Solana is pressing against key resistance as rising institutional buying fuels speculation of a breakout towards $300 and new all-time highs.

Institutional demand is starting to play a bigger role in Solana’s market story, with major funds quietly building exposure at scale. This shift comes as Solana continues to test its $210 to $215 resistance zone, a level that market watchers say could unlock a sharp rally if broken.

Solana Sees Rising Corporate Interest

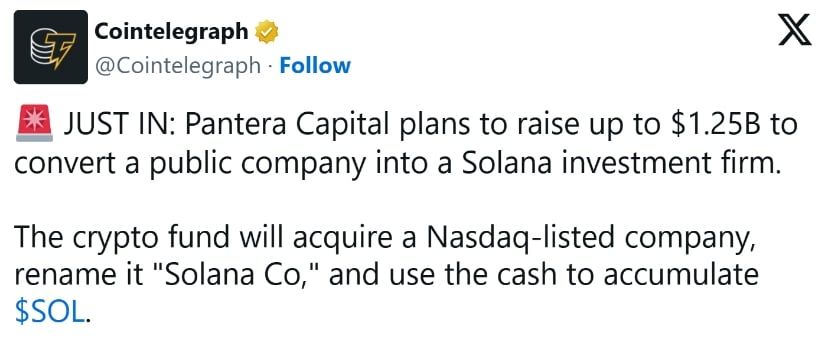

In a latest development, A major institutional move is underway as Pantera Capital revealed plans to raise up to $1.25 billion to back Solana. According to the report, Pantera aims to acquire a Nasdaq-listed company, rebrand it as “Solana Co.,” and channel the funds directly into accumulating SOL. This type of strategy not only signals strong conviction in Solana’s future but also shows how big capital is finding creative ways to gain exposure at scale.

Solana draws major institutional attention as Pantera Capital plans a $1.25B push into SOL, highlighting growing corporate confidence. Source: Cointelegraph via X

What stands out is how Solana is increasingly finding itself under the radar of large companies and funds. From ETF filings to billion-dollar allocations like Pantera’s, the network is no longer just a retail-driven story but one that institutions are now shaping.

If executed, this would add another strong layer of demand and credibility for Solana, potentially reshaping bullish Solana price prediction.

$210–$215 Remains the Key Hurdle

Solana’s chart continues to show repeated tests of the same resistance band near $210 to $215, marked by the red box in Kingpin Crypto’s analysis. Each approach has so far resulted in rejection, but the pattern of higher lows underneath suggests that buyers are steadily weakening this resistance. Technically, the more times a resistance level is tested, the weaker it becomes, which keeps the setup constructive for a potential breakout once momentum aligns.

Solana continues to battle the $210–$215 resistance zone. Source: Kingpin Crypto via X

That said, caution is still warranted as repeated failures at this zone also raise the risk of short-term exhaustion. A rejection without strong follow-through could send the price back towards the $180 or even $165 levels for a retest of support. For now, the game plan remains straightforward, patience is key, and a confirmed flip above $215 would be the cleaner signal that Solana is ready to sustain its next leg higher.

Solana Watching $180 as Next Support

SOL Solana is trading around $189, while analyst Fresh_Fontana highlights $180 as the next meaningful support zone. The chart shows that this level aligns with the broader ascending trendline that has guided price since early August, making it an important area to watch if current momentum eases.

Solana holds near $189 as $180 emerges as a key support level aligned with its broader trendline. Source: Fresh_Fontana via X

For now, bulls will want to see $180 hold as a short-term base, with the bigger picture hinging on whether Solana can maintain strength above its trendline support.

Solana Price Prediction: $300 Target Still in Play Despite Rejections

Solana price faced another rejection near the $200 zone, with analyst Ali Martinez noting that the chart leaves two clear paths for participants. The first is a dip toward $176, which coincides with a strong support cluster and a rising trendline that has been guiding price action since spring. The second is a breakout above $207, which would flip resistance into support and confirm bullish continuation. Both levels act as critical markers for Solana’s next move.

SOL Solana price shows $176 as key support and $207 as the breakout trigger, keeping the $300 target in play. Source: Ali Martinez via X

If either scenario plays out, the broader target remains intact at $300, supported by Fibonacci extensions aligning with the next major leg higher. For now, $176 serves as the downside buffer and $207 as the upside trigger. Until one of these levels breaks with conviction, Solana price prediction is likely to remain in consolidation.

Final Thoughts: Solana Could Break Out With Institutional Support

Institutional buying is positioning itself as the most important catalyst for Solana’s future. With large funds like Pantera Capital actively seeking exposure, the narrative is shifting from short-term speculation to long-term conviction. This wave of accumulation suggests that Solana’s market is maturing, and the consistent presence of institutional demand could provide the stability needed to drive prices higher.

The $210 to $215 resistance remains the defining test in the near term, but growing corporate interest makes it increasingly likely that this barrier will eventually break. A decisive move above it would confirm that institutional flows are reshaping the market’s structure, setting the stage for SOL Solana price to push towards $300 and ultimately challenge new all-time highs.