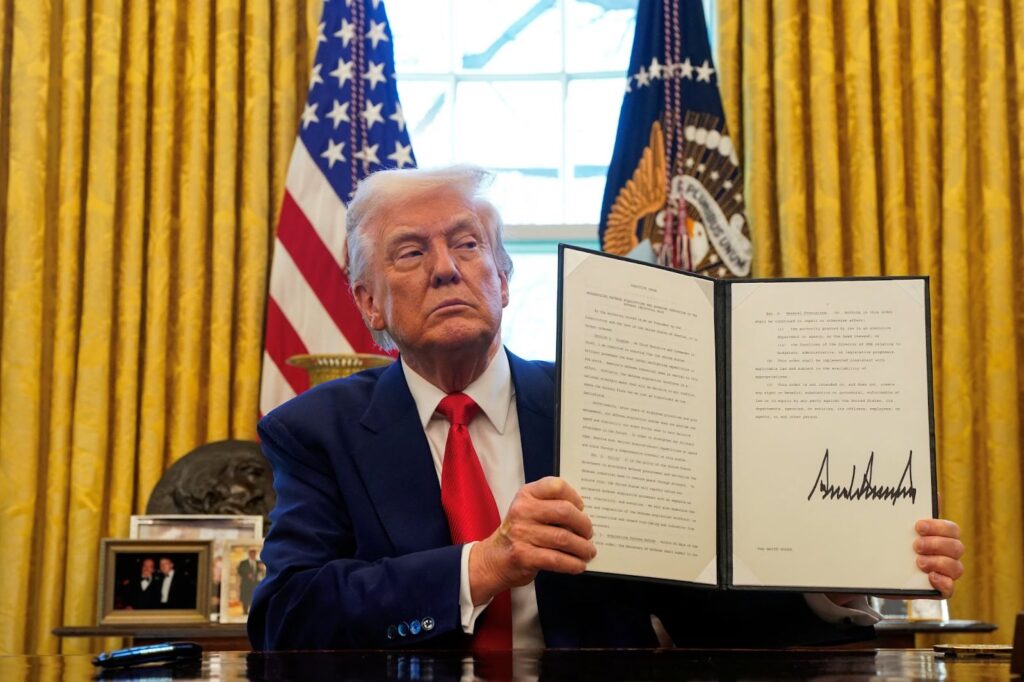

President Trump’s new executive order is setting the stage for a major shift by clarifying how retirement savings can be invested. A bold step that aims to make it easier to include alternative assets like private equity, cryptocurrency and real estate inside 401(k).

This matters because allowing alternative investments in retirement plans would transform the investment landscape, give individuals more diverse options, and shift institutional demand in the market.

BREAKING: 🇺🇸 President Trump To Sign Executive Order Allowing Crypto in 401(K) Retirement Plans Today! $BTC $XRP

$12.5 trillion held in the retirement accounts across the U.S…. BULLISH!💥📈 pic.twitter.com/iFlh8uG6AB

— Good Morning Crypto (@AbsGMCrypto) August 7, 2025

For investors, the key question isn’t about opinions or beliefs, but about how to choose good investments at a time when cryptocurrencies can be added to retirement accounts. Below is an explanation of what this change means for the market and a look at the best cryptos to buy now for long-term growth in your portfolio.

From Political Play to Pension Fund: Trump Puts Bitcoin at Heart of American Retirement

Donald Trump is set to make the US the crypto capital of the world. With back-to-back legal moves like the Genius Act, Project Crypto, hosting dinners for TRUMP coin holders, and the SEC’s recent steps regarding the clarity of Liquid Staking Tokens, all are leading to the fulfillment of his dream.

With a new executive order, Trump signed a presidential decree that could transform American finance, beginning a new era that leans toward the inclusion of crypto, real estate, and private equity in 401(k) retirement plans.

This is a monumental move that will not only impact 60 million Americans but also shake Wall Street and the foundations of the crypto community. Few anticipated that Bitcoin would become central to American political strategy. With $12 trillion in pension funds at stake, it speaks volumes about Trump’s vision..

Now, what’s next? The Labor Department and other federal agencies have to revise the definition of “qualified assets” under the Employee Retirement Income Security Act of 1974 (ERISA), which currently governs retirement plans.

Once this law is set in motion, private equity funds, Bitcoin, and real estate will become a big menu of investment choices presented to workers by their employers. However, the rulemaking process could take several months.

This all started way back in 2020. An opening was hinted at during Trump’s first presidency and then confirmed under Biden. But this time, things are getting real by expanding the freedom of investment for savers. Before all this, alternative assets were prohibited in 401(k) accounts.

By making Bitcoin a long-term savings tool, Trump is ready to change the perception of crypto in the United States as well as across the world.

Bitcoin Price Analysis

With this, Trump’s executive order, Bitcoin took a breath of relief and reacted immediately by jumping from $114,900 to $116,850. Here is the further analysis of its price.

Bitcoin recently pulled back from mid-July highs and found a floor around $112k where buyers stepped in. One can see the bounce off that level and the recovery candle to $116k. The area near $122k is the obvious overhead resistance (previous July peak), so rallies tend to stall there.

Right now, the price is showing a short-term range/consolidation between these two zones with a slight bullish bias because the recent bounce came on decent volume. If the price breaks above $122k on strong volume, expect a bullish continuation; if the price falls below $112k, that would be a bearish sign and could open a deeper pullback.

According to a crypto analyst on X named Mayank, Bitcoin has broken out of the descending channel and is currently retesting the breakout zone.

#BTC/USDT ANALYSIS

Bitcoin has broken out of the descending channel and is currently retesting the breakout zone. Price is holding just above the upper trendline of the channel.

The 50 EMA is starting to curve upward, and price is currently trading above it, indicating early… pic.twitter.com/PAZhmmKvAu

— Mayank Dudeja (@imcryptofreak) August 8, 2025

Best Crypto to Buy Now

The rule change is expected to bring in more stable, long-term investors into the crypto market, especially those looking to invest their retirement funds into the best crypto to buy now for long-term growth. This could shift the focus from short-term volatility to more sustainable, secure investments.

Maxi Doge

As retirement plans mix Bitcoin with riskier assets, Maxi Doge could become a small part of diversified portfolios, drawing attention and speculative investment in one package.

It is the final form of Doge, evolving into a satirical, ultra-degen meme coin designed for traders who dream of green candlesticks.

No sleep, only pumps. That is the mantra that $MAXI captures, to tame the raw energy of a bull market. Born in the gym and fueled by caffeine, it is built on Ethereum.

$MAXI centers around pure, unfiltered meme adrenaline, aiming for 1000x trades, rage-fueled lifts, and enough testosterone to turn red candles into green ones.

Strategically, it aspires to be a lifestyle coin for traders, with well-thought-out tokenomics where the majority of funds are allocated to the MAXI Fund and Marketing.

As stated by the well-known crypto YouTuber 99Bitcoins, Maxi Doge has the potential to deliver 100x returns.

To buy and stake, one can use Best Wallet, allowing rewards to start rolling in without delay. Early stakers can have a clear edge, as it offers 100% APY.

Snorter

As 401(k)s begin to allow crypto, Snorter’s transparency and active community could make it a fit for high-risk portions of diversified portfolios. It’s not for core retirement investments, but it could be a choice for bold investors.

Introduced as a low-fee Telegram native sniper bot, it is built for the Solana blockchain, with Ethereum, BNB, Polygon, and Base support coming after launch.

It helps traders by simply letting them set buy and sell orders or build entire trading strategies. All of these features are available through a Telegram interface.

Desktop or mobile, it doesn’t matter which device users are sniping from. The project enables its users with features like honeypot detection, copy trading, and the lowest fees with fast transaction speed.

The one thing that makes it the best crypto to buy now is its ability to detect when new tokens are listed and place trades for investors. All of this happens with lightning speed, and the best part is that users don’t have to stay glued to the screen.

Powered with advanced risk control (stop-losses, limit orders), it adds a safety net that is an important part of meme coin trading.

Bitcoin Hyper

A long-term, Bitcoin-focused investment designed for steady growth. It’s perfect for investors who want to hold BTC in a retirement-friendly way.

Bitcoin Hyper offers a Layer-2 solution that not only rides the Bitcoin wave but also strengthens it. A solution that is on a mission to prove its worth by expanding Bitcoin’s limited functionality.

The engine of its growth is the trust and brand power of Bitcoin. By integrating into the Solana Virtual Machine (SVM), it offers speedy transactions and minimal fees.

To unlock the ability to use it in decentralized finance, decentralized apps, token swaps, and smart contracts, Bitcoin Hyper connects its ecosystem to fifteen-year-old, outdated Bitcoin technology.

While adding a layer of utility to Bitcoin, its presale has already crossed the $4M target. No doubt, it could play a major role in expanding Bitcoin’s practical reach.

With every Bitcoin move into Hyper, it reduces the active Bitcoin supply on Layer-1, resulting in the strengthening of Bitcoin’s scarcity narrative.

Best Wallet Token

Built for security and user experience, Best Wallet, powered by the Best Wallet Token focuses on improving wallets. It’s important if 401(k) plans start including crypto, making it easier for employers to offer crypto investments.

Designed to strike the balance between security, UX, and built-in DeFi access, its scope extends beyond the non-custodial wallet image.

It is not wrong to describe it as the financial dashboard for the Web3 age. With its hybrid design, Best Wallet offers the privacy and control of self-custody.

What makes it user-friendly is its simple design, helping users store, send, receive, and swap tokens directly within the wallet.

Best doesn’t compromise on decentralization and offers its users a passive income program with dynamic reward rates.

Having already smashed the $14M target in its presale, there are still many more features in the pipeline, including a card for crypto payments.

Conclusion

The executive order isn’t the end of the process, but rather the start. It’s like the starting gun in a race, signalling that the process to include crypto in retirement accounts has officially begun. The executive order gives official approval to begin considering cryptocurrency as an investment option within retirement accounts like 401(k)s. It’s now politically acceptable to explore this idea further.

However, the real work of making these options safe and practical for investors lies with regulators and financial institutions. The move emphasizes two things: crypto gaining acceptance among big institutions and a focus on designing safe, long-term crypto investment options for more conservative investors.

For investors, the advice is to choose assets that focus on safe, regulated, and liquid crypto investments as the best cryptos to buy now, as they offer long-term upsides while also delivering on short-term virality.