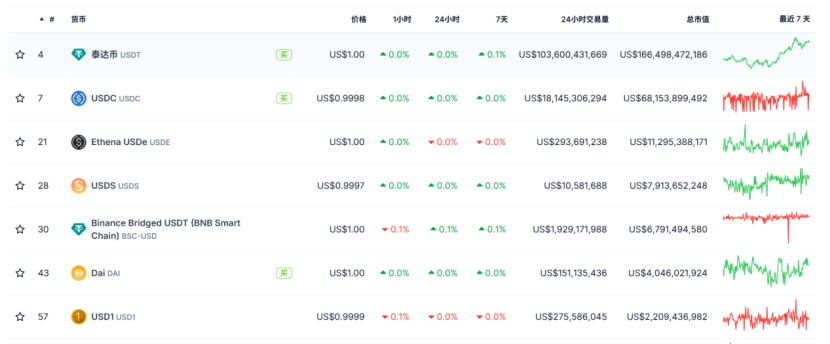

USD1, an institutional stablecoin pegged 1:1 to the US dollar and backed by cash and US Treasury reserves, has rapidly grown to over $2.7 billion in market capitalization since its March launch, ranking as the seventh-largest stablecoin. Issued primarily on the BNB Chain, it has gained significant traction through listings on major exchanges like Binance, Bitget, and Bybit, supported by airdrops and promotional campaigns.

- Its rapid expansion is closely tied to the Trump family’s World Financial Futures Fund (WLF), which provides substantial political and capital backing, attracting large investments such as a $2 billion commitment from Abu Dhabi’s MGX fund on Binance.

- However, USD1 faces political and regulatory scrutiny, with US senators raising concerns over potential conflicts of interest and the risk of the Trump family leveraging political influence for commercial gain in the crypto space.

- Comparisons have been drawn to the memecoin $TRUMP, which earlier raised suspicions about circumventing campaign finance laws, though USD1 is structurally different as a regulated stablecoin.

- Ongoing US regulatory developments around stablecoins may introduce compliance challenges and potential restrictions, especially given bipartisan political tensions.

Despite controversies, USD1 continues to gain investor favor by offering additional trading options and enhancing market convenience.

1. Rise of the New Force: USD1 Rapidly Expands

Earlier this year, the World Financial Futures Fund (WLF) first announced plans to launch its institutional stablecoin, USD1. USD1 is pegged 1:1 to the US dollar, with reserves comprised of cash, US Treasury bonds, and equivalents. BitGo is its custodian, and Crowe LLP issues monthly reserve verification reports. USD1 is widely regarded as highly transparent and trustworthy. USD1 officially launched in early March with a supply of $3.5 million. To date, its market capitalization has exceeded $2.7 billion, ranking it seventh among stablecoins.

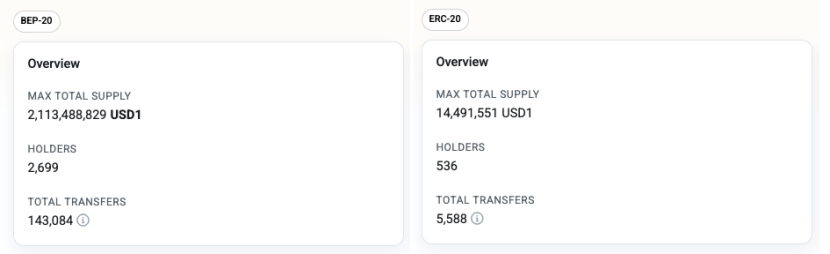

USD1 has garnered significant attention since its inception, and in recent months, leveraging its advantageous background, it has rapidly risen to prominence. USD1 is issued almost entirely on the BNB blockchain. According to BscScan data, USD1 issued on the BNB blockchain has a supply of $2.1 billion, representing over 99% of its total circulating supply. Etherscan data shows that the Ethereum version holds only $14.5 million. Subsequently, public chains with significant transaction volumes, such as Tron, have begun listing USD1 to meet on-chain funding needs. In just a few months, USD1 has been listed on major exchanges such as Binance, Bitget, and Bybit, rapidly entering multiple on-chain ecosystems.

Figure 2: Comparison of USD1 on the BNB chain (BEP-20) and Ethereum (ERC-20). Source: BscScan, Etherscan

USD1’s rapid expansion is inseparable from the support of major exchanges. Binance was the first to list USD1 in April, followed by PancakeSwap’s promotional activities to increase its exposure. Related memecoins quickly took the market by storm. For example, $B broke $400M in just ten days, triggering another small surge in the BNB chain. Bitget and Bybit subsequently listed USD1 in June and July, respectively, and launched airdrops and bounty programs, further increasing liquidity and user access.

2. Political factors: USD1’s off-market controversy

While focusing on USD1’s product design, users have also shown a keen interest in its political background. As is well known, USD1 originates from the World Financial Futures (WLF), which is backed by the powerful Trump family. Therefore, one of USD1’s most distinctive features is its deep connection with the Trump family. This may also explain USD1’s powerful market mobilization capabilities, even leading the Abu Dhabi investment fund MGX to invest approximately 2 billion USD1 in Binance. The Trump family’s resources, coupled with the backing of international capital, have given USD1 a unique growth environment from the outset, unlike most stablecoins.

However, as USD1’s circulation surged, more and more people, even politicians, began to question whether the Trump family was exploiting their political status for commercial gain. For example, several senators on the U.S. Senate Banking Committee sent an open letter to regulators, requesting an examination of USD1’s compliance and potential conflicts of interest. They argued that if the presidential family directly profited from the stablecoin business, the independence of regulators could be severely undermined.

These concerns are not unfounded. Similar questions were raised about the memecoin $TRUMP, which caused a sensation in January of this year. At the time, the token was believed to have the potential to circumvent campaign finance regulations, becoming a key channel for the Trump family to generate opaque income and even political bribes. While USD1 and Trumpcoin differ significantly in their positioning and nature, they share a core concern: whether President Trump’s family is seeking additional political or economic advantage through the cryptocurrency market. Some media outlets have also suggested that USD1’s partnership with Binance may offer further benefits, given Binance’s long history of scrutiny by US regulators and its proactive promotion of USD1. There are widespread concerns that this approach could allow stablecoins to become a rent-seeking tool for politicians, further complicating regulation and undermining social equality.

Currently, the US Congress is pushing for the implementation of new stablecoin laws and more crypto-asset regulatory rules. Whether USD1 can successfully obtain and maintain regulatory compliance will directly impact its long-term development. Especially in the context of bipartisanship, some lawmakers may propose special restrictions on President Trump’s family’s crypto-asset operations. As a pioneer, USD1 faces certain political uncertainties and compliance risks.

Despite some controversies, USD1 still provides crypto asset investors with more optional trading media, creates a more convenient market environment, and is increasingly favored by investors.