Key Insights

- Raydium is one of the highest-yielding protocols in all of crypto. Annualizing Q2’s buyback allocation of $10.7 million, RAY had $0.21 in earnings per token (EPT) at Q2-end on an adjusted market cap (removing buybacks from circulating supply) of $441.7 million, a 9.7% yield.

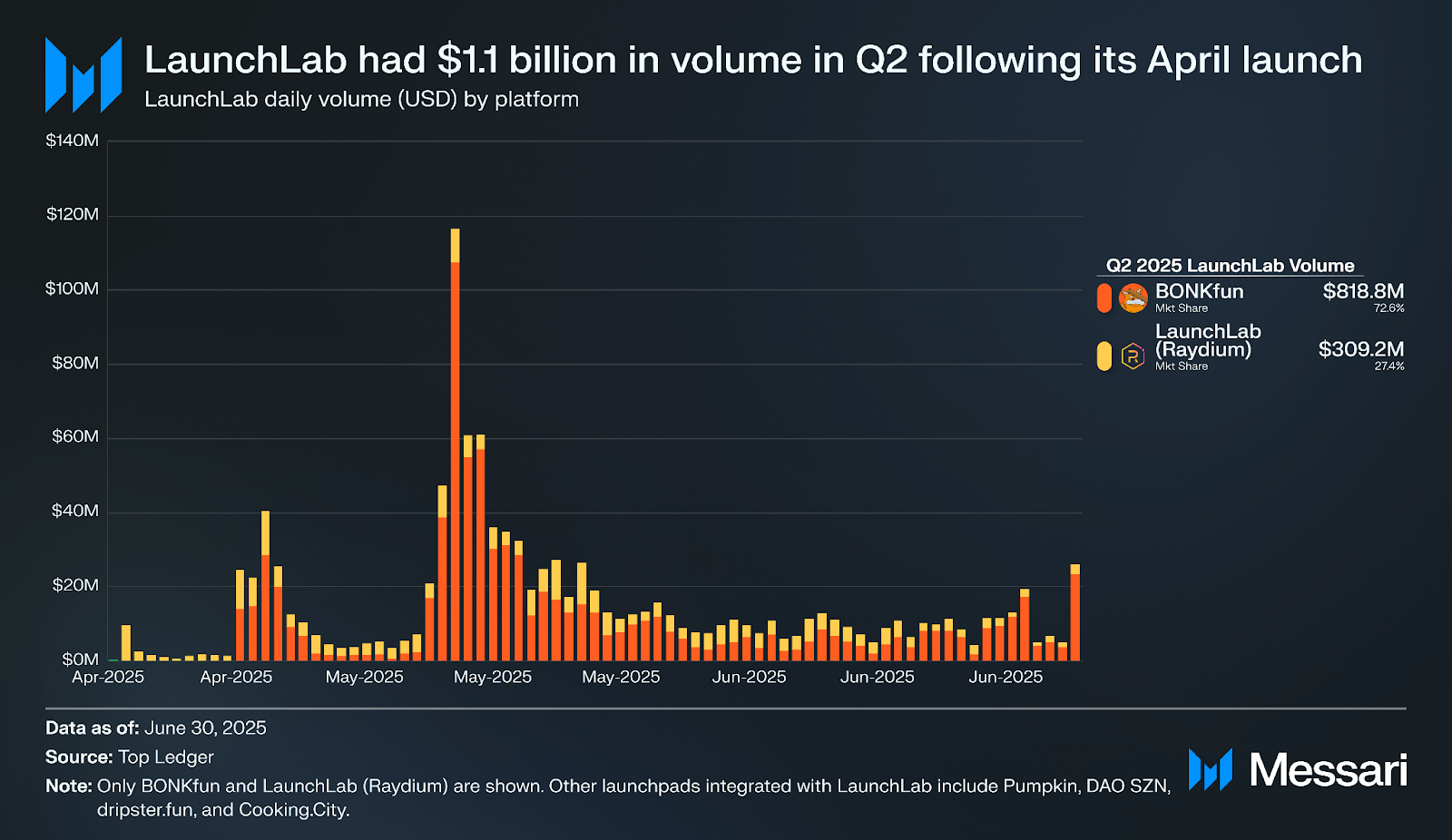

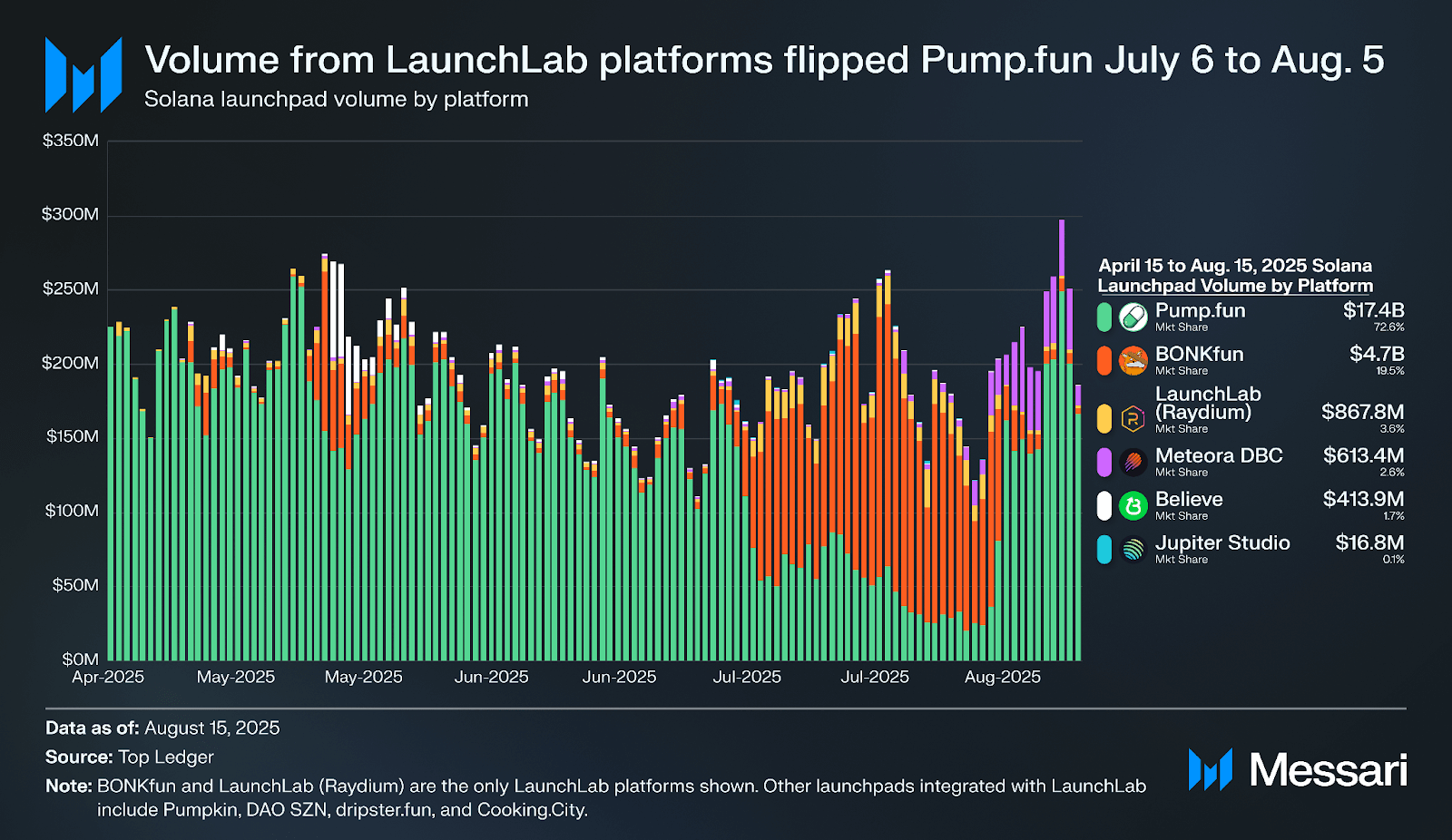

- Raydium’s token launchpad, LaunchLab, went live in April with free token launches and support for third-party integrations. BONKfun and Raydium combined for $1.1 billion in LaunchLab volume in Q2 and generated roughly $4.0 million (21.7%) of Raydium’s $18.4 million Q2 net revenue. Moreover, LaunchLab integrated platforms flipped Pump.fun in volume from July 6 to August 5.

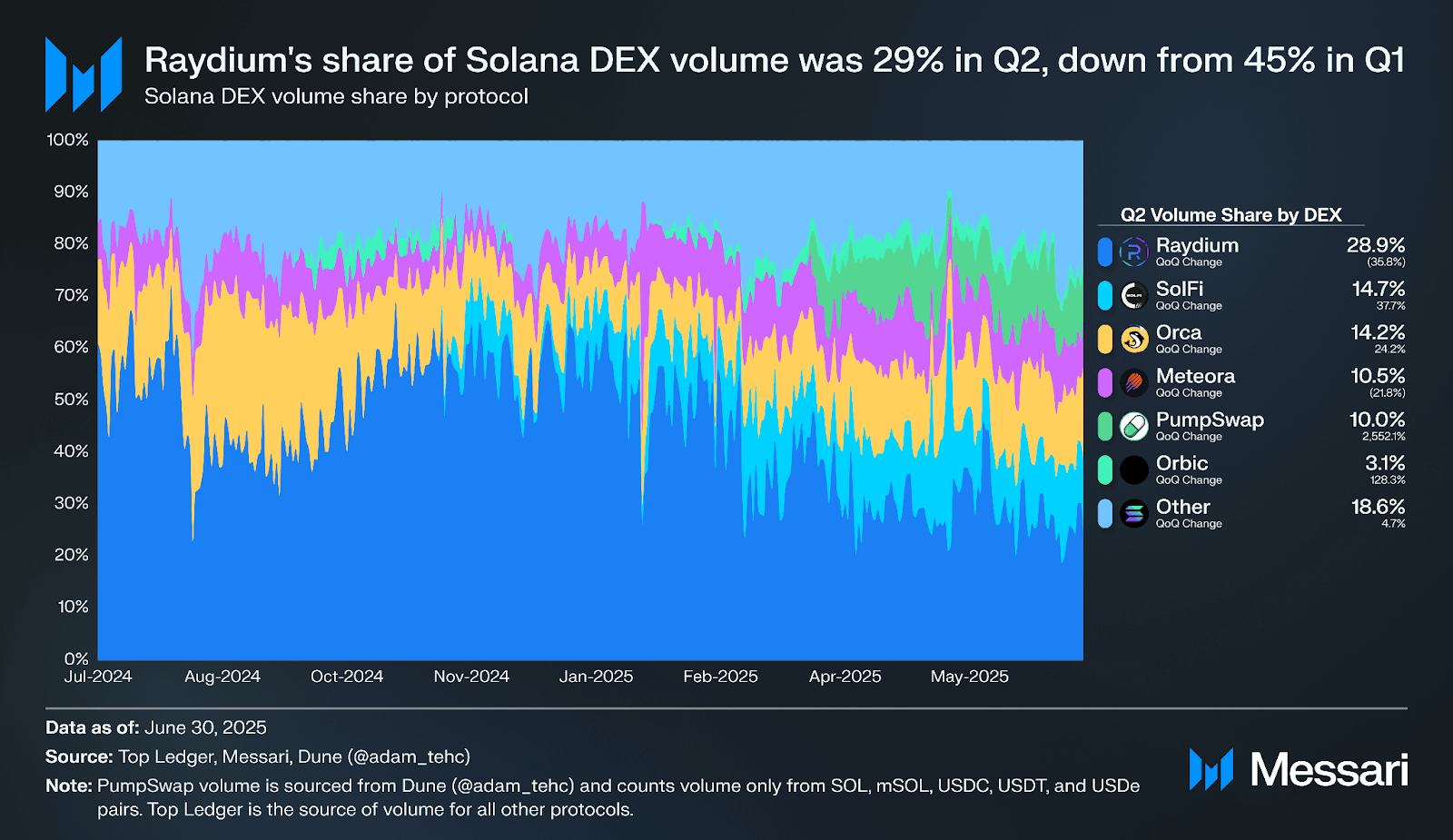

- Q2 was Raydium’s fifth straight quarter as the leader in Solana daily DEX volume, with 28.9% of total volume, down from 44.9% in Q1.

- Raydium averaged $1.1 billion in daily volume in Q2, down 69.2% QoQ from a record $3.6 billion in Q1 amidst a broader decline in trading volume, particularly of memecoins, across Solana.

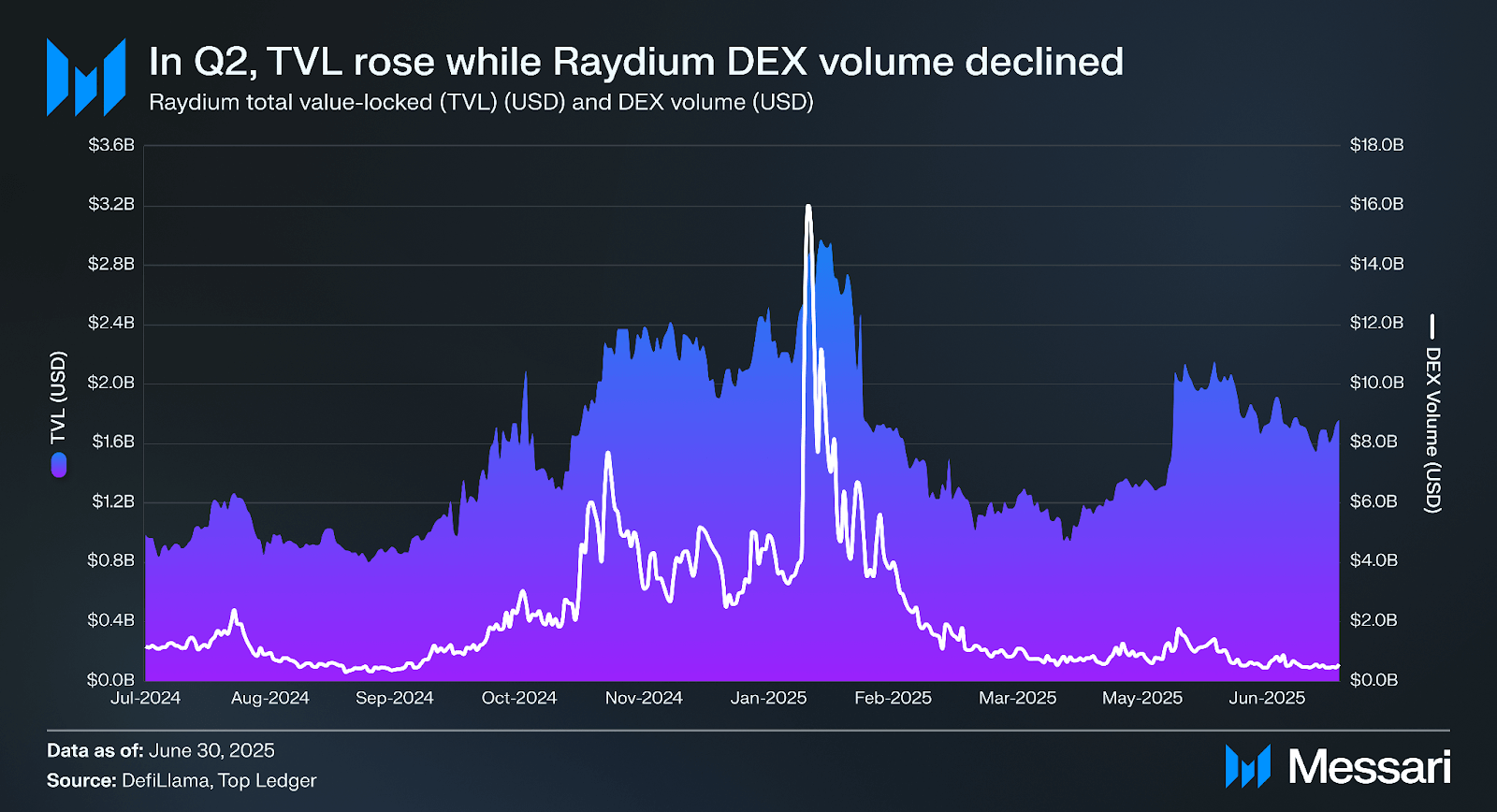

- Raydium closed Q2 with $1.8 billion in total value-locked (TVL), up 54.7% QoQ and 85.9% YoY, driven by a recovery in Solana asset prices.

Primer

Raydium (RAY) is the largest automated market maker (AMM) decentralized exchange (DEX) by volume on Solana. First launched in 2021, Raydium allows users to permissionlessly create new liquidity pools, provide liquidity to existing pools, launch tokens, swap tokens, and trade perpetual futures. Liquidity providers earn trading fees on each swap made in a pool as well as RAY, the protocol’s token, and/or other tokens if the pool is incentivized. RAY can also be staked to earn additional RAY tokens and is rewarded to traders and token creators on Raydium’s token launchpad LaunchLab.

In May 2024, the Raydium V3 application launched alongside revamped Constant Product Market Maker (CPMM) pools that support the Token-2022 token program and include a built-in price oracle. In addition to CPMM pools and its legacy standard AMM pools (AMM V4), which offer uniform liquidity distribution, Raydium offers Concentrated Liquidity Market Maker (CLMM) pools that allow for liquidity concentration at specific price points. CLMM provides lower slippage for traders and higher fee earnings for LPs, though the risk of higher impermanent loss is magnified by this design. Trading and routing are also available via the Raydium API.

More recent developments include Raydium’s release of its perpetual futures trading platform, Raydium Perps, on Jan. 9, 2025, and its token launch platform, LaunchLab, on April 16, 2025.

Website / X / Discord / Telegram

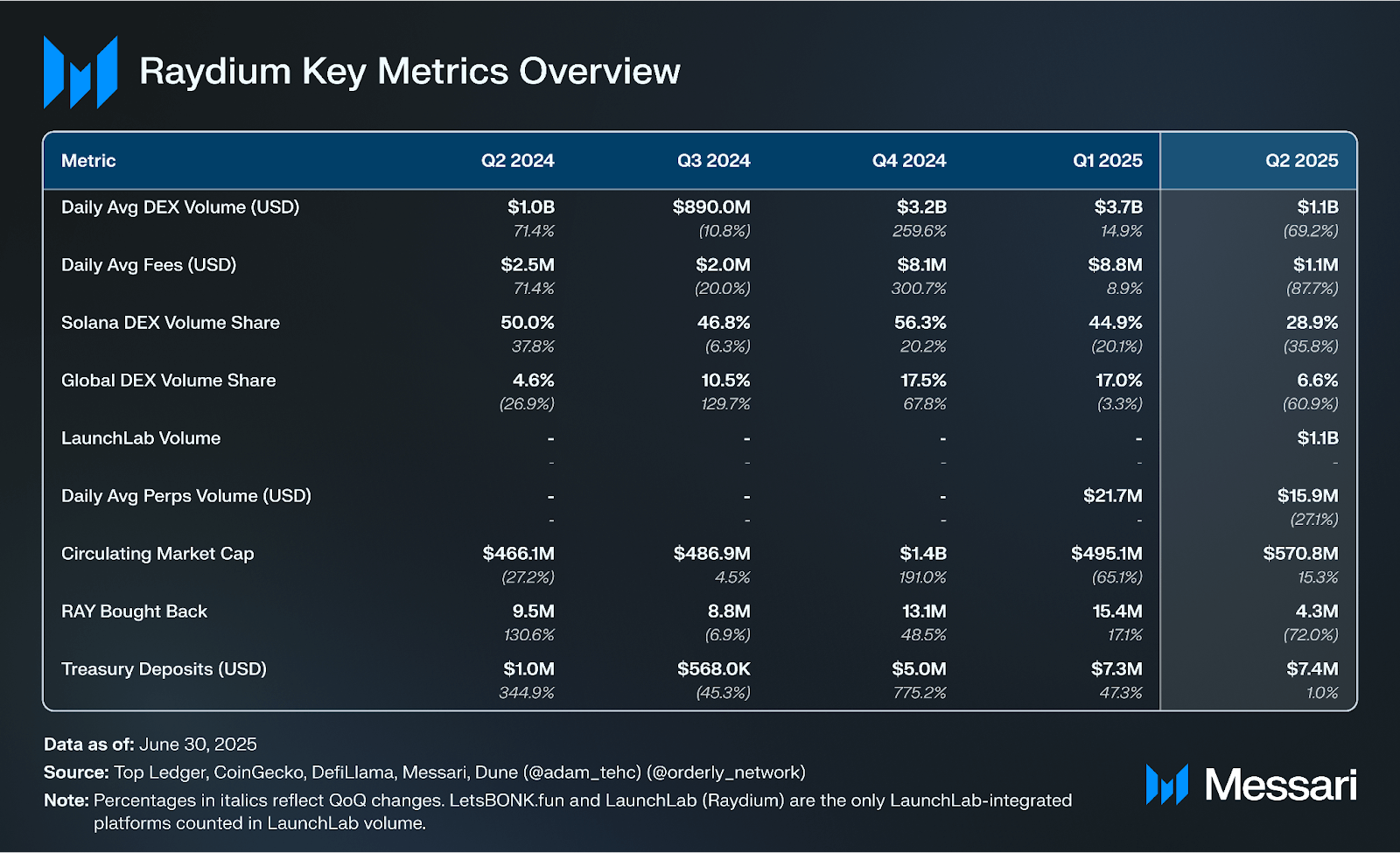

Key Metrics

Performance Analysis

Trading Activity

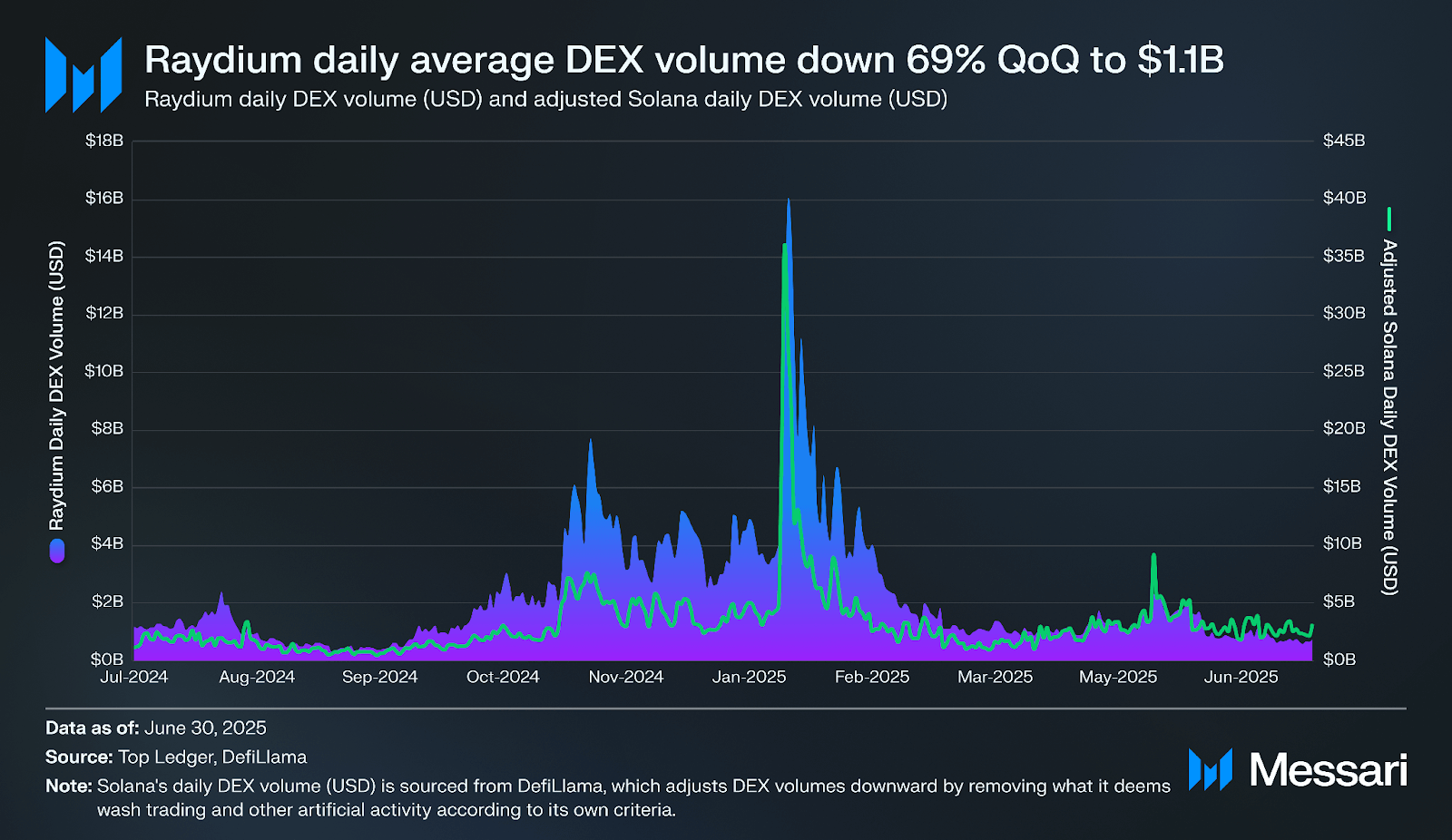

As the leading DEX by volume on Solana, Raydium’s trading volumes are a key indicator of the network’s overall activity. In Q2, daily average volume declined 69.2% from a record $3.6 billion in Q1 to $1.1 billion. Likewise, adjusted daily average volume across all DEXs on Solana declined 56.4% from $4.7 billion to $3.0 billion. Notably, adjusted daily Solana DEX volume is sourced from DefiLlama, which adjusts DEX volumes downward by removing what it deems wash trading and other artificial activity according to its own criteria.

Raydium’s daily volume peaked at $16 billion on Jan. 19 following the launch of President Donald Trump’s memecoin, TRUMP, on Jan. 17. Token prices and trading activity across the broader crypto market also peaked at this time. Thereafter, daily trading volume on Raydium steadily declined through April, with a daily average volume of $1.1 billion that month. Daily average trading volume rebounded 32.2% in May to $1.5 billion, followed by a 48.0% month-over-month decline to $772.9 million in June. June’s daily average volume was a 87.8% decline from the record $6.3 billion in daily volume Raydium averaged in January, but still 36.1% higher than the prior 12-month low of $568 million averaged in September 2024. Notably, on July 18, Raydium surpassed $1 trillion in all-time volume and $292.1 million in cumulative net revenue.

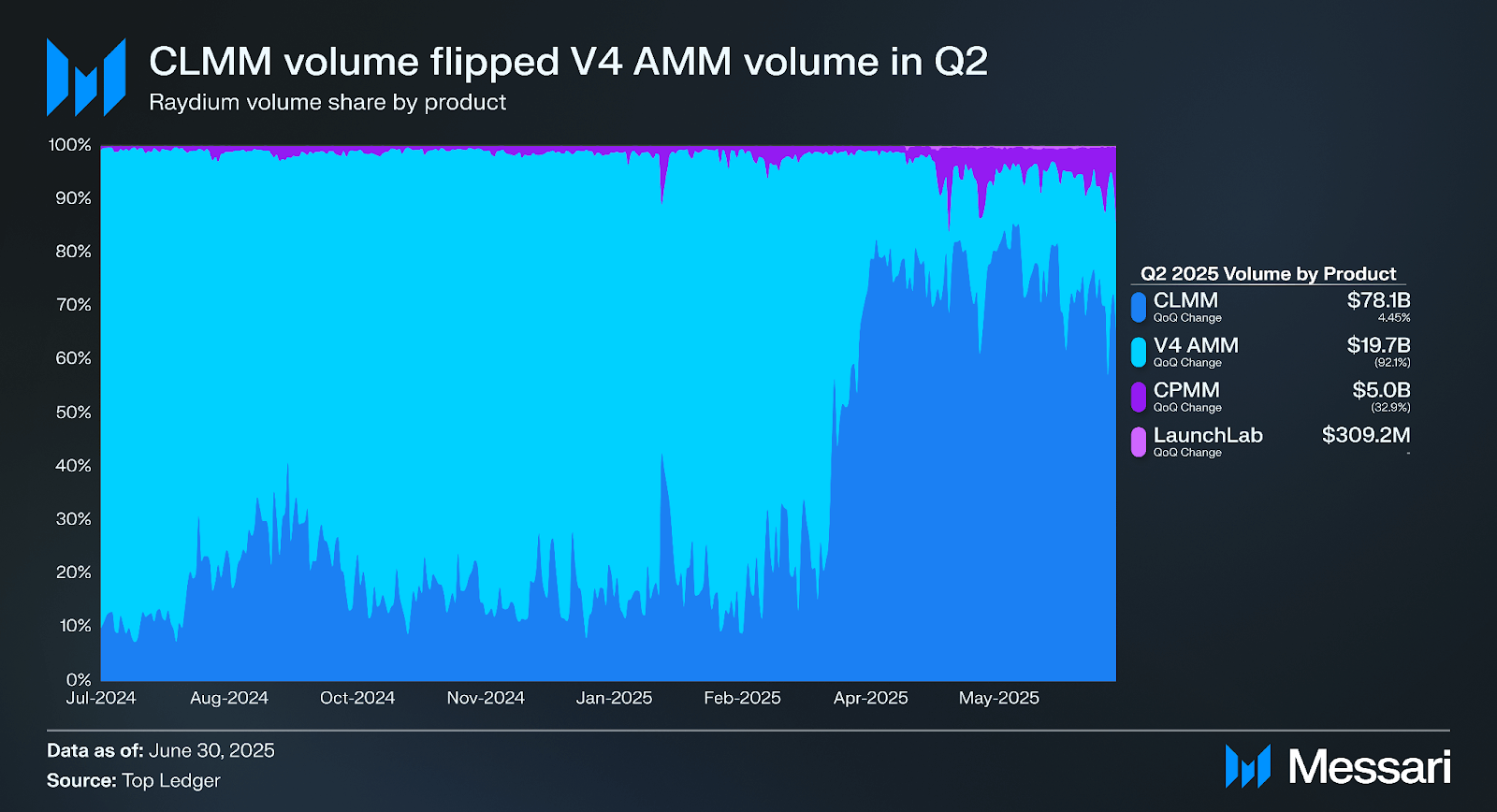

In Q2, CLMM pools flipped V4 AMM pools in volume for the first time. CLMM pools had $78.1 billion in volume (75.7% share) while V4 AMM pools had $19.7 billion (19.1% share), together making up 94.9% of all Raydium volume. In contrast, V4 AMM pools had $248.7 billion in volume (75.2% share) in Q1, while CLMM pools had $74.7 billion in volume (22.6% share).

Following CLMM and V4 AMM pools, CPMM had $5 billion in volume (4.8% share), while LaunchLab, Raydium’s new token launchpad, had $309.2 million (0.3%). On July 20, CPMM surpassed V4 AMM in daily volume for the first time. Also in July, Raydium’s CLMM program was upgraded to reduce rent costs by ~0.0024 SOL per pool. Support was also added for custom block and allowlist functionality for RWA-issuers to remain regulatorily compliant.

LaunchLab

Overview and Background

On April 16, Raydium launched a token launchpad called LaunchLab. Tokens launched on LaunchLab are free, with token creators able to choose between a default JustSendit mode and custom settings via LaunchLab mode. When a token’s bonding curve reaches the set amount of SOL (85 SOL for JustSendit mode), the SOL and its equivalent in token liquidity are migrated to a Raydium AMM pool. LP tokens are then burned, and trading continues in the Raydium pool.

Prior to LaunchLab’s release, Solana token launchpad Pump.fun launched its own AMM called PumpSwap on March 20. Like other token launchpads, Pump.fun simplifies the process for deployers, who need only select a name, ticker, and image to commence trading on a bonding curve, with no fees to create a token. Previously, when Pump.fun tokens reached a market capitalization of $69,000, $12,000 was added to a standard AMM pool on Raydium, which supports asset pricing between zero and infinity. However, since the launch of PumpSwap on March 20, Pump.fun migrates liquidity to PumpSwap rather than Raydium.

Pools for tokens first launched on Pump.fun like FARTCOIN have generated significant trading volume on Raydium. From May 2024 through the launch of PumpSwap on March 20, tokens that originated on Pump.fun, accounted for between 20% to 83% of Raydium’s total daily volume, depending on the day, while since the launch they have accounted for between 7% to 35%.

LaunchLab Mode

With LaunchLab mode, users can adjust the percentage of supply sold on the bonding curve, with a minimum of 20% sold and a maximum of 80% sold, with the remainder migrated to the AMM pool upon graduation. Additionally, users can choose to lock and vest a percentage of the token supply and set cliff and vesting durations. Moreover, LaunchLab mode creators can elect to turn on post-migration fee share, which allows the creator to claim 10% of LP trading fees from the CPMM pool the token has graduated to (migration is to an AMM V4 pool if this feature is turned off). This uses Raydium’s “Burn & Earn” feature, which allows the creator to claim fees using a “Fee key” using Raydium’s portfolio page.

Referral Program

LaunchLab has a referral program in which each token page has a “Share” button where each Solana address to share a unique referral link. When anyone trades using that link, the referrer receives 0.1% (10 bps) of the trade. Rewards are paid in SOL or the quote token used in the specific AMM pool.

Third-Party Integrations

LaunchLab supports third-party integration through a flexible Platform PDA (Program Derived Address) system that allows external teams to white label and manage their own launch environments. By registering a Platform PDA, third parties can maintain a separate brand and platform that is powered by LaunchLab’s infrastructure and Raydium ’s AMM for liquidity.

On April 25, Bonk launched BONKfun, Raydium’s most popular third-party token launchpad to date, powered by LaunchLab. LaunchLab also has an SDK that provides tools and functions for interacting with LaunchLab bonding curves.

LaunchLab Rewards

Raydium awards LaunchLab traders and token creators via actively managed reward distribution of RAY tokens.

At the end of April, Raydium launched LaunchLab Rewards, whereby RAY is awarded via actively managed prize pools to traders and token creators of all tokens launched using LaunchLab that trade via partner platforms. The LaunchLab Leaderboard then went live on May 7, with daily leaderboard rewards distributed based on the previous 24-hour volume. Through May 12, ~950,000 RAY (~0.17% of the maximum supply) was allocated.

In June, the Raydium team introduced the LaunchLab Incentive Program with 50,000 RAY in weekly rewards and all unclaimed rewards rolled over throughout the month. The top 50 traders by pre-graduation token volume from eligible LaunchLab SDK platforms receive daily RAY rewards, while wallets 51-200 receive raffle tickets for weekly RAY raffle rewards. Token creators earn a fee rebate based on the trading volume the token generates pre-graduation and if a token graduates from the bonding curve.

In Q2, LaunchLab platforms had more than $1.1 billion in volume. BONKfun facilitated $818.8 million in volume, while Raydium’s LaunchLab interface facilitated $309.2 million. Other notable launchpads integrated with LaunchLab include Pumpkin, DAO SZN, dripster.fun, and Cooking.City.

Despite the majority of LaunchLab volume coming from BONKfun, it still generated Raydium $4 million in net revenue (21.7% of its $18.4 million in total net revenue). Raydium earns 25bps on all bonding curve swaps for all tokens deployed, including on other integrated platforms, like BONKfun.

From July 6 to Aug. 5, daily volume from BONKfun and Raydium’s LaunchLab flipped Pump.fun volume. During this period, BONKfun and Raydium’s LaunchLab collectively had 69.7% of all Solana launchpad volume, while Pump.fun had 27.0%. Moreover, LaunchLab generated $10.3 million in net revenue during this one-month period, more than double the $4 million generated in all of Q2.

Additionally, on July 6, BONKfun became the first Solana token launchpad to flip Pump.fun in 24-hour token launches. Since the launch in April through Aug. 15, Raydium’s LaunchLab has facilitated $867.8 million in volume, while BONKfun has facilitated $4.7 billion.

TVL

Raydium closed Q2 with $1.8 billion in total value-locked (TVL), up 54.7% QoQ from $1.1 billion at Q1 close, and up 85.9% YoY from $944.7 million. A significant driver of the quarterly increase was the 22.9% QoQ increase in the price of SOL from $124.81 at the close of Q1 to $153.35 at the close of Q2. SOL accounted for $871.5 million (47.2%) of Raydium’s TVL at the close of Q2 compared to $775 million (40.4%) at the close of Q1. Still, as adoption of stablecoins and other real-world assets (RWAs) like tokenized treasuries and tokenized stocks increases over a longer time horizon, SOL should account for a smaller percentage of Raydium TVL.

Historically, rises in Raydium TVL have coincided with increased Raydium DEX trading volume. However, in Q2, TVL rose while Raydium DEX volume declined, as asset prices recovered despite lower trading volumes, particularly from memecoins, which drove Raydium’s record Q1 DEX volume.

Volume Share

Token Types

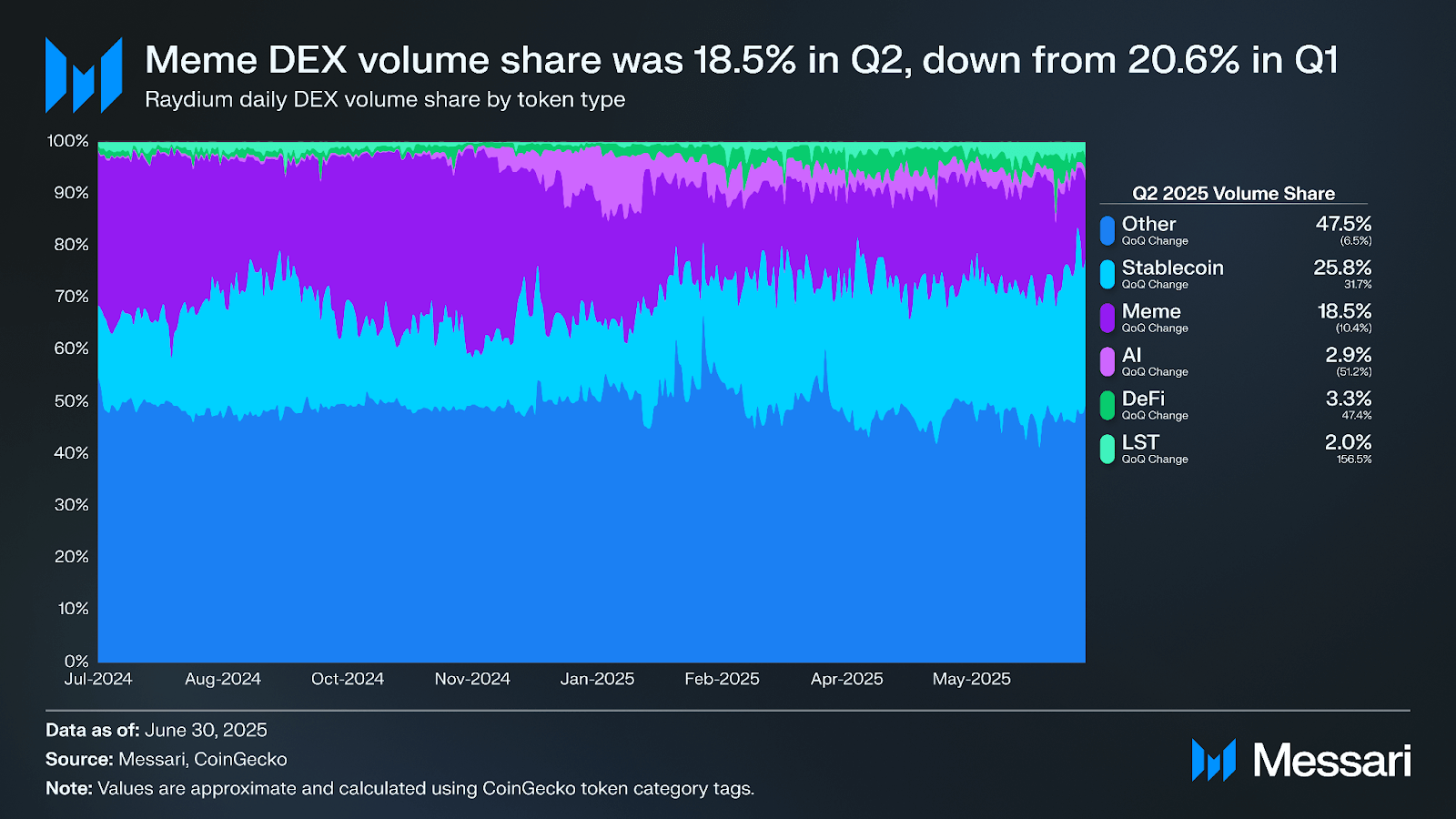

Volume share by token type is an important metric to understand which tokens are trending on Raydium. Meme volume share on Raydium decreased from 33.3% in Q2 2024 to 18.5% in Q1 2025. In contrast, stablecoin volume share increased from 11.8% in Q2 2024 to 25.8% in Q2 2025, a trend that continued into Q3. Likewise, over the same period, DeFi volume share increased from 1.1% to 3.3% and liquid staking token (LST) volume share from 1.0% to 2.0%.

The increase in volume share for Stablecoin, DeFi, and LST token types was driven by volume for these token types declining less than other token types QoQ. While volume for all token types declined in Q2 2025, volume for stablecoin, DeFi, and LST token types declined between 30% to 65% QoQ, far less than the 75% to 87% decline for Meme, AI, and other token types. Across longer time horizons, trading volumes for Stablecoin, DeFi, and LST token types are less variable (to both the upside and downside) compared to the much larger variance in Meme, AI, and other, longer-tail token types. Though token types with less variance gain volume share when overall volume declines, narratively hot categories like Memes and AI have historically driven volume growth to the upside, as attention has driven trading activity in crypto, particularly on Solana.

Liquidity pools were launched on Raydium for the first time for a number of wrapped tokens from leading networks in Q2, including Wrapped Bitcoin (WBTC) and Universal uAssets, such as uSUI, uXRP, and uDOGE. Additionally, at the end of June, xStocks by Kraken launched a number of tokenized equities on Solana, with liquidity pools deployed on Raydium for SPYx, APPLx, NVDAx, TSLAx, METAx, GOOGLx, COINx, QQQx, CRCLx, and MSTRx. Since launch, these assets have been a significant source of trading volume on Raydium. Total trading volume for tokenized assets on Raydium surpassed $110 million on Aug. 15, accounting for more than 90% of all tokenized asset volume on Solana.

Solana DEX Volume Share

Q2 was Raydium’s fifth straight quarter as the leader in Solana daily DEX volume at 28.9%, down from 44.9% in Q1. This was Raydium’s second straight quarter not capturing the majority of Solana’s DEX volume, a feat the protocol previously achieved in Q3 and Q4 2024..

New entrants like PumpSwap ate into Raydium’s volume share, as did Orbic, the only prior existing protocol in the top six by volume to have QoQ volume growth. Quarterly volume on SolFi, Orca, Meteora, and collectively all other protocols declined less on a percentage basis than Raydium, resulting in increased volume share for these protocols.

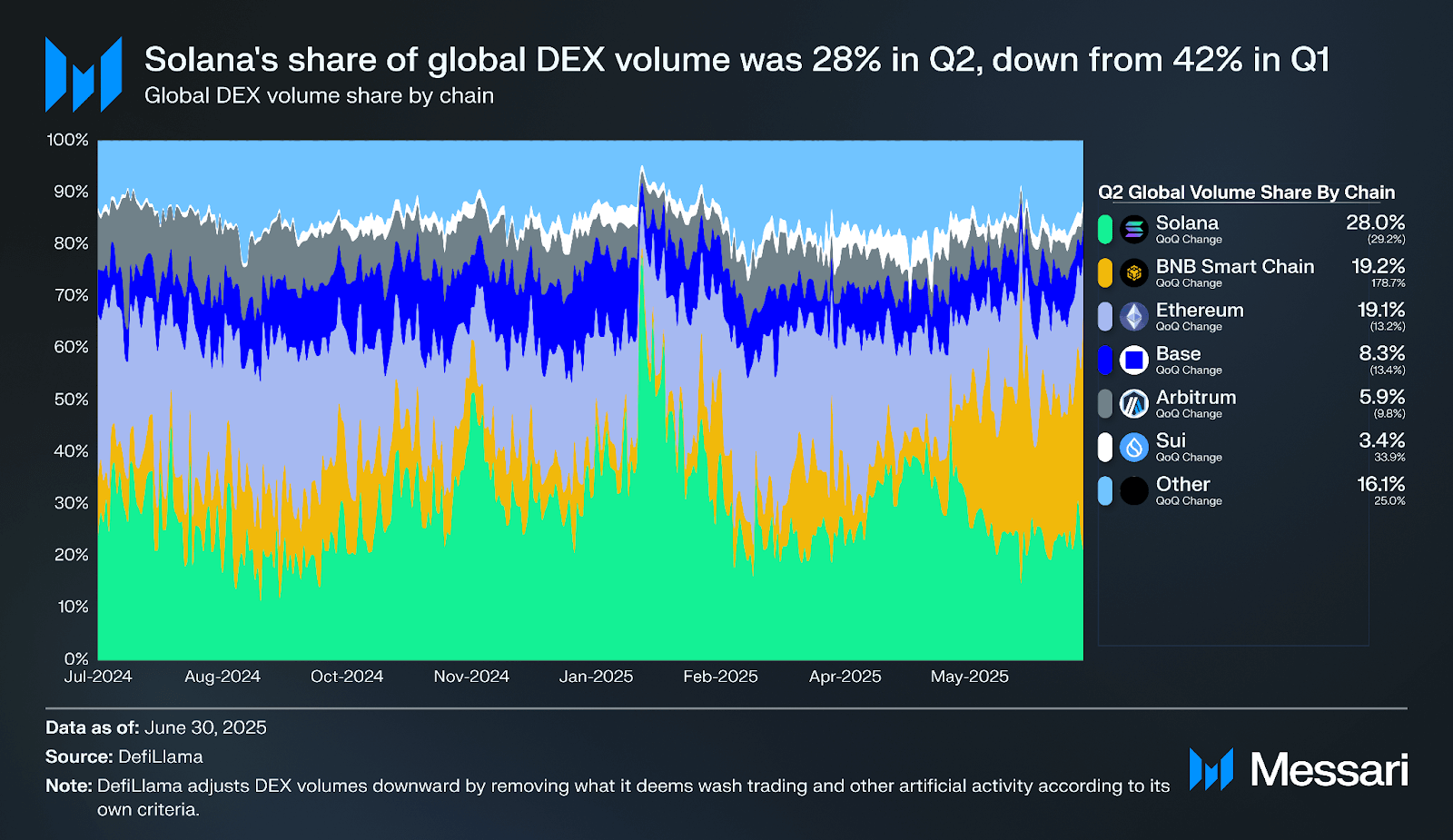

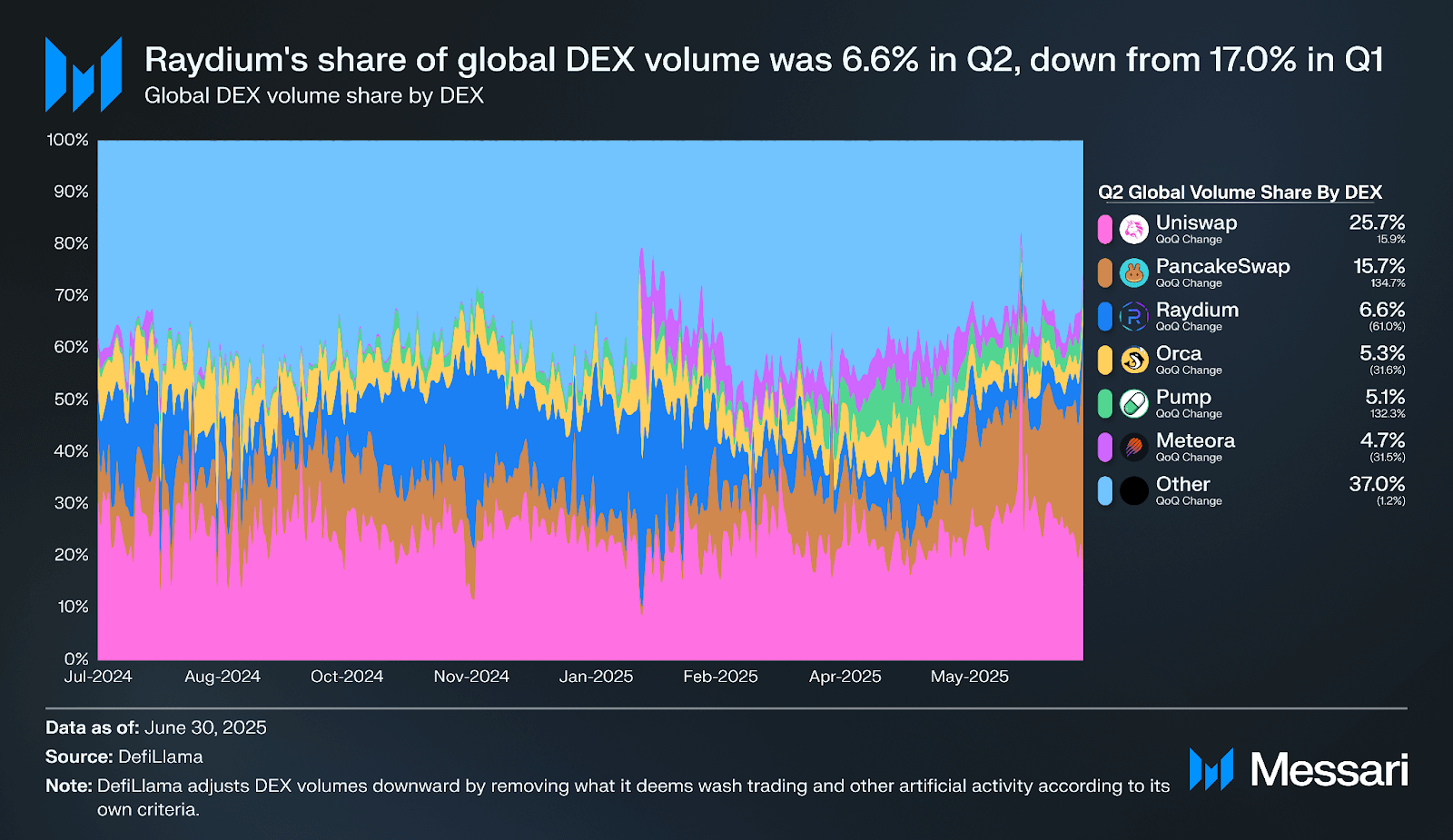

Global Volume Share

Zooming out, Solana’s share of global DEX volume by network was 28.0% in Q2, down from 42.1% in Q1. This was caused by two main factors: first, the decline in Solana DEX volume discussed above, and second, a 154.5% QoQ increase in DEX volume on BNB Smart Chain, a 22.2% increase in DEX volume on Sui, and a 14.1% QoQ increase in volume on other chains.

Raydium’s share of global DEX volume declined from a record 17.0% in Q1 to 6.6% in Q2. Still, year-over-year, Raydium’s share is up two percentage points from 4.6% in Q2 2024, showing sustained growth in spite of a pullback from record levels. The QoQ loss in global DEX volume share is attributable to Raydium’s decline in DEX volume, coupled with modest 6% QoQ growth in volume from Uniswap, and roughly 100% QoQ growth in volume from PancakeSwap and Pump.

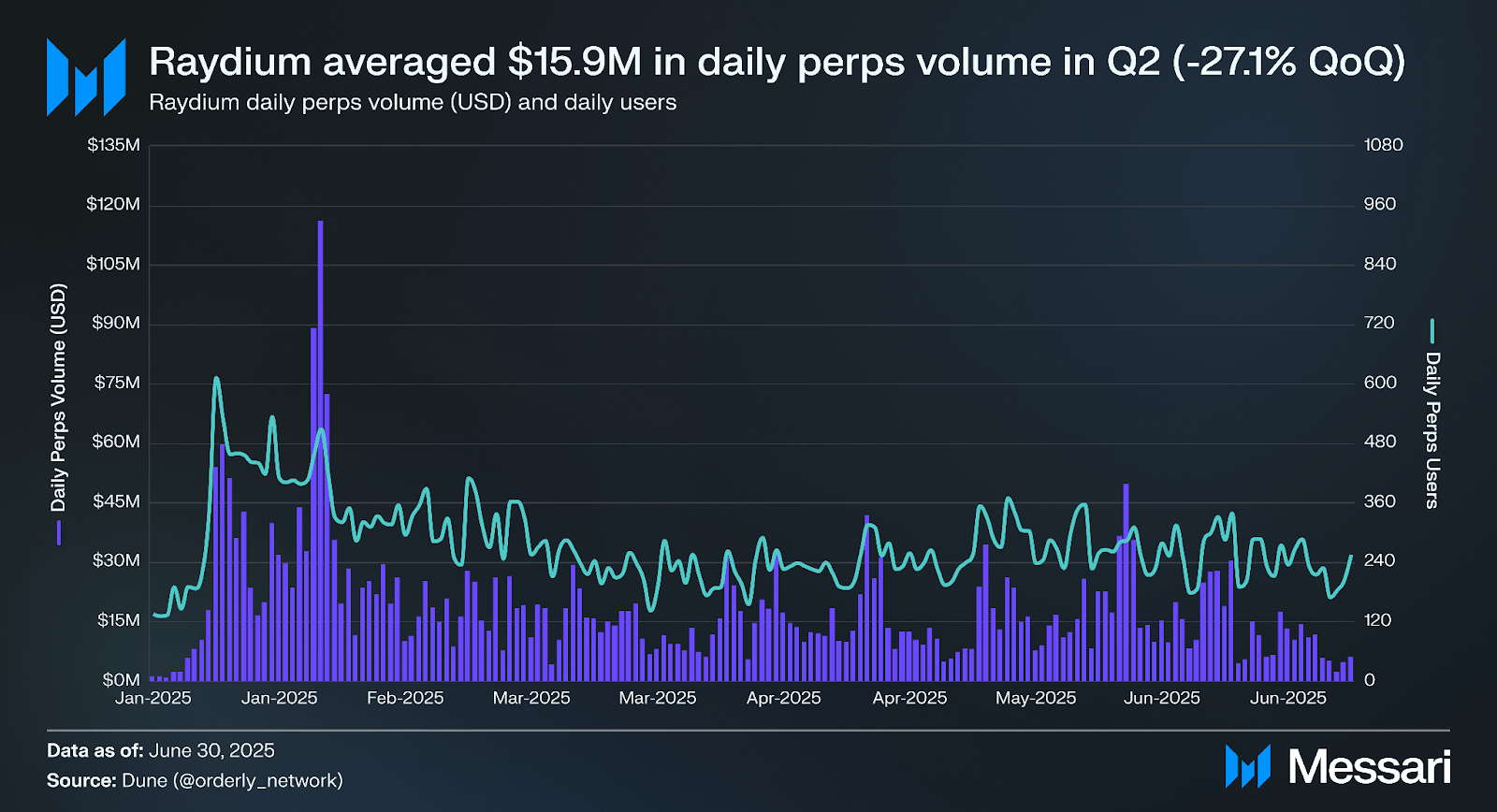

Raydium Perps

In its first full quarter of availability, Raydium Perps averaged $15.9 million in daily trading volume, down 27.1% QoQ from $21.7 million. Following its launch on Jan. 9, volume peaked at $116.0 million on Feb. 3, and steadily declined to range between $4-$34 million in daily trading volume thereafter.

Perpetual futures are a type of derivative contract that allows traders to speculate on an asset’s price without an expiry date. Raydium Perps is powered by Orderly Network’s liquidity layer and features gas-free trading with up to 50x leverage on more than 120 trading pairs. During the beta phase, which it is currently in, there are no fees on maker trades and 0.0025% (2.5bps) in fees on taker trades charged by Orderly Network. To begin trading, users can connect a Solana wallet, register and generate an API Key, and deposit USDC, the only accepted form of collateral. Notably, a swap and bridge feature to deposit any asset converted to USDC collateral is intended for future release.

Financial Analysis

At the close of Q2, RAY’s circulating market cap was $570.8 million, up 15.3% QoQ. In contrast, daily average fees declined 87.7% QoQ from $8.8 million to $1.1 million. Year-over-year, daily average fees declined 57.1% from $2.5 million in Q2 2024, while RAY’s circulating market cap increased 22.5% from $466.1 million.

Notably, public APIs like CoinGecko’s still count RAY bought back by the protocol as part of the token’s circulating supply. In June, Raydium contributor Infra published an article arguing that these tokens should not be counted in direct earnings calculations. Removing them leaves an adjusted circulating supply of 207.1 million RAY at Q2-end. Annualizing Q2’s buyback allocation of $10.7 million, RAY had $0.21 in earnings per token (EPT) at Q2-end on an adjusted market cap of $441.7 million, a 9.7% yield, one of the highest in all of crypto.

Of RAY’s 555 million maximum supply, 188.7 million RAY (34%) is allocated to a mining reserve, with ~1.9 million emitted each year, and ~1.65 million of that rewards single-sided RAY staking. At the end of Q2, approximately 275.2 million RAY (49.6% of the maximum supply) were circulating. The project’s documentation states that the “Team” and “Seed” allocations, which together make up 25.9% of the maximum supply, fully vested in February 2024. Additionally, the documentation states, “The majority of the locked supply remains allocated to the Mining Reserve, Partnership & Ecosystem, and Advisors.” Together, these allocations make up 66% of the maximum supply (366.3 million RAY), as seen on Messari Token Unlocks.

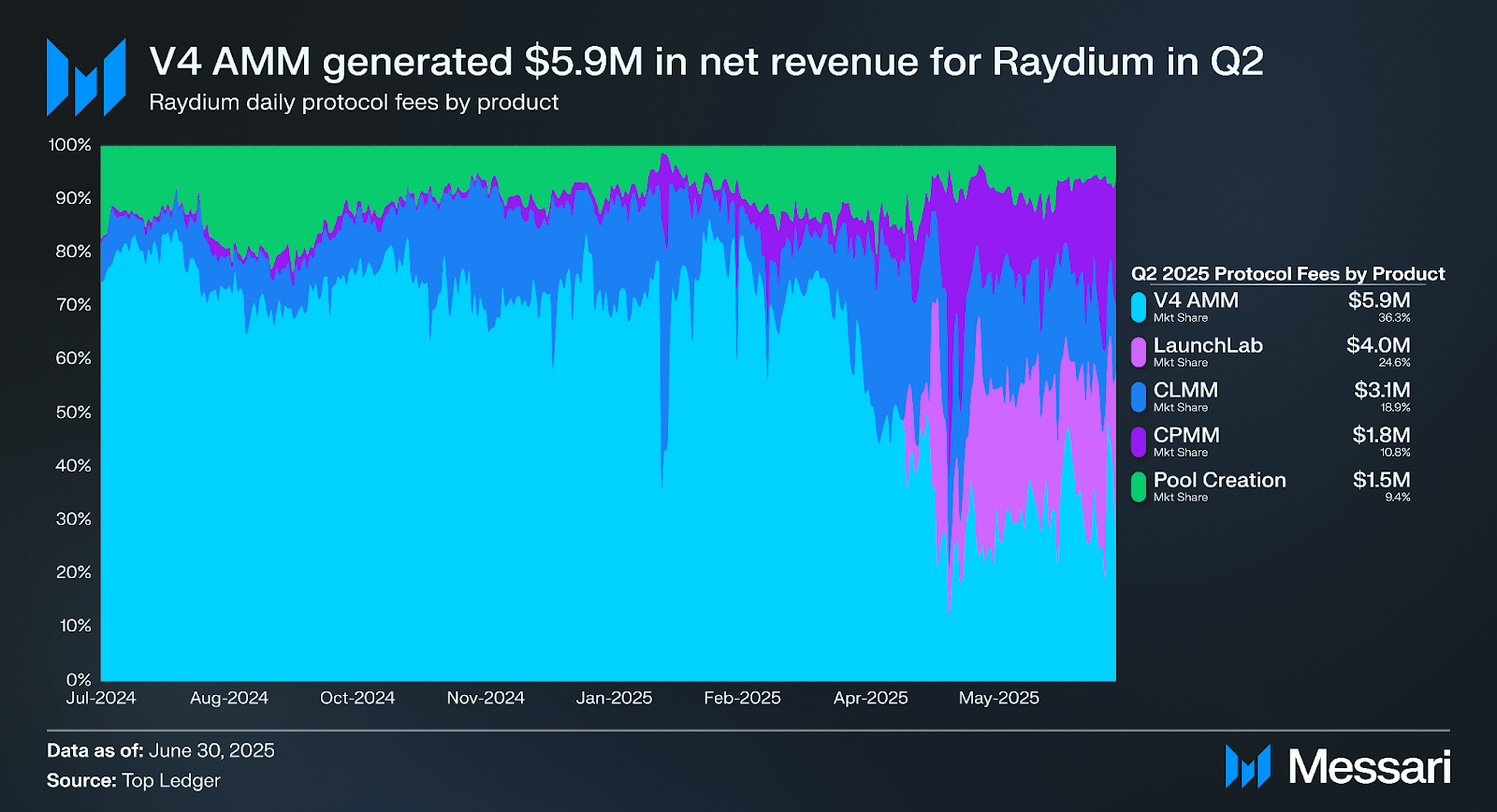

In Q2, $18.4 million (18.9%) of Raydium’s $97.7 million in total fees accrued to Raydium as net revenue, down 82.9% QoQ from $108.1 million (13.6%) of $793 million. V4 AMM pools led, generating $5.9 million (32.1% share), followed by LaunchLab with $4.0 million (21.7%), CLMM pools with $3.8 million (20.7%), CPMM pools with $3.2 million (17.2%), and pool creation fees, which generated $1.5 million (8.3%).

The increase in the percentage take of total fees to Raydium from 13.6% in Q1 to 18.9% in Q2 is due to the Q2 release of LaunchLab, as Raydium earns 25bps on all bonding curve swaps for all tokens deployed, including on other integrated platforms, like BONKfun.

On Raydium, pool creators can select the pool’s trading fee from a number of fee tiers depending on the pool type:

- Standard AMM (AMM V4): 0.25%

- Concentrated liquidity (CLMM): 0.01%, 0.02%, 0.03%, 0.04%, 0.05%, 0.25%, 1%, 2%

- Constant Product (CPMM): 0.25%, 1%, 2%, 4%

For all pool types, 12% of the trading fee is allocated to RAY buybacks. Trading fees allocated to buybacks are automatically claimed when the value reaches $10 and transferred to intermediary wallets to “programmatically” buyback RAY.

For AMM V4, the remaining 88% of the fee is distributed to the pool’s liquidity providers pro rata, while for CLMM and CPMM it is 84%, with the remaining 4% allocated to the treasury. Treasury fees for CLMM and CPMM pools are automatically swapped to USDC and held in treasury accounts controlled by the protocol multsig. $1.6 million USDC was deposited to the treasury in Q2, a 77.7% decline from the record $7.3 million deposited in Q1, but still 57.3% more than the $1.0 million deposited in Q2 2024. At the end of June, Raydium’s treasury held approximately $60 million in non-RAY assets (SOL, USDC, etc) available to deploy during downturns or for new product initiatives.

Finally, a 0.15 SOL pool creation fee is charged for AMM V4 and CPMM pools (there is no pool creation fee for CLMM). Fees are held in accounts controlled by the protocol multisig and reserved for protocol infrastructure costs. In Q2, Raydium generated 9,880 SOL in pool creation fees (-73.4% QoQ), with more than 251,160 SOL generated since pool creation fees were first instituted. Additionally, since June 2024, Raydium has run a 0% commission validator with 182,480 SOL staked to date entirely from a portion of lifetime pool creation fees.

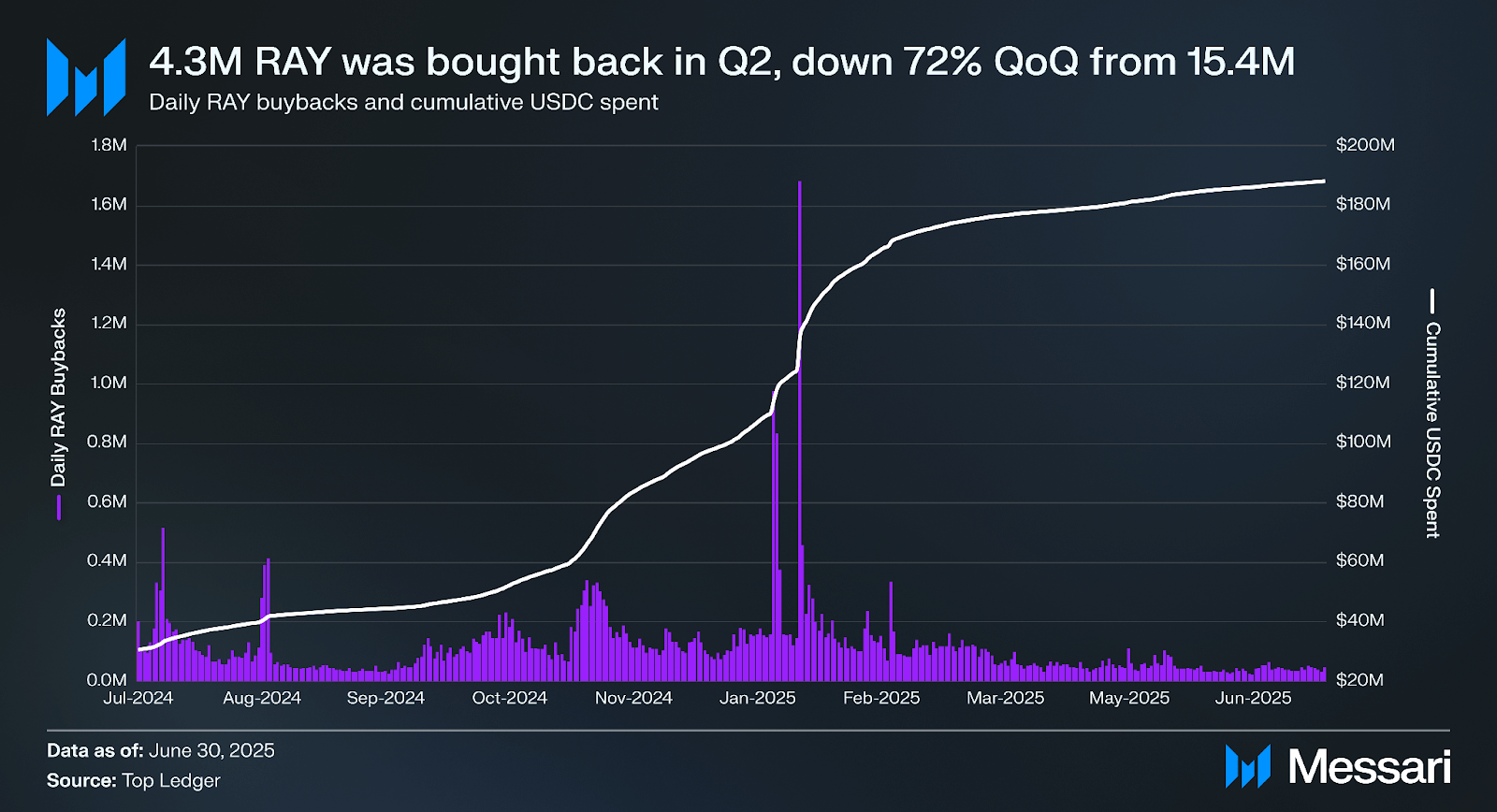

In Q2, $10.7 million in USDC (-86.0% QoQ) generated from net revenue was spent buying back 4.3 million RAY from the open market, a 72% QoQ decline from the 15.4 million bought back in Q1. At Q2 end, an all-time total of 68.1 million RAY (12.3% of the maximum supply) had been bought back using $188.2 million USDC for an average buyback price of $2.76. In July, the Raydium team announced it had allocated $4 million from LaunchLab fees as single-sided SOL liquidity in the RAY-SOL CLMM pool. Moving forward, discretionary buybacks will occur by converting single-sided SOL positions to RAY, removing that RAY as liquidity, and transferring it to Raydium’s buyback wallet. The team is testing this method and evaluating execution going forward.

On Raydium, the RAY token has a number of functions:

- Stake RAY to earn RAY: RAY tokenholders can stake RAY to earn additional RAY tokens at an APR of approximately 5%.

- RAY Liquidity Provision Rewards: Liquidity providers can earn RAY when it is allocated by the project team to reward liquidity providers of incentivized pools. Pools incentivized with RAY and/or third-party tokens can easily be seen on Raydium.

- Other RAY Rewards: The protocol may also offer other ways to earn RAY at its discretion, such as the current LaunchLab Incentive Program. Additionally, Raydium’s bug bounty program pays rewards in RAY, SOL, or USDC on Solana.

- Governance: Raydium has an offchain governance process facilitated via Realms, where users must deposit RAY to participate. A minimum of 1 million RAY is required to create a proposal, while each token equals one vote for active proposals. As of the close of Q1, there have been two proposals.

Integrations, Partnerships, and Upgrades

Raydium made significant strides in expanding its ecosystem and enhancing its utility through a series of strategic integrations, partnerships, and upgrades in Q2 and beyond:

- CUBE Integration (April 9) – CUBE, a digital asset marketplace, integrated Raydium as its first onchain route.

- GREED Academy Contribution (April 18) – Raydium contributed 8,500 RAY to Web3 educational initiative GREED Academy’s reward pool used to distribute prizes to participants.

- FluxBot Integration (April 21) – FluxBot, a Telegram trading bot, integrated Raydium’s LaunchLab, enabling trading of tokens launched via the platform.

- Maestro Integration (April 23) – Maestro, a Telegram trading bot, enabled trading of pre and post-bonded LaunchLab tokens with its Maestro 2.0 upgrade.

- BONKfun Integration (April 25) – Bonk launched BONKfun, its token launchpad powered by Raydium’s LaunchLab.

- Pumpkin.fun Integration (May 5) – Pumpkin.fun launched its token launchpad powered by Raydium’s LaunchLab.

- BONKfun BCM Hackathon Sponsorship (June 6) – Raydium cosponsored the BONKfun “hackathon,” whereby the top three tokens by market cap at the end of the one-month contest won prizes as follows: first place ($140,000), second place ($140,000), third place ($10,000).

- SendAI Integration (June 6) – SendAI integrated Raydium’s LaunchLab into its Solana Agent Kit, a toolkit that connects any AI agent to Solana. Raydium’s liquidity pools (AMM V4, CLMM, and CPMM) were previously integrated.

- Scaled UI Token-2022 Extensions (June 26): Raydium added support for trading Scaled UI Token-2022 extensions, which are part of the Solana Token-2022 program. CP-Swap and CLMM now support permissionless pool creation for tokens launched using the Solana Token-2022 program.

- GeckoTerminal Integration (July 15) – CoinGecko’s DEX tracker GeckoTerminal integrated Raydium Launchlab to track all assets launched on the platform.

- Raydium Devnet UI (July 15) – Raydium launched a fully functioning Devnet UI for users to test pool creations, swaps, and integrations.

- Metaplex Partnership (July 18): Metaplex announced a partnership with Raydium, in which Raydium will provide special marketing and incentive support to projects whose tokens launch using Metaplex’s token launch framework Genesis, and choose to migrate their liquidity to Raydium pools.

Closing Summary

Raydium averaged $1.1 billion in daily volume in Q2, down 69.2% QoQ from a record $3.6 billion in Q1 amidst a broader decline in trading volume, particularly of memecoins, across Solana. Still, Q2 was Raydium’s fifth straight quarter as the leader in Solana daily DEX volume despite its share of all volume declining to 28.9%, down from 44.9% in Q1. Raydium also closed the quarter with $1.8 billion in total value-locked (TVL), up 54.7% QoQ and 85.9% YoY, driven by a recovery in Solana asset prices.

Raydium’s token launchpad, LaunchLab, went live in April with free token launches and support for third-party integrations. Leading LaunchLab platform BONKfun also launched in April. Together, these platforms combined for $1.1 billion in volume in Q2 and generated roughly $4.0 million (21.7%) of Raydium’s $16.3 million Q2 net revenue. Moreover, LaunchLab integrated platforms flipped Pump.fun in volume from July 6 to Aug. 5.

On top of this, Raydium remains one of the highest-yielding protocols in all of crypto. Annualizing Q2’s buyback allocation of $10.7 million, RAY had $0.21 in earnings per token (EPT) at Q2-end on an adjusted market cap (removing buybacks from circulating supply) of $441.7 million, a 9.7% yield.

Finally, RAY’s circulating market cap closed Q2 at $570.8 million, up 15.3% QoQ, while RAY’s price increased 25.3% QoQ from $1.70 to $2.13, signaling increased optimism after 65% declines in both metrics in Q1. With LaunchLab’s momentum and Solana asset prices ticking higher, Raydium is primed for a strong Q3, reversing the downtrend and lows of Q1 and Q2.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Reactor Labs. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization may have input on the content of the report, but Messari maintains editorial control over the final report to retain data accuracy and objectivity. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.