Takeaway: By serving as a proxy for U.S. debt, Ethereum is at the center of the digital dollar system — a move our Digital Assets team was ahead of.

Over the weekend I bought one of my favorite paintings.

John Curry’s Our Good Earth was a World War II poster urging Americans, particularly farmers, to support the war effort by buying bonds. Hence the bold call: “BUY WAR BONDS.”

Fast forward to today, and the tables have turned—or perhaps progressed.

The U.S. still needs buyers of its debt, but the mechanics are shifting.

Instead of Americans being urged to buy war bonds, the modern version of that poster might read: “BUY STABLECOINS.”

Stablecoins, digital assets backed by U.S. Treasuries and dollars, serve as a second-derivative buyer of government debt.

Rather than purchasing bonds directly, investors mint or hold stablecoins, which are then collateralized by U.S. debt.

|

This dynamic helps answer the critical question: Who buys our debt now? |

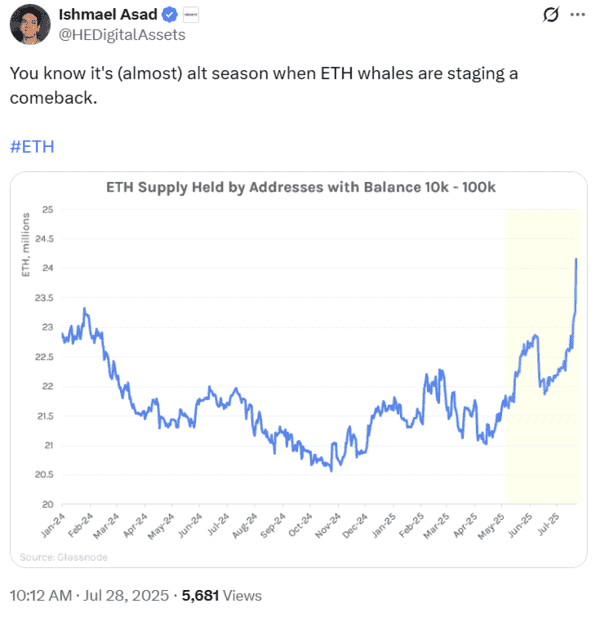

Ishmael on Ethereum — the new channel for global dollar demand

If you’ve been following Digital Assets Analyst Ishmael Asad, you know he’s been ahead of the curve on Ethereum. He was one of the first to connect stablecoins to sovereign debt demand, highlighting that:

|

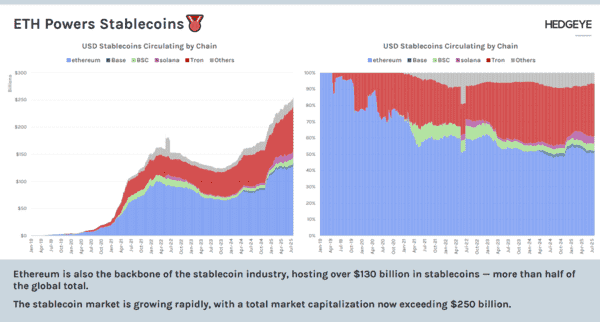

“Ethereum is the backbone of stablecoins. Roughly 50%+ of stablecoin market cap (USDT, USDC, DAI) settles on Ethereum rails.” |

This makes ETH more than just a “tech token.” It’s the infrastructure layer where digital dollars meet real-world debt markets—a second-derivative buyer of U.S. debt at scale.

|

Ishmael alongside the Digital Assets team have been all over this development:

|

Ethereum’s link to stablecoins and U.S. Treasuries makes it the backbone of digital dollars — a powerful tailwind as institutional investors continue to pile in.

Fundamentals, Macro, AND POLICY: The PERFECT STORM

Fundamentals: Ethereum remains the backbone of the digital dollar system.

Over half of all stablecoins run on its rails, and more than $80 billion is locked in lending, staking, and tokenized finance built directly on Ethereum.

Every time those dollars move, they run through ETH.

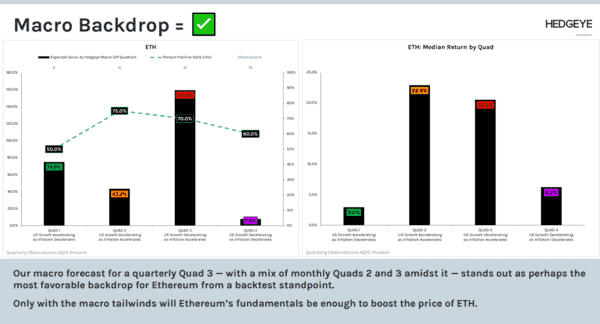

Macro: Ethereum has historically thrived when the U.S. economy slows while inflation runs hot—exactly the backdrop today.

Backtests show ETH delivers some of its best returns in Quad 3 (with strength in Quad 2 as well).

We’re currently in a Quarterly Quad 3 alongside a Global Quad 2—prime conditions fueling the rally we’re seeing now.

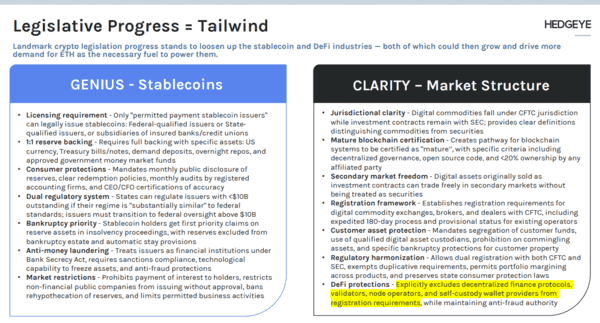

Policy: Washington is finally providing clarity instead of resistance.

Stablecoins will be fully backed, DeFi is gaining regulatory breathing room, and Ethereum is becoming further embedded in the global financial system.

Put it all together, and the setup is rare: Ethereum has inelastic corporate demand, a favorable macro regime, and regulatory clarity all at once. That’s why Ish’s call on ETH as the channel for digital dollars is being validated in real time.

And it’s also why Hedgeye CEO Keith McCullough said “Of anything that’s been pitched so far, it’s the most bullish setup” on The Pitch.

Ishmael’s Call AND KEITH’s green light

Back in May, Ishmael Asad and the Hedgeye Digital Assets team planted the flag: ETH was a Best Idea Long. Since then, corporate treasuries, institutional flows, and macro tailwinds have validated the call.

The results speak for themselves. ETH is up 71.5% since being added to their Best Idea Long List, and up 22.6% since joining ETF Pro (ETHA) on August 4, 2025.

For more timely calls backed by Fundamentals, Macro, and Policy, subscribe to Digital Assets Pro for institutional level research on Digital Assets and use our #GoAnywhere approach by investing in ETFs through ETF Pro Plus.