Ethereum price today is trading near $4,600, stabilizing after an intense August that saw repeated attempts to reclaim the $4,800 mark.

The latest breakout from a descending trendline has renewed bullish sentiment, with traders now debating whether Ethereum can extend gains toward $6,000—and possibly higher.

Market Overview: Ethereum Holds Key Levels

Ethereum (ETH) is currently consolidating above $4,600 after testing $4,750 earlier this week. The price action remains guided by an ascending parallel channel, with immediate support around $4,500–$4,525 and overhead resistance at $4,750–$4,800.

Ethereum smashes resistance with a breakout and retest confirmed, fueling bold calls for a run to $10,000. Source: @crypto_goos via X

“Ethereum’s breakout above its descending trendline is a textbook bullish signal,” crypto analyst CryptoGoos noted in a recent post, suggesting a long-term path toward $10,000 if momentum holds. However, he added that confirmation requires Ethereum to sustain closes above $4,800.

Technical indicators remain supportive. The relative strength index (RSI) is at 54, above neutral yet below overbought levels, indicating room for further upside. Moving averages also reinforce the bullish structure, with ETH trading above its 20-EMA ($4,572) and 50-EMA ($4,526).

Whale Accumulation and Flows Strengthen Outlook

On-chain activity points to renewed institutional interest. On August 27, Ethereum recorded over $93 million in positive inflows, reversing a summer-long trend of outflows. Exchange balances also show a broader pattern of ETH moving off centralized platforms—a dynamic that often signals long-term accumulation.

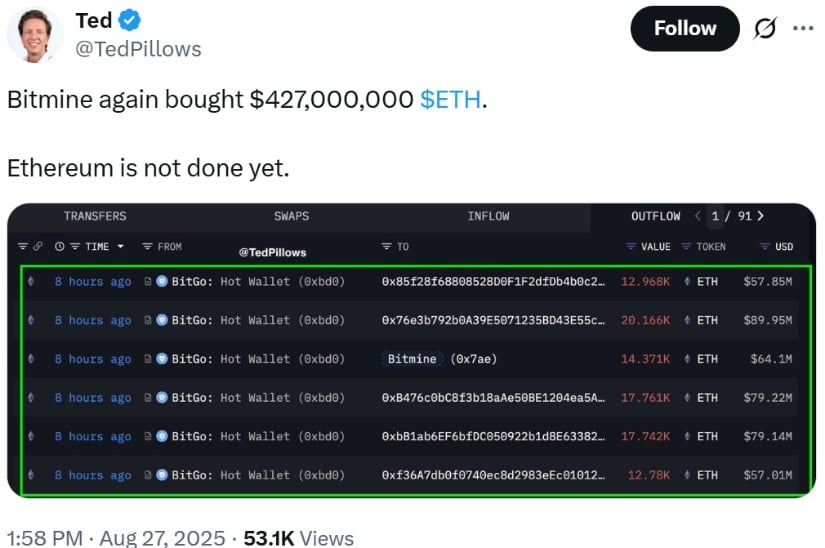

Bitmine scoops up $427M in ETH—signaling that Ethereum’s rally may be far from over. Source: @TedPillows via X

In a separate development, whale-tracking data revealed that Bitmine acquired $427 million worth of ETH in a single day, marking one of the largest accumulation events of the year. According to analyst @TedPillows, such large-scale purchases “tend to precede sharp upward moves, as whales position ahead of expected demand.”

This divergence from Bitcoin is particularly notable, as BTC continues to experience ETF-related outflows. Some market watchers argue that Ethereum could gain relative strength against Bitcoin in September if accumulation persists.

Breakout Levels in Focus

For bulls, the immediate challenge lies in clearing the $4,800 resistance zone. A successful breakout could open the door toward $5,000, with higher projections targeting $5,200–$5,400. Beyond that, analysts such as Lord Hawkins believe Ethereum could extend toward $6,000 in the coming months if momentum remains intact.

Ethereum’s roadmap unfolds flawlessly—after $4K and $4.8K, the structure signals expansion toward $6,000.Source: @MerlijnTrader via X

“The $6,000 level is realistic if Ethereum maintains channel support and breaks $4,800 with conviction,” Hawkins explained, though he cautioned that volatility remains high.

Meanwhile, Polymarket odds reflect a more cautious market stance, assigning a 76% probability of ETH reaching $5,000 by year-end, but far lower confidence in a push to $10,000.

On the downside, support remains at $4,500, followed by a stronger floor at $4,400, where the 100-EMA and prior lows converge. A breakdown below this pivot could flip the structure bearish, exposing ETH to $4,100–$4,200.

Fundamental Catalysts: Staking, L2 Growth, and Gas Fees

Outside of technicals, Ethereum fundamentals keep building. Ethereum staking remains robust with validator rewards attracting institutional demand while gas prices stabilize from highs.

At the same time, Layer 2 ecosystems such as Arbitrum, Optimism, and zkSync are showing strong transaction growth, propelling overall network activity for Ethereum. Growing Layer 2 total value locked (TVL) means that scaling solutions are becoming an increasingly larger part of ETH’s long-term adoption narrative.

These tailwinds to the environment could provide additional support to Ethereum’s bullish case as it tries to move upward.

Ethereum Forecast: Bullish but Cautious

Ethereum’s near-term direction hinges on whether bulls can recapture and hold the $4,800 level. A strong breakout could propel ETH to $5,200 and potentially even $6,000, or a breakdown risks backing off to $4,400 support.

Ethereum (ETH) was trading at around $4,645, up 2.96% in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

In the longer term, Ethereum’s break above its downtrendline has stoked controversy surrounding a $10,000 rally scenario. These are speculative calls, but rising whale accumulation, positive flows, and Layer 2 expansion give the bull case credibility.

Ethereum is currently trapped in a high-pressure consolidation range, with September set to decide whether ETH rallies to new highs—or remains capped by resistance.