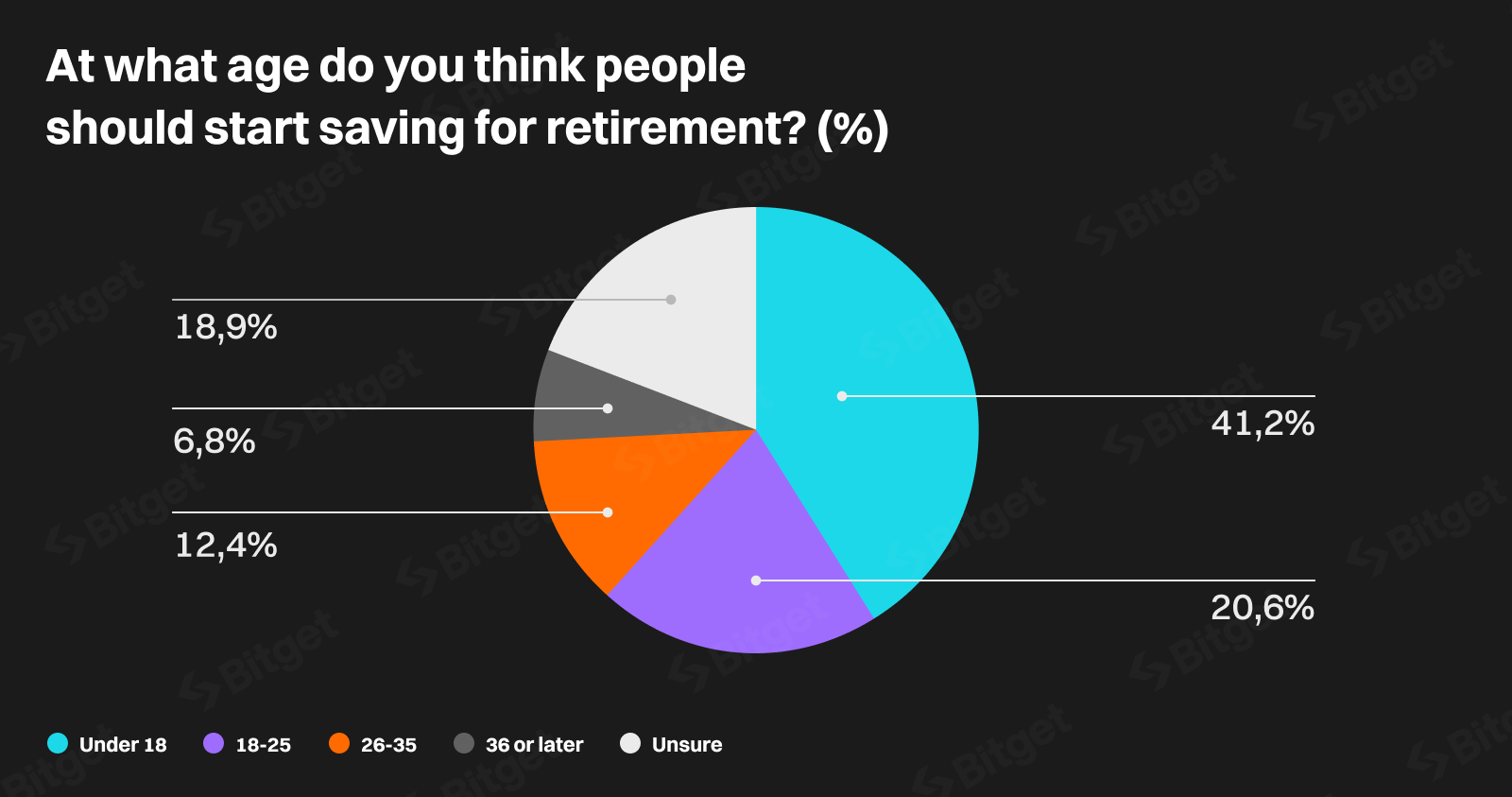

- 41.2% believe people should begin saving for retirement under 18.

- 20.6% think the ideal age is 18–25.

- 12.4% suggest starting between 26–35.

- Only 6.8% recommend beginning at 36 or later.

- 18.9% are unsure about when to start saving.

Portfolio Performance Statistics with Cryptocurrency

- A crypto-focused portfolio yielded 26.46% YTD and 76.25% annualized return over 10 years as of August 17, 2025.

- In comparison, the S&P 500 returned 9.66% YTD and 11.89% annualized over 10 years, spotlighting crypto’s superior growth.

- Crypto portfolios significantly outperform balanced allocations, but such returns come with higher volatility, requiring careful risk alignment.

- Hedge funds like Tephra Digital posted 10% YTD, and Edge Capital logged 7.3% YTD amid volatile markets.

- Even during volatility spikes, some quantitative strategies, such as long/short, achieved 6% YTD gains, demonstrating tactical resilience.

- Models incorporating hierarchical risk parity or GARCH‑Copula portfolio optimization outperform traditional allocations.

- Agent-based, dynamic allocation strategies deliver stronger out-of-sample Sharpe and Sortino ratios than static weighting.

Contribution of Bitcoin and Ethereum to Portfolio Performance

- Bitcoin often contributes more to risk-adjusted returns given its liquidity and deep markets, especially when comprising 1–5% of portfolio weight.

- Ethereum (and other altcoins) can enhance upside but bring more volatility and structural risk; allocations tend to be lower.

- During bull cycles, Ethereum may outperform on raw return but lags Bitcoin in Sharpe due to higher drawdowns.

- When Bitcoin and Ethereum move in tandem, combined exposure raises overall portfolio correlation, builders allocate diversely to soften overlap.

Diversified Crypto Portfolio Example

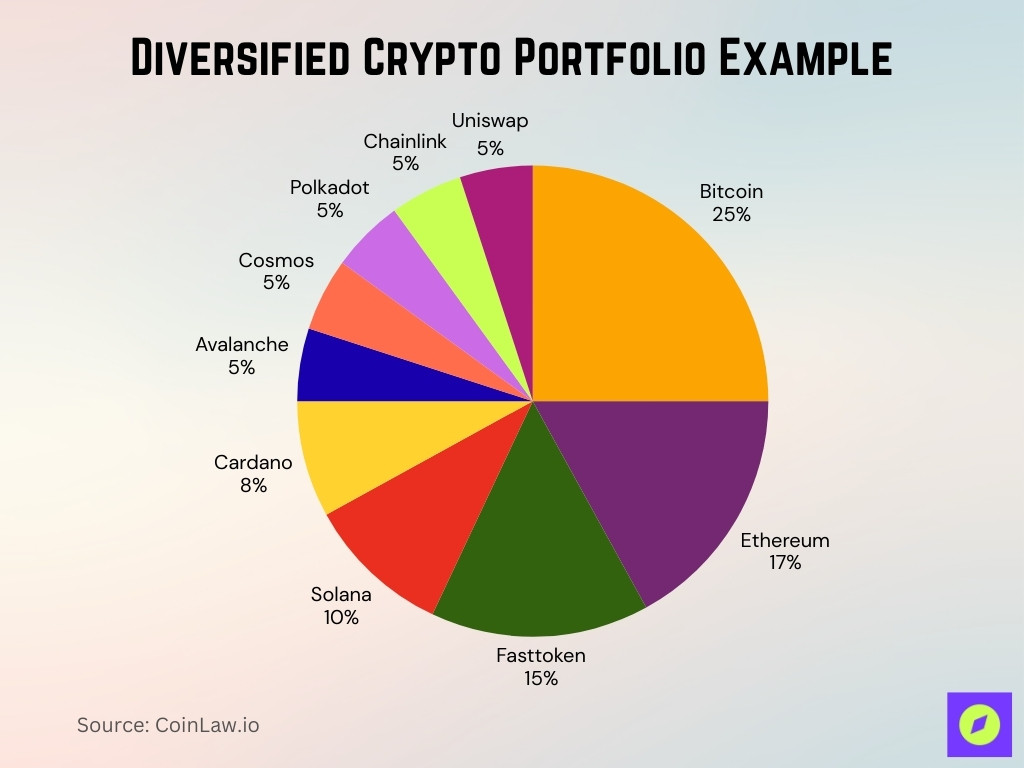

- Bitcoin (BTC) holds the largest share at 25% of the portfolio.

- Ethereum (ETH) makes up 17%, reinforcing its role as a strong secondary asset.

- Fasttoken (FTN) is allocated 15%, giving it a notable presence.

- Solana (SOL) accounts for 10%, showing confidence in high-performance blockchains.

- Cardano (ADA) represents 8%, adding balance with its long-term growth focus.

- Avalanche (AVAX), Cosmos (ATOM), Polkadot (DOT), Chainlink (LINK), and Uniswap (UNI) each hold 5%, providing diversification across multiple projects.

Stablecoins’ Role in Portfolio Structure

- The global stablecoin market reached approximately $255 billion by June 2025, with nearly 99% pegged to the U.S. dollar.

- Major fiat‑backed stablecoins include USDT, USDC, and BUSD; these dominate the stablecoin landscape.

- Stablecoins simplify crypto trading, letting investors conveniently switch into a stable asset during market volatility.

- Used heavily for cross-border payments, especially in emerging markets, stablecoins offer speed and cost advantages.

- U.S. legislation, the GENIUS Act, now requires stablecoins to be backed 1:1 by high-quality assets.

- In the EU, MiCA provides a legal framework for stablecoins; Hong Kong and the UAE have also adopted formal regulations.

- The DWS CEO describes stablecoins as a “gigantic market” unfolding in institutional workflows.

Altcoins’ Share in Portfolio Allocations

- Bitcoin dominance dropped from 65% in May 2025 to 59% in August, as altcoin capitalization surpassed $1.4 trillion.

- Retail allocators show interest shifting, altcoin season index remains low (~40s), but broader capital rotation is underway.

- Institutional portfolios allocate ~67% to BTC and ETH combined, versus 37% for retail investors.

- The search for yield and diversification is pushing interest toward altcoins with utility, such as AI and infrastructure-focused.

- Ethereum recently rallied nearly 42% year-to-date, closing in on record highs, highlighting investor interest in altcoins.

- ETF interest in Ether is rising alongside Bitcoin, enhancing its relevance in institutions’ altcoin exposure.

Institutional vs. Retail Allocation to Crypto Assets

- 75% of institutional investors plan to increase crypto allocations in 2025, marking a shift from speculative to strategic use.

- A survey of 352 institutional investors shows 83% plan to expand crypto exposure in 2025, 59% already targeting over 5% AUM.

- Institutions often concentrate portfolios in BTC and ETH (67%) compared with retail (37%).

- 35% of institutions currently allocate 1–5% to digital assets, 60% allocate more than 1%.

- Only 3% of investors allocate more than 20% of their portfolios to digital assets.

- Smaller institutions (AUM 1%) than larger institutions (> $500B).

Dynamic Allocation Strategies Involving Cryptocurrencies

- Including a 10% crypto allocation (BTC + ETH) in a combined portfolio significantly boosts return and Sharpe ratio, with marginal volatility or drawdown increases.

- Dynamic dilution (DD90/10) portfolios using EWMA or GARCH models achieved ~10.1–10.4% returns, Sharpe ratios of ~1.04–1.06 vs. baseline Sharpe of 1.00.

- Multi-agent AI strategies (static vs. rolling-window optimization) yield stronger risk-adjusted returns, especially during volatile markets.

- Markowitz + GARCH-Copula optimization combining crypto with traditional assets yields portfolios with higher Sharpe ratios and more stable performance.

- Optimization using network analysis, price forecasting, and portfolio theory helps identify profitable crypto portfolios under uncertainty.

Sharpe Ratio Analysis Including Crypto Assets

- Adding Bitcoin to a 60/40 portfolio steadily raises the Sharpe Ratio up to a 5% weight, after which gains plateau.

- An ideal 71.4% BTC and 28.6% ETH crypto-only mix yields a Sharpe of 1.43, outperforming 100% Bitcoin (1.16) or 100% Ether (0.83).

- 10–20% BTC allocation for individual investors consistently improves returns and Sharpe Ratio across both lump sum and rolling portfolios.

Standard Deviation and Value-at-Risk in Crypto Portfolios

- Crypto portfolios typically display a standard deviation 2–4× that of equities, reflecting extreme volatility.

- In the DD90/10 dynamic portfolios, volatility remained similar (~9.7–9.8%) compared to the traditional 8.2% baseline, while return and Sharpe improved.

- GARCH‑Copula optimized portfolios consistently show lower tail risk (VaR) and more stable performance than crypto-only or traditional portfolios.

Strategic Approaches to Crypto Risk Management

- Static caps (e.g., ≤10% crypto exposure) provide a simple yet effective risk control strategy.

- Dynamic rebalancing using tools like EWMA or GARCH models enables volatility-controlled exposure adjustments.

- Agentic AI strategies offer scalable, auditable, and adaptive portfolio allocation, especially valuable in fast-moving crypto markets.

- Incorporating clean or ESG-focused cryptocurrencies may boost portfolio resilience while addressing environmental and regulatory expectations.

- Tailored models, like GARCH-Copula or network analysis, help manage tail risk and correlation shifts effectively.

Long-Term vs. Short-Term Portfolio Statistics with Crypto

- Long-term allocations (5–10 years) feature crypto outperforming traditional benchmarks in both raw return (~76% annualized) and risk-adjusted terms (Sharpe >1).

- Short-term dynamic strategies and rebalancing help navigate volatility and improve performance in turbulent episodes.

- Strategic allocations under 10% via long-term investing yield boosted returns with manageable risk profiles.

Regulatory Trends Affecting Portfolio Crypto Allocations

- The U.S. enacted the GENIUS Act in July 2025, solidifying stablecoin regulatory frameworks.

- MiCA continues as the EU’s foundational crypto regulation, with Hong Kong and the UAE advancing stablecoin licensing and oversight.

- Major banks, like Citigroup, are entering stablecoin custody and payment services, expanding institutional infrastructure.

- Regulatory clarity underpins surging institutional flows and ETF growth in both Bitcoin and Ethereum markets.

Conclusion

Cryptocurrency continues to reshape the world of investment portfolios. A modest crypto allocation (1–10%), particularly in BTC and ETH, often yields superior risk-adjusted returns, enhanced portfolio performance, and added diversification. Dynamic optimization models, AI-led strategies, and thoughtful risk management frameworks further refine these benefits, especially in turbulent markets. Stablecoins offer strategic liquidity and regulatory appeal, while altcoins present growth opportunities amid shifting market cycles. Growing institutional adoption, backed by evolving regulatory clarity, solidifies crypto’s place in portfolios. For U.S. investors and global market participants alike, integrating crypto demands a balance of strategy and prudence.

Disclaimer: The content published on CoinLaw is intended solely for informational and educational purposes. It does not constitute financial, legal, or investment advice, nor does it reflect the views or recommendations of CoinLaw regarding the buying, selling, or holding of any assets. All investments carry risk, and you should conduct your own research or consult with a qualified advisor before making any financial decisions. You use the information on this website entirely at your own risk.