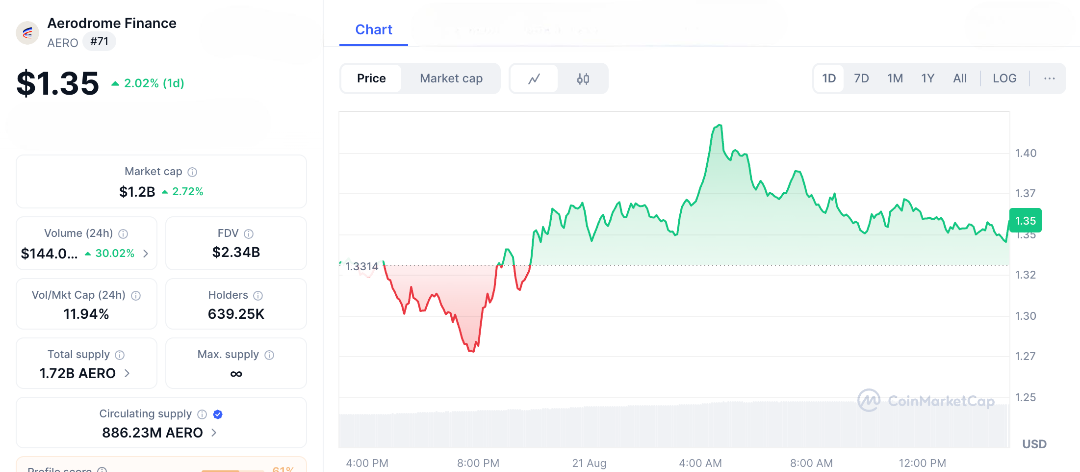

AERO, the governance token of Aerodrome Finance on Coinbase’s Base network, has shot up to $1.36, driven by a massive increase in decentralized exchange (DEX) volume. Imagine a previously quiet layer-2 chain turning into a busy marketplace, with DEXs handling billions in trades. AERO rewards both liquidity providers and voters, offering yields that compete with traditional finance.

Called the “Uniswap of Base,” Aerodrome has seen its total value locked exceed $2 billion. This has attracted traders looking for faster, more efficient transactions compared to Ethereum’s high gas fees. From Bitcoin halving excitement to Solana’s quick transactions, AERO’s rise marks a new era in layer-2 technology, blending innovation with opportunity and potentially sparking a major rally in the Base ecosystem.

AERO Takes Flight

The story of AERO starts in Base, Coinbase’s Ethereum layer-2 designed to scale without bottlenecks. Aerodrome Finance quickly positioned itself as the go-to DEX, using a ve(3,3) model that locks Aerodrome tokens for voting on emissions, creating a flywheel where liquidity attracts more liquidity. Early adopters staked Aerodrome for yields topping 50% on stablecoin pairs, but it was the recent DEX surge that supercharged growth. Base’s daily DEX volume hit $2.5 billion, surpassing rivals like Arbitrum and Optimism, fuelled by low-cost trades and integrations with apps like Friend.tech.

🚨 AERODROME IS ABOUT TO GO PARABOLIC

Top DEX on Base. Over $553M TVL. Backed by Coinbase.

And now… direct integration into Coinbase’s main app (8M+ MAUs) is coming in weeks.$AERO is down 68% from ATH but chart says higher highs are loading.

WHEN RETAIL RETURNS, THIS IS… pic.twitter.com/Npsli2c3ea

— Kyle Chassé / DD🐸 (@kyle_chasse) August 6, 2025

AERO has seen significant growth, with Aerodrome capturing over 60% of Base’s decentralized exchange (DEX) market share. The token’s value surged by 66% in one week to reach $1.36. This success wasn’t by chance; it came from strategic partnerships, shared liquidity pools, and airdrops that attracted and retained users. AERO’s open interest in futures markets has reached $80 million, with many traders betting on its continued growth. Its 24-hour trading volume hit $144 million, driven by large investors accumulating millions of tokens during the surge.

Base’s ecosystem is thriving, with over 1 million daily users taking advantage of low-cost transactions. This supports DeFi applications that rely on Aerodrome for token swaps. The DEX boom is largely due to Base’s EIP-4844 upgrade, which reduces data costs and enables trades for less than a cent, benefiting smaller investors avoiding Ethereum congestion.

Aerodrome token holders also benefit by voting on how emissions are directed to high-TVL (total value locked) pools, earning up to 100% APY (annual percentage yield) on volatile token pairs. If this momentum continues, analysts predict the token could reach $1.55 soon, with the potential to hit $2 in the long term if Base’s total value locked doubles to $10 billion.

The Exciting Rise of AERO and Base

AERO’s journey is fascinating because it’s key to the success of the Base network. Once overshadowed by Arbitrum, Coinbase’s Base now handles up to 50 million transactions a day, making it a leader in speed and efficiency. Aerodrome, with AERO at its center, has locked in $1.2 billion in total value, outpacing competitors like Uniswap v3 on the same network. This growth is linked to larger trends: Ethereum’s Dencun upgrade reduces costs for layer-2 solutions, attracting memecoins, NFTs, and yield farms to Base, all using DEXs like Aerodrome.

Whales, are also paying attention. On-chain data shows them increasing their Aerodrome holdings, betting on continued high volume as Base connects with more wallets and bridges. However, there are risks. AERO’s price can be quite volatile, and a 10% drop could test its $1.25 support level if the market sentiment turns negative due to concerns like Fed rate hikes. Competition is growing, with platforms like Velodrome on Optimism offering similar services, and there are worries about Base’s dependence on Coinbase, which may lead to centralization issues.

Despite these challenges, there is strong optimism. As Aerodrome reduces emissions to create scarcity, the deflationary effect could boost its value. If Base’s DEX volume maintains $2 billion daily, AERO as a governance token could reach $3 during a bull market.

AERO’s rise on the Base network feels groundbreaking, making layer-2 efficiency a reality and rewarding its supporters amidst a DEX boom. With record-breaking volumes and attractive yields, this could signal the start of Base’s dominance. The charts look promising, but the market will have the final say. Share this exciting story with your friends; Aerodrome could be the next big thing in the crypto world.

FAQs

What is AERO?

Aerodrome is the governance token of Aerodrome Finance, a leading DEX on Coinbase’s Base network, driving liquidity and token swaps.

Why did AERO hit $1.36?

AERO surged to $1.36 due to Base’s record $2.5 billion DEX volume and Coinbase’s in-app integration, boosting accessibility.

Will AERO continue rising?

Aerodrome could hit $1.55 or $2.33 if momentum holds, but overbought RSI at 70.84 suggests a possible $1.25 pullback.

What makes AERO unique?

AERO’s ve(3,3) model rewards liquidity providers and voters, cementing Aerodrome as Base’s top DEX with $2 billion TVL.

Is AERO a good investment?

Aerodrome’s growth on Base is promising, but volatility and competition require careful research before investing.