Key Notes

- Ethereum’s uptrend stalls near its 21-day moving average.

- ETH price faces rejection near $4,700 with risk toward $4,000 if selling pressure increases.

- ETH is currently trading 7.7% down from its latest peak.

Ether

ETH

$4 615

24h volatility:

1.3%

Market cap:

$557.37 B

Vol. 24h:

$34.39 B

is currently recovering from its recent drop to the critical support level, posting a 3.5% daily gain on Aug. 26. Popular analyst Markus Thielen noted that Ethereum is entering a decisive phase as momentum weakens.

Notably, ETH has been respecting its 21-day moving average, currently around $4,355, with multiple bounces observed through early and mid-August. Large buyers and institutions stepped in to defend this level, but the strength of dip-buying appears to be fading.

📊Today’s #Matrixport Daily Chart – August 27, 2025⬇️

Respect the Technicals: Ethereum’s Next Big Test #Matrixport #Bitcoin #Ethereum #CryptoMarkets #CryptoETF #InstitutionalFlows #BTC #ETH #MarketStrategy #TechnicalAnalysis pic.twitter.com/u0418lzsZx

— Matrixport Official (@Matrixport_EN) August 27, 2025

Thielen predicted that Ethereum is likely to oscillate between $4,355 and $4,958 in the short term. However, he also noted the risk of retesting levels below $4,355 if sellers regain control.

A Major Long Squeeze

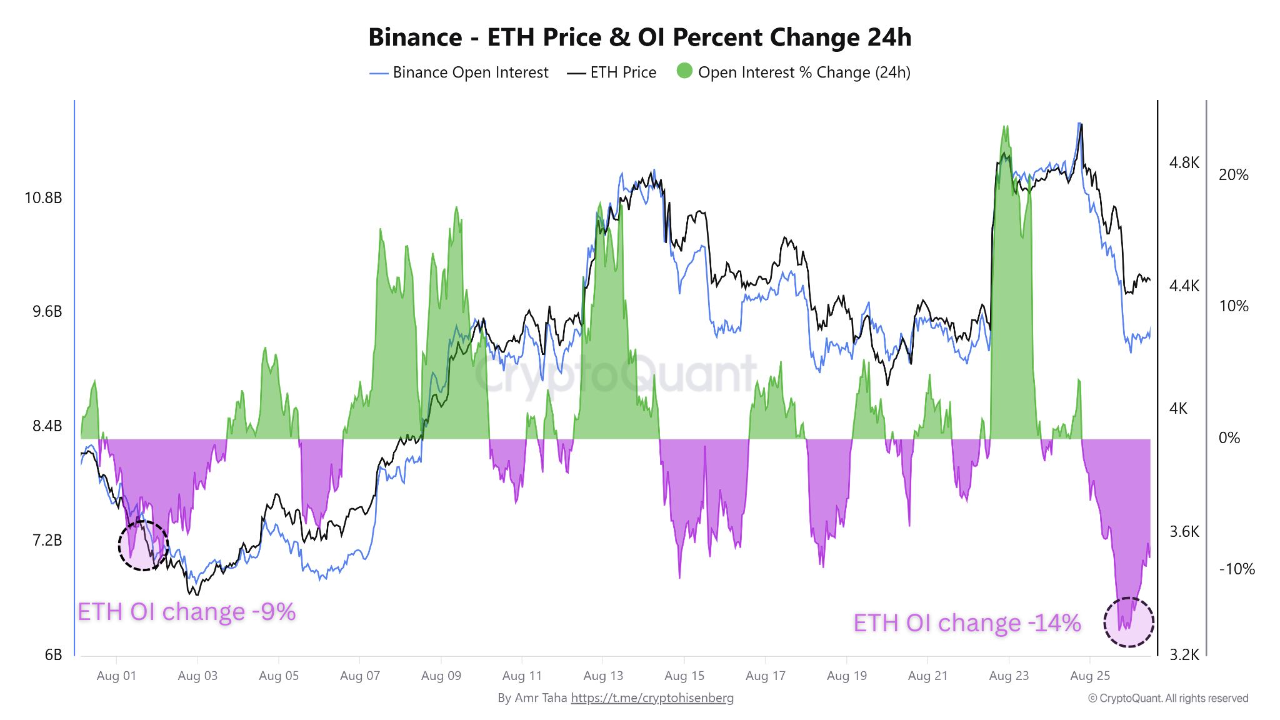

Adding pressure to Ethereum’s trajectory, the derivatives market recently witnessed one of its steepest single-day shakeouts. On Aug. 24, open interest on Binance plunged more than 14% within 24 hours as ETH slid below $4,400.

The sudden collapse triggered widespread liquidations, surpassing the early August contraction of -9%. This points to a forced deleveraging event rather than voluntary selling.

ETH price & OI percent daily change | Source: CryptoQuant

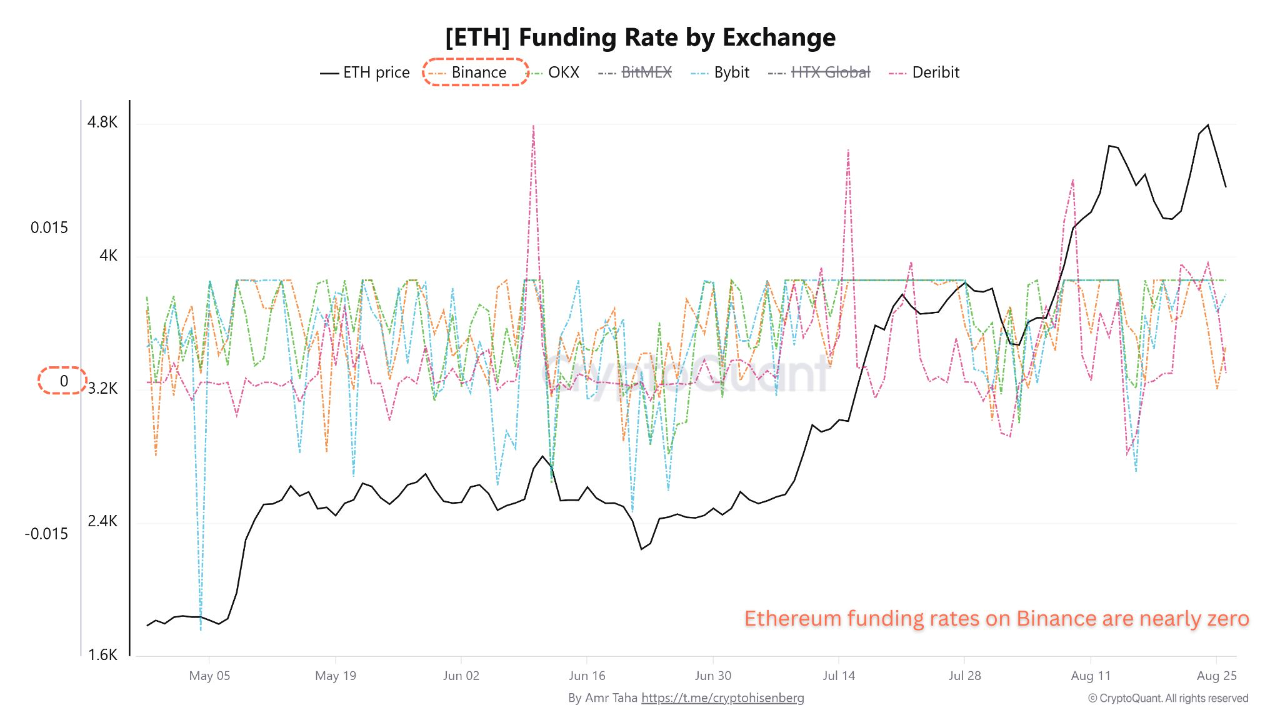

Meanwhile, ETH funding rates cooled to near-zero levels, a zone typically associated with the aftermath of long squeezes. According to on-chain insights from a CryptoQuant contributor, this reflects a collapse in bullish sentiment where late buyers are flushed out of the market.

ETH funding rate by exchange | Source: CryptoQuant

The synchronized fall suggests that leverage-driven demand is drying up quickly.

ETH Price Outlook: Bulls vs. Bears

At the time of writing, Ethereum is trading near $4,586 after briefly retesting its long-term support around $4,350. Just two days earlier, ETH had marked a new all-time high at $4,953 before sellers drove the price back down.

On the 4-hour chart, ETH is currently filling a bearish fair value gap between $4,600 and $4,450, with a possible extension toward $4,000 if selling pressure accelerates.

ETH 4-hour chart with possible price directions | Source: Trading View

For bulls to regain control, ETH must reclaim the $4,662 zone and post a daily close above $4,700. Such a move could restore bullish momentum and re-open the path toward $5,000.

Despite the near-term uncertainty, crypto analysts are optimistic. Popular trader Ted suggested ETH could hit $10,000 by year-end.

$ETH $10,000 end of year.

With a dip in September to buy. 👀

I agree with Tom Lee.

— Ted (@TedPillows) August 27, 2025

Ted predicted that before such a surge, traders could see an Ether price drop serving as a good buying opportunity.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

A crypto journalist with over 5 years of experience in the industry, Parth has worked with major media outlets in the crypto and finance world, gathering experience and expertise in the space after surviving bear and bull markets over the years. Parth is also an author of 4 self-published books.