Key Insights

- Cross-chain intent-based swaps are live on DeGate across Ethereum, Solana, Base, Arbitrum, Optimism, Polygon, and Avalanche, enabling users to trade across networks using a unified interface with gas-free execution.

- Gas abstraction allows users to pay for all swap-related gas costs in USDC. DeGate’s solver network handles execution across supported chains, enabling users to consolidate liquidity in a single stablecoin in the DeGate stablecoin-powered wallet.

- DeGate’s stablecoin-powered multichain wallet enables secure, self-custodial key generation for multiple EVM and non-EVM chains. DeGate’s wallet architecture removes the need to acquire or native gas tokens or set up multiple wallets.

- DeGate’s Meme Signals recently identified the SPARK memecoin, which appreciated 78x from identification. DeGate’s Meme Signals identifies early-stage memecoin trends by tracking high-performing wallets.

- DeGate integrated xStocks to bring tokenized U.S. equities and ETFs to DeGate. Users can trade xStocks directly and access customized yield strategies on xStocks through DeGate’s Alpha Hub.

Primer

DeGate (DG) is a non-custodial multichain decentralized exchange (DEX) designed to remove the friction of interacting with assets across blockchain. It began as an Ethereum Layer-2 (L2) orderbook exchange leveraging zero-knowledge rollup technology to deliver low-cost, high-throughput spot trading secured by Ethereum. However, on June 18, 2025, DeGate announced it would sunset the orderbook exchange and focus on intent-based cross-chain swaps, enabling users to buy any token without bridging, native gas tokens, or complex wallet setup.

As of Aug. 13, 2025, DeGate supports intent-based swaps across Ethereum, Solana, Base, Arbitrum, Optimism, Polygon, and Avalanche. Users can express a trade intent, such as “Buy SOL with USDC.” DeGate solvers execute the trade, source liquidity, and deliver tokens to the user’s address on the target chain. All transactions are settled in USDC, which enables DeGate to abstract away gas fees, while DeGate’s solvers handle all gas requirements on destination chains, allowing users to maintain liquidity in a single stable asset across ecosystems.

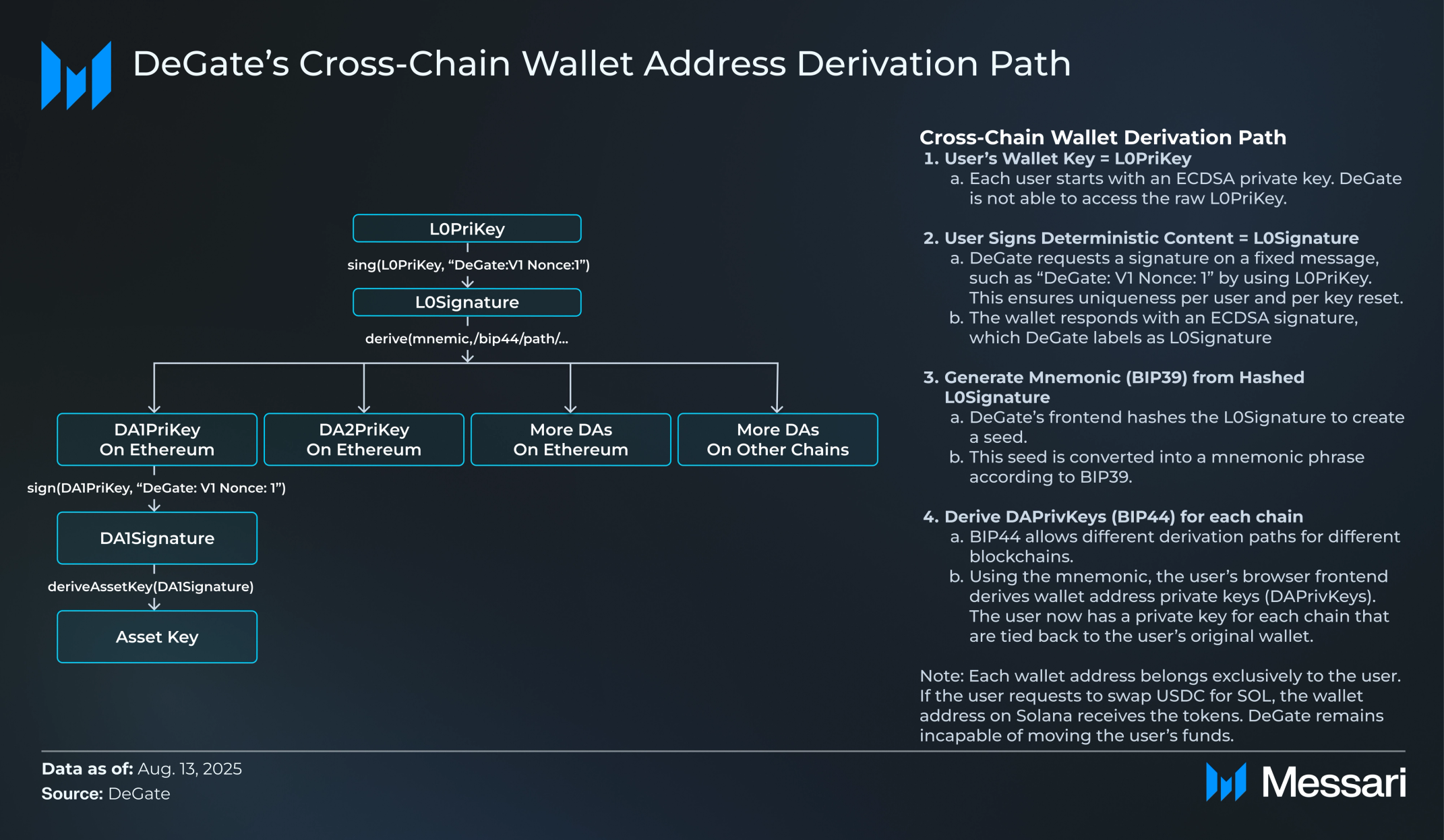

DeGate’s stablecoin-native design is enabled by DeGate’s deterministic wallet architecture, which derives chain-specific keys locally in the browser from the user’s connected Ethereum wallet. Keys are never stored or transmitted, ensuring full self-custody while enabling secure interaction with EVM and non-EVM networks.

In addition to swaps, DeGate offers complementary features aimed at expanding onchain participation. The Alpha Hub provides curated yield opportunities and airdrop campaigns, Meme Signals tracks smart wallet activity to discover early memecoin trends, and xStocks allow trading of tokenized U.S. equities onchain. These tools position DeGate as a stablecoin-powered access layer for decentralized markets, integrating trading, yield generation, and market discovery within a single, self-custodial platform.

DeGate’s Strategic Shift

DeGate’s Focus on Intent-Based Cross-Chain Swaps

On June 18, 2025, DeGate announced it would discontinue its Ethereum Layer-2 (L2) orderbook exchange. The orderbook had provided a decentralized alternative to centralized orderbook exchanges, offering a smooth trading experience with high throughput and low fees. However, liquidity fragmentation and limited asset availability within a single L2 constrained its ability to deliver a comprehensive, cross-ecosystem trading experience. To address these issues, DeGate has shifted its offering to an intent-based, cross-chain model designed to meet the growing demand for universal market access.

On DeGate’s Intent-based platform, users express a trade intent such as “Buy SOL with USDC,” and DeGate’s solver network manages every step of execution. This includes sourcing liquidity on the target chain, performing the swap, paying all required gas fees, and delivering the purchased tokens directly to the user’s wallet. All trades settle in USDC, allowing users to operate from a single stable asset directly from the DeGate wallet without acquiring native gas tokens or managing multiple wallets.

DeGate’s Wallet Architecture

DeGate’s stablecoin-focused model is enabled by its wallet architecture, which extends a single Ethereum wallet across multiple blockchains without requiring additional wallet setups or custodial intermediaries. Users can onboard in multiple ways, including connecting an existing Ethereum wallet, creating a new wallet via email login through Privy, or generating a wallet directly in the DeGate mobile app. This flexibility lowers barriers to entry while preserving the platform’s self-custodial foundation.

When a user connects their Ethereum wallet, DeGate generates chain-specific private keys locally in the browser. These keys are derived from the user’s Ethereum account through cryptographic methods and are never stored on DeGate’s servers or transmitted over the network. Instead, they are held temporarily in the browser’s session storage and are automatically cleared when the session ends.

To further protect private keys, DeGate isolates signing operations from the rest of the application interface, reducing exposure in the event of a front-end compromise. This design ensures users retain full self-custody while enabling secure interaction with EVM and non-EVM chains. By linking DeGate’s wallet with its gas abstraction system, DeGate can deliver purchased tokens directly to the user’s address on the destination chain without requiring manual wallet configuration.

The DeGate wallet is available for download on the iOS App Store and Google Play, extending its secure, cross-chain functionality to mobile users. This availability allows traders to access intent-based swaps, yield opportunities, and DeFi tools on the go, with the same USDC-powered gas abstraction and self-custodial security as the desktop interface.

Stablecoin Powered Gas Abstraction

USDC is at the core of DeGate’s wallet and intent-based cross-chain swaps, functioning as the sole asset for trade settlement and gas costs across all supported chains. By consolidating all transaction requirements into a single stablecoin, DeGate removes the need for users to hold native gas tokens, a common friction point in cross-chain activity.

As of Aug. 13, 2025, DeGate supports swaps across Ethereum, Solana, Base, Arbitrum, Optimism, Polygon, and Avalanche. On swaps across these networks, gas fees are covered by DeGate’s solver network, with the USDC equivalent deducted from the user’s balance. This design keeps user liquidity concentrated in a stable asset, simplifies accounting, and eliminates the need to manage small residual balances on multiple networks.

The stablecoin-native model is one of DeGate’s key differentiators in the cross-chain DEX landscape. It allows users to treat USDC as their operational base currency for DeFi participation, streamlining the onboarding process and day-to-day execution.

Product Expansion

Alpha Hub

Alpha Hub is DeGate’s curated gateway to yield opportunities and airdrop campaigns across multiple blockchain ecosystems. It aggregates vetted DeFi pools, staking programs, and promotional incentives into one interface, eliminating the need for users to navigate between separate dApps. By centralizing discovery and execution, Alpha Hub enables faster decision-making, reduces the risk of missing time-sensitive campaigns, and allows users to manage opportunities alongside their core trading activity. As of Aug. 13, 2025, Alpha Hub’s featured airdrop campaigns include the Monad testnet and MegaETH testnet farming strategies, providing users with structured participation guides. Beyond airdrops, the Alpha Hub provides guides on accessing high-yield opportunities across onchain concentrated liquidity pools and lending markets, including opportunities on Euler, Morpho, Amnis Finance, and Raydium. This blend of campaign access and yield guides makes the Alpha Hub a one-stop interface for active traders and long-term DeFi participants seeking to maximize returns.

Meme Signals

Meme Signals is DeGate’s dedicated tool for identifying emerging memecoin trends by tracking the activity of high-performing wallets. The platform aggregates data from carefully selected onchain sources, filtering out noise and highlighting only the most promising opportunities. This targeted approach is designed to give traders an informational edge in one of the fastest-moving segments of the crypto market.

The tool has recently flagged several high-performing tokens, including SPARK (78x), Clippy (9x), Internet (4x), and ORANGE (2x), after they were identified on DeGate’s Meme Scanner. By surfacing these opportunities early, Meme Signals allows users to capitalize on trends before they reach broader awareness. This performance record underscores the potential value of combining curated onchain intelligence with timely execution.

Integrated directly into DeGate’s interface, Meme Signals enables users to act on identified opportunities without leaving the platform. Traders can use DeGate’s intent-based swap execution to buy tokens across supported chains without bridging or managing native gas tokens. This tight integration shortens the time from signal to execution, often critical in the volatile memecoin market.

xStocks

xStocks brings tokenized U.S. equities and ETFs to DeGate, powered by Backed, a real-world asset (RWA) issuer. Founded in 2021, Backed bridges traditional capital markets to blockchain, creating neutral, composable tokenized assets for the common good. Each xStock token is backed 1:1 by the underlying security and issued on Solana, enabling secure, transparent, and verifiable onchain ownership.

Through DeGate, users can trade a range of high-profile equities and ETFs, including Tesla (TSLA), SPDR S&P 500 ETF (SPY), MicroStrategy (MSTR), NVIDIA (NVDA), Circle (CRCL), Invesco QQQ Trust (QQQ), Apple (AAPL), Amazon (AMZN), SPDR Gold Shares (GLD), Alphabet (GOOGL), Meta (META), and McDonald’s (MCD). Trades are settled in USDC, aligning with DeGate’s stablecoin-native design, and can be executed 24/7 without commissions or traditional brokerage restrictions.

Beyond trading, xStocks are DeFi-ready and freely transferable, opening opportunities for integration into decentralized lending, derivatives, and asset management protocols. DeGate also offers customized liquidity provision opportunities for xStocks directly from its dashboard, allowing users to supply capital to selected tokenized equity pools and earn fees or rewards. This flexibility enables investors to build hybrid portfolios of crypto assets and tokenized equities while generating yield in a single, self-custodial environment. By combining Backed’s regulatory-compliant issuance with DeGate’s cross-chain infrastructure, DeGate acts as a gateway to traditional and decentralized markets.

Closing Summary

DeGate’s shift to intent-based cross-chain swaps is anchored by its wallet architecture, where USDC functions as the single asset for trade settlement and gas fees across all supported networks. This approach removes a major friction point in DeFi by eliminating the need for users to hold native gas tokens or manage small balances across multiple chains. Paired with DeGate’s deterministic wallet architecture, users can execute trades, receive assets, and cover all costs in one asset, streamlining both onboarding and daily activity in a secure, self-custodial environment.

The platform’s product suite extends beyond swaps to include Alpha Hub for curated DeFi opportunities, Meme Signals for identifying early-stage token trends, and xStocks for 24/7 onchain access to tokenized U.S. equities and ETFs. By combining unified execution, seamless cross-chain interoperability, and a growing set of integrated trading and yield tools, DeGate provides a single environment for trading, yield generation, and market intelligence. With support for Ethereum, Solana, Base, Arbitrum, Optimism, Polygon, and Avalanche, DeGate is positioned to serve users seeking frictionless USDC-powered access to a global pool of digital and tokenized assets.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by DeGate. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization may have input on the content of the report, but Messari maintains editorial control over the final report to retain data accuracy and objectivity. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.