Pump Fun Coin (PUMP) posted an 11% gain in the past 24 hours, trading near $0.00313, diverging from its bearish 21% weekly and 25% monthly downward trend.

The move pushed Pump Fun Crypto into the top gainers list, alongside top coins like Chainlink, OKB, Aerodrome Finance, Conflux, and Algorand, despite the broader crypto market experiencing only a 1.98% uptick in total capitalization.

This recovery overlaps with aggressive token buybacks, rising revenue dominance on Solana’s launchpad ecosystem, and fresh whale activity from Wintermute, suggesting renewed bullish appetite even as technical signals remain fragile.

Pump.fun Reclaims Solana Launchpad Top Spot

After losing some ground to competitor Bonk.fun in July, Pump.fun has regained its position as the leading memecoin launchpad on Solana. From August 4 to 17, the platform earned 62% of launchpad revenue, amounting to $16.7 million, and handled 55.6% of trading volume, which totaled $1.4 billion.

READ MORE: What is the Winklevoss Twins’ Net Worth Ahead of Gemini IPO?

This success led to $13.48 million in revenue during the week of August 11 to 17, making it Pump Fun’s highest week since February, according to DeFiLlama.

Daily $PUMP buybacks have reinforced the resurgence. In the past 24 hours alone, the protocol purchased $1.84 million worth of tokens, offsetting over 1% of the total supply.

Cumulative purchases now exceed $46 million, tightening circulating liquidity and creating upward price pressure.

This buyback-driven cycle is central to Pump Fun’s tokenomics. With annualized revenue now topping $321M and holder revenue at $411M, even modest retention of current activity could sustain consistent supply reduction.

Big Money Returns to $PUMP

On-chain data also points to heightened whale involvement. Market-making giant Wintermute has been spotted accumulating large volumes of PUMP coins, with transactions ranging from 10 million to 111 million tokens in a single day.

Traders on Crypto Twitter highlighted the pattern as consistent with Wintermute’s market-making strategy of shaking out weak hands through staggered sells before accumulation.

As one analyst noted, “CT is full of FUD, but those who wanted out have already sold. Meanwhile, the Pfun team keeps building, even rolling out a mobile app during heavy sell pressure.”

That mix of strategic buybacks and whale absorption has helped counter community skepticism about whether Pump.fun is merely exit liquidity.

Pump Fun Coin Price Action at a Crossroads

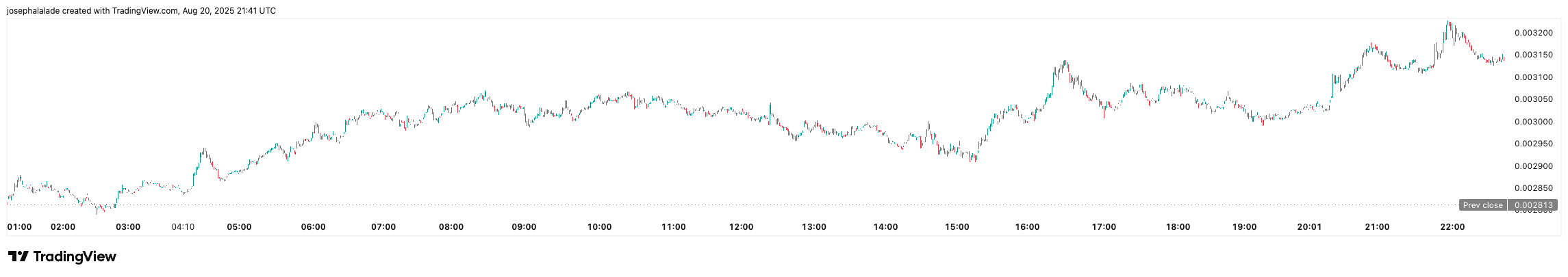

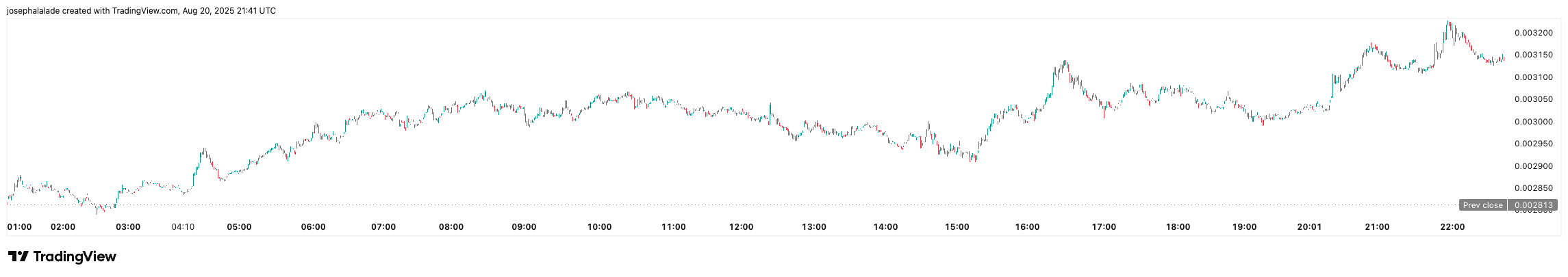

The Pump Fun Crypto price rally has yet to break free of broader downtrend pressure. Oscillator readings show RSI (14) at 41.7 and Stochastic at 12.6, signaling mildly oversold conditions that justify short-term relief. The MACD histogram has flipped positive, suggesting tentative bullish divergence.

PUMP/USDT | TradingView

Still, the daily technicals remain skewed bearish. Moving averages are stacked against the token, with the 20-day, 50-day, and 100-day SMAs all flashing sell signals.

Traders now eye resistance at $0.00398, the 23.6% Fibonacci retracement as the first upside hurdle. A break above could open room to $0.0045, but failure risks a retest of the $0.0028 support zone, where liquidity has clustered.

Volume trends add another wrinkle. Pump Fun’s $269M 24h turnover highlights intense speculative churn, but whether buyers sustain momentum into the weekend will likely determine if the rebound is a base-building event or just a dead cat bounce.

READ MORE: Chainlink Price Eyes $30 Breakout on Whale Accumulation, Supply Squeeze