TLDR

- Nasdaq-listed Safety Shot bought $25 million in BONK memecoin and took a 10% revenue stake in Bonk.fun launchpad

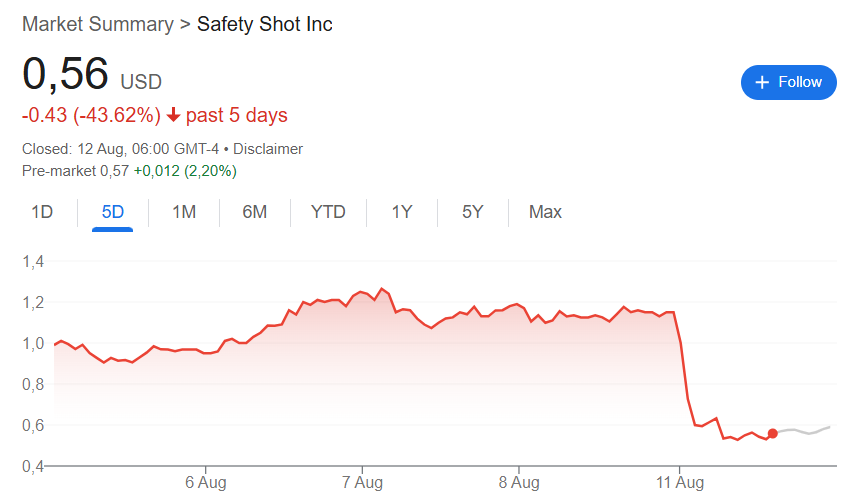

- Company stock dropped 50% after the announcement as investors reacted poorly to the treasury strategy

- Bonk.fun generated over $35 million in user fees in July and controls 80% of Solana’s token launch market

- Safety Shot will reinvest 90% of its BONK.fun revenue into more BONK token purchases

- This marks a shift from typical corporate crypto holdings to revenue-generating asset exposure

Nasdaq-listed drinks maker Safety Shot saw its stock price fall by half after announcing a major investment in the BONK memecoin. The company revealed plans to add $25 million worth of BONK tokens to its treasury as part of a new digital asset strategy.

Safety Shot also secured a 10% revenue stake in Bonk.fun, one of Solana’s largest memecoin launchpads. The platform generated over $35 million in user fees during July alone, making it the month’s highest-earning memecoin launchpad.

The company’s stock (SHOT) dropped to $0.59 in after-hours trading on Monday following the announcement. Shares had risen 36% over the past month but remain down 22.5% year-to-date.

Safety Shot, formerly Jupiter Wellness, manufactures blood alcohol detox drinks under the Sure Shot brand. CEO Jarrett Boon previously co-founded GBB Drink Lab, which developed the Safety Shot product.

The deal represents more than a simple crypto purchase, according to company leadership. Safety Shot will receive recurring income tied to BONK ecosystem activity and token price performance.

Revenue-Generating Strategy

Bonk.fun controls more than 80% of Solana’s daily new token launch market share. On peak days, the platform sees over 20,000 tokens deployed with daily volumes exceeding $100 million.

Safety Shot plans to reinvest about 90% of its BONK.fun revenue into additional BONK token purchases. The company cleared all outstanding debt and maintains over $15 million in cash to support this strategy.

BONK ranks as the fourth-largest memecoin with a $2 billion market cap and 980,000 on-chain holders. The token has integration across over 400 Solana applications covering DeFi, gaming, and consumer products.

Safety Shot will issue preferred shares convertible into common stock valued at $35 million to fund the transaction. The company describes this approach as acquiring a stake in “a highly profitable engine” within digital assets.

Platform Performance

Bonk.fun consistently ranks among the top 10 decentralized applications globally by revenue metrics. The platform’s success helped it eclipse rival Pump.fun during July’s performance period.

BONK prices reached their peak in November 2024 but have since declined 57% as memecoin market interest cooled. The broader memecoin market cap has dropped 25% year-to-date while overall crypto markets gained 22%.

This transaction follows a pattern of public companies exploring memecoin treasury strategies. GD Culture Group announced similar plans in May, seeking to raise $300 million for crypto reserves including the TRUMP memecoin.

CEO Boon called the move “a first step in a much broader corporate evolution” for Safety Shot. The company prepared for this shift by settling debts and building cash reserves ahead of the announcement.

Safety Shot represents one of the first public companies to take direct revenue exposure in a memecoin ecosystem rather than simply holding tokens as treasury assets.