Traders and investors are focusing on the strongest projects as Bitcoin and other major assets climb sharply. The surge comes after a period of tight consolidation and has been fueled by fresh developments in the blockchain market.

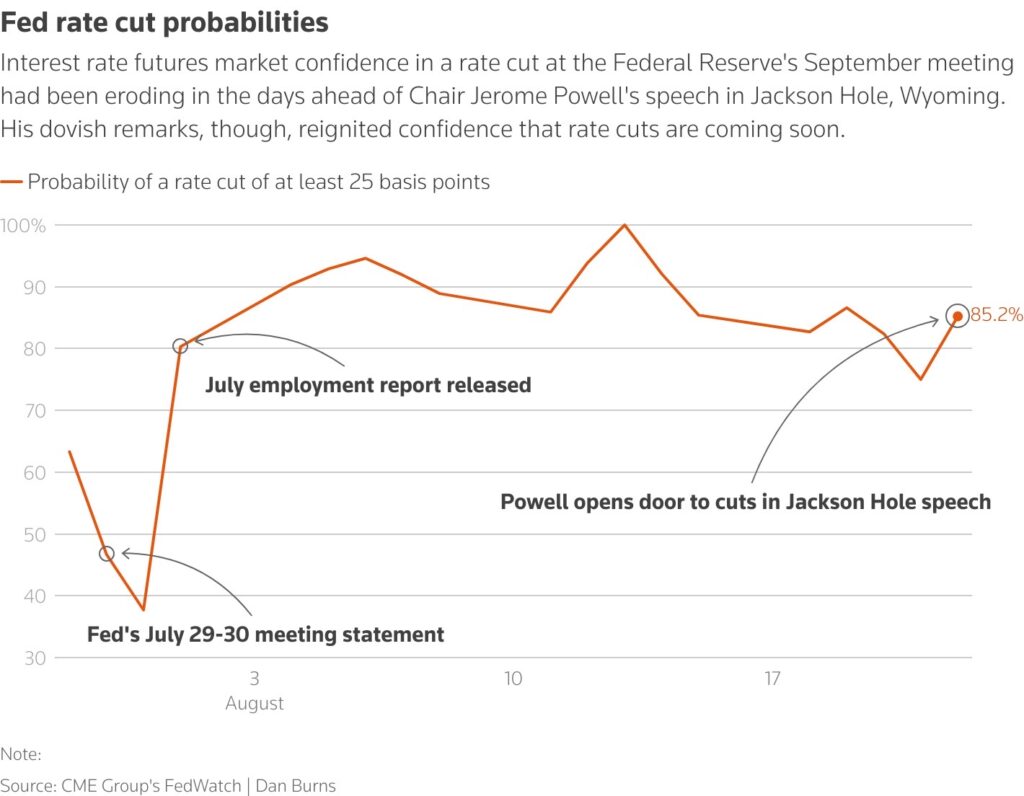

At the center of this move is Federal Reserve Chair Jerome Powell, whose recent comments suggested that rate adjustments could arrive sooner than expected. His words provided just enough reassurance to spur a rush of buying, adding energy to a market already primed for action. With momentum now building, interest is also turning to assets that can benefit most from this stage.

Market Dynamics and Bitcoin’s Powerful Break

Markets rarely ignore signals from the Federal Reserve, and Jerome Powell’s recent comments were enough to spark a sharp reaction across every major asset. In his latest address, Powell acknowledged that employment trends are softening and that policy may need to adjust sooner than previously thought.

While he emphasized caution and the ongoing risks from inflation, investors heard what they needed: the door to lower rates has opened. Analysts immediately increased the probability of a rate cut at the September meeting to over 85%, and the shift in expectations was reflected almost instantly on the charts.

Bitcoin, which had been holding near the $113,000 range, broke higher as the speech gained traction. Within hours, it cleared $117,000 and stayed firm, catching many short sellers off guard. Ethereum responded even more impressively, climbing toward an all-time high near $4,900.

The speed and conviction behind these moves created a wave of liquidations. Roughly $750 million in positions were wiped out, including $470 million+ in shorts, as bearish bets failed to keep up with the change in sentiment.

This type of aggressive repricing often highlights the underlying strength in the market. When capital rotates quickly into perceived safe or high-growth assets, the pressure tends to extend beyond the leaders. Altcoins and emerging projects often benefit as confidence spreads. For investors, these moments are not simply about chasing the headline moves but identifying tokens and platforms with the structural potential to magnify gains as the rally continues.

Best Crypto to Buy Now as Market Pumps Indicating Further Growth

Bitcoin Hyper

Bitcoin Hyper has introduced itself as one of the more forward-looking projects built around Bitcoin. Rather than trying to reinvent the wheel, it strengthens it by creating a secondary layer that increases speed and reduces transaction costs while maintaining Bitcoin’s core principles.

This approach has found renewed interest as the market’s appetite for efficiency grows. The latest surge in Bitcoin’s price has been a reminder that traders value networks that can keep up with volume without bottlenecks.

Where Bitcoin Hyper gains attention is in its ability to handle real-time transfers and provide an environment for developers to build decentralized applications on top of Bitcoin’s settlement layer. In the wake of Powell’s comments and the resulting rally, tokens tied to scalability and utility have seen renewed demand.

The sharp move to $117,000, combined with Ethereum’s push toward $4,900, has created the kind of attention that spills over into assets that bring added value to the leading chains.

Investors see potential here because Bitcoin Hyper’s architecture is not speculative flair. It focuses on throughput, layered security, and compatibility with existing wallets and exchanges, meaning adoption can scale without friction. The project’s popularity has only picked up further after top crypto content creator channels like 99Bitcoins and more featured the project in their lists.

As liquidity grows, so does the value of ecosystems that make existing networks more capable. With shorts being forced out and capital rotating toward assets with utility, Bitcoin Hyper is increasingly viewed as a candidate for sustained momentum rather than a passing trade.

Wall Street Pepe

Community-driven tokens often depend on novelty, but Wall Street Pepe has managed to move past being a simple meme. It has drawn traders by combining its playful branding with serious technical moves.

The most significant development has been its expansion beyond its original chain to embrace Solana, which has given it faster settlement speeds and access to an active liquidity pool. That decision positioned Wall Street Pepe to benefit when Solana-linked assets started attracting renewed attention.

The recent market rally provided a timely boost. As Bitcoin pushed to $117,000 and Ethereum closed in on record highs, funds flowed into risk assets that could offer upside. Wall Street Pepe’s multichain reach became a selling point, and interest from speculative traders returned. The project’s growth reflects a shift in meme coin culture: investors are now looking for humor wrapped around some form of function, and Wall Street Pepe’s Solana activity meets that demand.

In an environment where nearly $770 million in leveraged positions were liquidated, projects that can sustain volume are at an advantage. Wall Street Pepe’s community continues to organize trading pools and promotions that keep engagement high.

As the odds of a rate cut remain strong and liquidity likely to improve, tokens that bridge entertainment and adaptability often attract the kind of early capital that drives large percentage moves. For those scanning the meme coin sector for potential leaders, this one has shown it can surprise both with humor and execution.

Best Wallet Token

Best Wallet Token has steadily built a reputation as more than a trading instrument. Its platform continues to refine its core wallet offering, and the release of its v2.10 signaled that development is active and listening to user needs. The upgrade included security improvements, faster token handling, and integration with dApps, making it a more compelling choice for those who see wallets as gateways rather than static storage tools.

The timing of this update could not have been better. As Bitcoin surged past $117,000 and Ethereum tested heights near $4,900, market participants began revisiting tools that support active engagement. The projects that gain users during rallies tend to be those that solve immediate problems. Best Wallet’s focus on privacy, ease of use, and seamless connectivity puts it in that category.

🔥 Over $15M Raised! 🔥

Best Wallet is setting a new standard for speed, access, and control:

✅ Trade new tokens early, directly in-app

✅ Swap across chains seamlessly

✅ Sleek design paired with full control📲 Download Best Wallet today: https://t.co/Ykt3PTrPG0 pic.twitter.com/qIZ8kY96L1

— Best Wallet (@BestWalletHQ) August 21, 2025

In a week where almost half a billion dollars in shorts were wiped out, attention naturally turns to infrastructure plays that can capture higher transaction activity. Best Wallet Token benefits from that dynamic because its token is tied to usage and rewards within the ecosystem. Thanks to this utility, the project has already raised more than $15 million at the time of writing.

More users and more activity can translate to increased demand. For investors, it is appealing because it combines utility with exposure to market growth. While wallets often get overlooked during hype cycles, this token’s fundamentals make it more than a passive bet and give it a reason to stay on watchlists as momentum builds.

Snorter

Snorter has found a spot in a crowded field by focusing on where traders already spend time. Its Telegram-based bot is not just a novelty; it integrates AI tools for data analysis and trade execution in real time. This setup has become especially relevant as markets move quickly. Traders want insights delivered to where they already operate, and Snorter meets that demand with simplicity.

The latest surge in crypto pricing has lifted interest in tokens that support decision-making. When Bitcoin jumped to $117,000 and Ethereum challenged $4,900, rapid changes in market structure demanded faster responses. Snorter’s appeal is that it puts analysis and execution into one stream, cutting the time between seeing a move and acting on it. That is valuable in weeks like this one, where hundreds of millions in shorts were erased and traders scrambled to adjust.

As analysts raise the probability of a rate cut, the expectation is for continued volatility. Assets that thrive in active markets often draw users when price action is intense. Snorter’s token reflects participation in that service ecosystem, meaning usage can push value higher.

Its mascot and branding keep it connected to meme culture, but its function gives it a wider reach. At a time when information speed can be as important as price, Snorter looks positioned to benefit from traders wanting both entertainment and an edge.

Conclusion

The rally that cleared $117,000 for Bitcoin and pushed Ethereum near $4,900 has reminded traders that opportunity often comes when sentiment changes quickly. Powell’s remarks gave a clear spark, liquidating nearly half a billion in shorts and confirming that confidence can return in an instant.

At times like these, it is not just the leaders that matter. Tokens and platforms that pair utility with momentum tend to capture interest first, and those are the names worth considering as the cycle develops.