Ethereum surged toward record highs today, climbing past $4,700 as renewed institutional interest, ETF inflows, and bullish technical signals sparked optimism for a potential breakout toward new all-time highs.

Analysts note that Ethereum’s network activity and Layer 2 adoption continue to strengthen its long-term growth outlook, suggesting momentum may carry ETH toward significantly higher price targets.

ETH Price Climbs Toward All-Time High

Ethereum is now less than 4% away from its all-time high of $4,891, reached in November 2021. The world’s second-largest cryptocurrency surged around 5% in the past 24 hours, buoyed by over $2.3 billion in net inflows to spot Ethereum ETFs over the last six trading days. Monday alone saw a record $1 billion in ETF inflows, signaling strong institutional demand.

Ethereum (ETH) was trading at around $4,709, up 4.96% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

On-chain data from Glassnode shows bids for Ethereum are strengthening, with the asset “marching toward ATHs” and continuing to act as a bellwether for the broader altcoin market.

Technical Analysis Points to Higher Targets

Analyst Gert van Lagen sees Ethereum breaking out from a four-year inverse head-and-shoulders pattern, a historically bullish formation that he believes could propel ETH toward $22,000 in the long term. The breakout was confirmed when ETH crossed the $4,659 level, which now serves as key support.

Ethereum has broken out of a four-year inverse head-and-shoulders pattern, positioning $ETH for a potential target of around $22K as part of its 2019–2025 bull market cycle. Source: Gert van Lagen via X

CryptoQuant data further supports the bullish case, showing the 30-day SMA of Ethereum Netflows remains negative despite the recent rally—indicating fewer coins are moving onto exchanges and suggesting selling pressure is limited.

Institutional and Corporate Accumulation

Institutional participation is intensifying. ARK Invest CEO Cathie Wood has doubled down on Ethereum, calling it “the institutional protocol” and highlighting that ARK’s ETH ETF is seeing its strongest investor interest since launch.

Cathie Wood highlighted Ethereum’s growing institutional adoption, citing its dominance in Layer 2 solutions, stablecoin activity, and treasury utility with staking features. Source: @CryptoGucci via X

Corporate treasury holdings of ETH now exceed $16.5 billion, led by BitMine Immersion Technologies with $5.33 billion worth of Ethereum. This accumulation is tightening supply, especially with more than 30% of ETH staked and unavailable for immediate sale.

Network Activity Near Record Highs

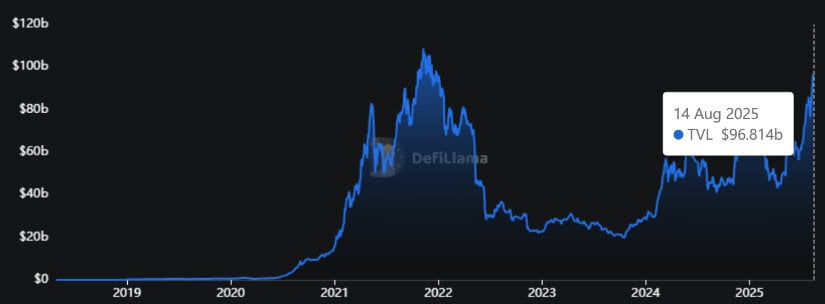

Ethereum’s daily transactions topped 1.87 million on Tuesday, approaching record levels. July 2025 alone saw roughly 50 million transactions, the highest in over a year. DeFi total value locked (TVL) stands at over $96 billion, securing over 61% of the entire DeFi market share.

Ethereum (ETH) TVL chart. Source: DeFiLlama

This surge in activity underscores Ethereum’s role as a leading smart contract platform, with Layer 2 solutions like Arbitrum, Optimism, and zkSync also contributing to scaling and adoption.

Price Outlook

Key resistance lies around $4,700–$4,750, according to Glassnode’s Week Onchain Report. A decisive breakout above this zone could trigger “price discovery,” with analysts targeting between $7,000 and $13,000 in the medium term, and up to $22,000 over a longer horizon if bullish momentum persists.

While traders remain optimistic, analysts caution that retests of support levels are possible before a sustained rally unfolds.