Key Notes

- Seven-year-old Bitcoin wallets worth $1.69 billion are being liquidated to fund massive Ethereum long positions totaling $334 million.

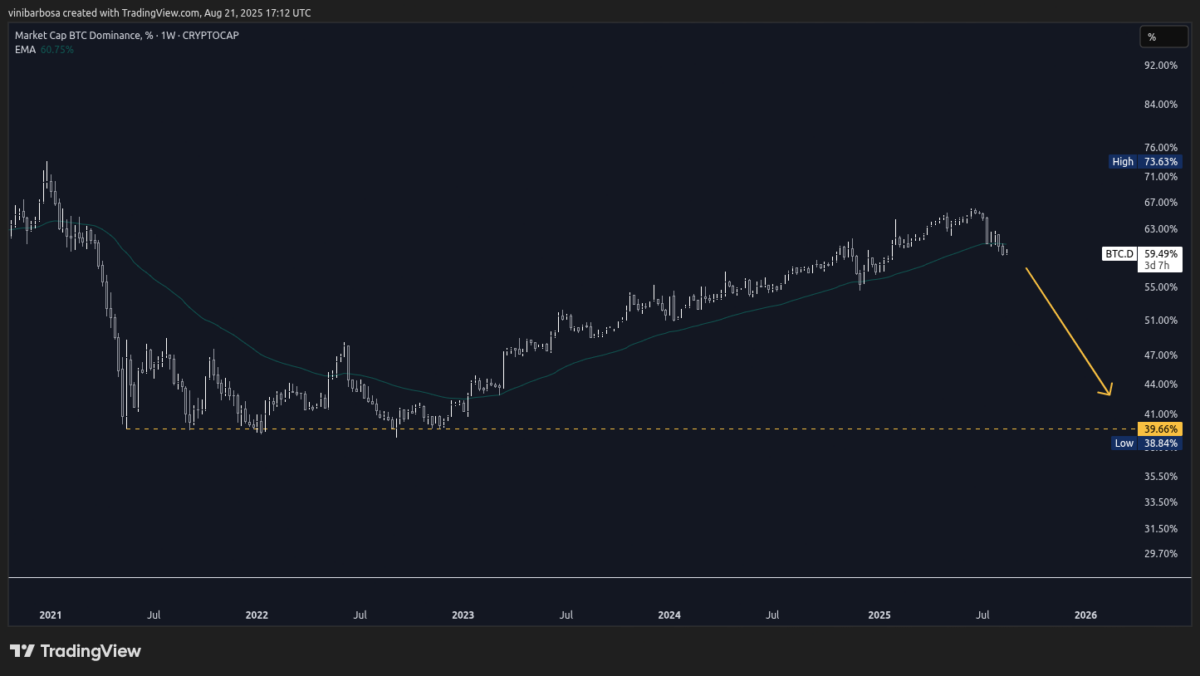

- Bitcoin dominance index breaks below key technical levels after losing its 2.5-year uptrend, confirming the altseason transition.

- Institutional capital flows now favor Ethereum ETFs over Bitcoin products while privacy coins gain search interest momentum.

An old Bitcoin

BTC

$112 572

24h volatility:

1.2%

Market cap:

$2.24 T

Vol. 24h:

$33.30 B

whale has been spotted selling millions of dollars of BTC to open leveraged long positions on Ethereum and spot buy ETH. This move is part of a broader capital migration trend from Bitcoin to altcoins like Ethereum

ETH

$4 260

24h volatility:

1.2%

Market cap:

$515.08 B

Vol. 24h:

$29.43 B

, signaling the altseason has started in the cryptocurrency market.

The activity has been reported by Lookonchain on X since August 21 post-midnight (UTC), which identified three connected ancient Bitcoin wallets that received 14,837 BTC seven years ago from Binance and HTX. Valued at $107.50 million at that time, this Bitcoin stack is now worth approximately $1.69 billion, according to Lookonchain’s calculations.

A Bitcoin OG holding 14,837 $BTC($1.69B) sold 670.1 $BTC($76M) today and opened massive longs of 68,130 $ETH($295M).

A whale deposited 670.1 $BTC($76M) to Hyperliquid in the past 20 hours and sold it, then went long on $ETH across 4 wallets with positions totaling 68,130… pic.twitter.com/2xdG2LjgYl

— Lookonchain (@lookonchain) August 21, 2025

According to a subsequent report, the “Bitcoin OG” went from longing Ethereum on Hyperliquid’s perpetual market—using four different wallets—to closing some of these risky positions and spot buying and holding 19,794 ETH, worth $85 million.

Nevertheless, his most recent activity was depositing 20 million USDC from the BTC sales to again open a 6x-leveraged long position on Ethereum. “He now holds ETH long positions totaling 78,265 ETH ($334M) across 5 wallets,” the analyst concluded.

This Bitcoin OG just created a new wallet and deposited 20M $USDC to go long on $ETH with 6x leverage.

He now holds $ETH long positions totaling 78,265 $ETH($334M) across 5 wallets.https://t.co/gle55iYVTchttps://t.co/0cy5OG65Js pic.twitter.com/TObynZWORL

— Lookonchain (@lookonchain) August 21, 2025

Altseason Approaches: Multiple Market Indicators Signal the Shift

This OG Bitcoin whale represents just one signal among several key indicators pointing toward an altseason. The most significant development has been TradingView’s Bitcoin Dominance Index (BTC.D) losing its 2.5-year uptrend above the 50-week exponential moving average (1W50EMA) during the first half of August. The index broke below this critical technical indicator and confirmed the reversal with two subsequent weekly candlesticks, marking a potential shift in market dynamics.

BTC.D currently stands at 59.49%, representing Bitcoin’s capitalization share of the total crypto market cap.

One-week chart for the Bitcoin Dominance Index (BTC.D) | Source: TradingView

Additionally, we have seen institutional moves, previously favoring Bitcoin, now favoring massive Ethereum allocations—also signaling capital rotation. On that note, BitMine recently consolidated as the world’s largest ETH treasury, with $6.6 billion in holdings, as Coinspeaker reported.

We also reported larger Wall Street capital flow to the Ethereum ETFs than to the BTC-based products, together with growing interest in privacy coins according to Google searches and Zcash’s shielded supply.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Vini Barbosa has covered the crypto industry professionally since 2020, summing up to over 10,000 hours of research, writing, and editing related content for media outlets and key industry players. Vini is an active commentator and a heavy user of the technology, truly believing in its revolutionary potential. Topics of interest include blockchain, open-source software, decentralized finance, and real-world utility.