In the set of AI projects building on Base (or active around Base), the three names with the biggest market values are Virtuals Protocol (VIRTUAL), Venice AI (VVV), and AWE Network (AWE). In the tooling layer for AI agents, Warden Agent Kit does not have its own token (the parent protocol has the WARP token). Several small projects like A0x, Ratio1, and OXAI do have tokens, but their market values are still tiny. The data below is a snapshot at the time of writing; prices and market caps move all the time.

The Base AI Projects

Looking at the Base AI map, we can split projects into two simple buckets. The first is AI infrastructure: tools and rails that give data, indexing, storage, and processing for AI agents. Examples include Masa, OpenCoin AI, Mozaic Finance, Virtuals Protocol, and Ratio1.

The second is AI agents and apps (DApps): teams that build smart agents or end-user apps powered by AI. Examples include Rivalz Network, Yield Seeker, AITV, and Innovation Game.

For more: A Deep Dive into the Base Ecosystem

Base AI Ecosystem

Top Token Projects and Market Size

The top three take most of the “AI cap” on Base: VIRTUAL ~$744M > VVV ~$104M ≈ AWE ~$96M. The “future supply weight” is not the same across them: AWE is already fully circulating (market cap ≈ FDV), VIRTUAL still has about 34% not unlocked yet (Mcap/FDV ~0.66), while GIZA has only about 13% in circulation (Mcap/FDV ~0.13). That means dilution risk is higher for GIZA if unlocks are heavy. The numbers come from each token’s page on CMC.

|

Project |

Token |

Market cap (est.) |

FDV |

Mcap/FDV |

Quick note |

|

Virtuals Protocol |

VIRTUAL |

~$744.3M |

~$1.13B |

~0.66 |

655.5M/1B in circulation; ~$41M 24h volume |

|

Venice AI |

VVV |

~$103.6M |

~$219.0M |

~0.47 |

35.3M/74.6M in circulation; “450k+ users” |

|

AWE Network (STP rebrand) |

AWE |

~$95.9M |

~$95.9M |

~1.00 |

100% circulating; tagged “Base” on CMC |

|

Giza |

GIZA |

~$37.9M |

~$282.6M |

~0.13 |

134.3M/1B self-reported; “autonomous markets” infra |

|

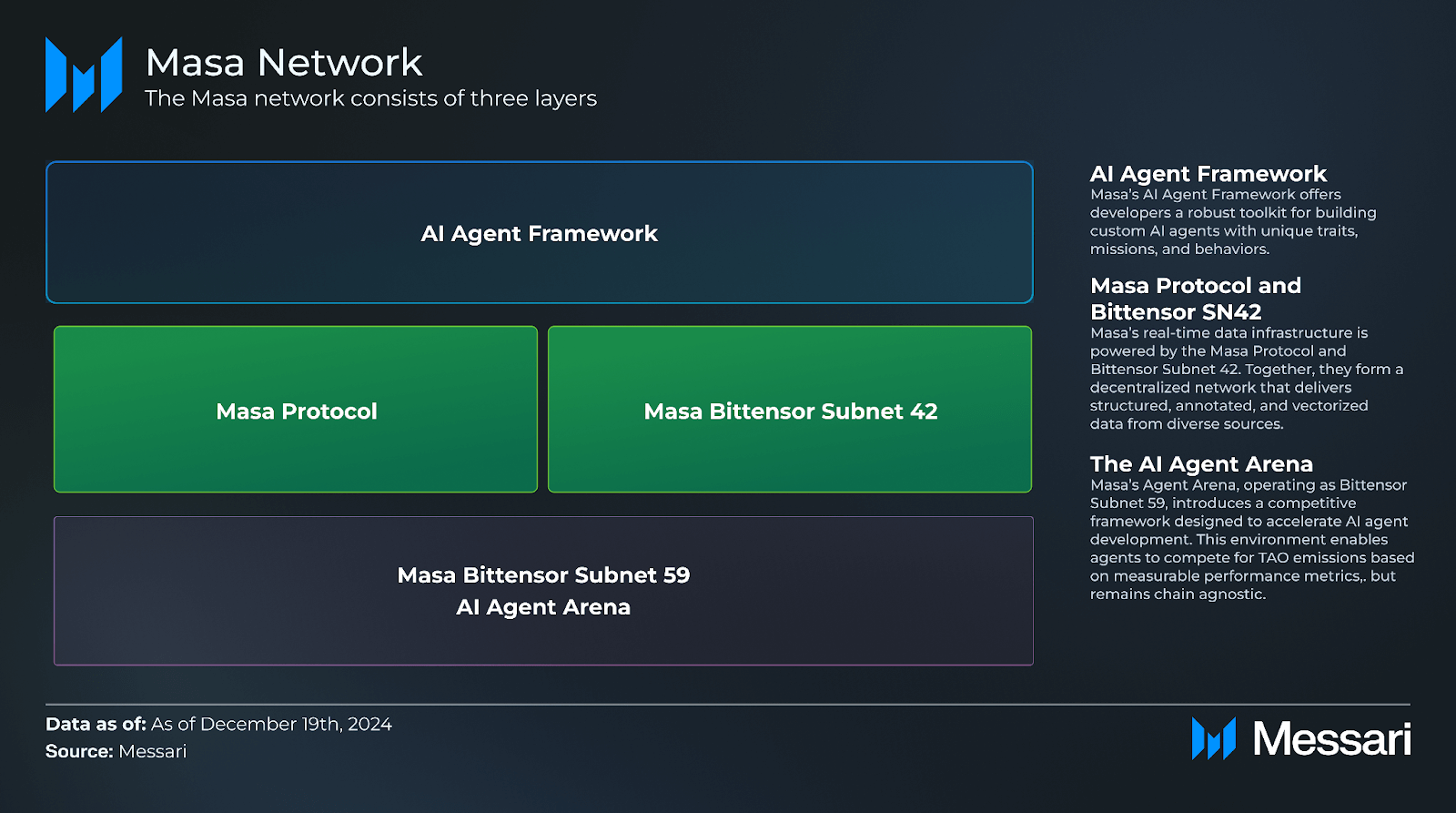

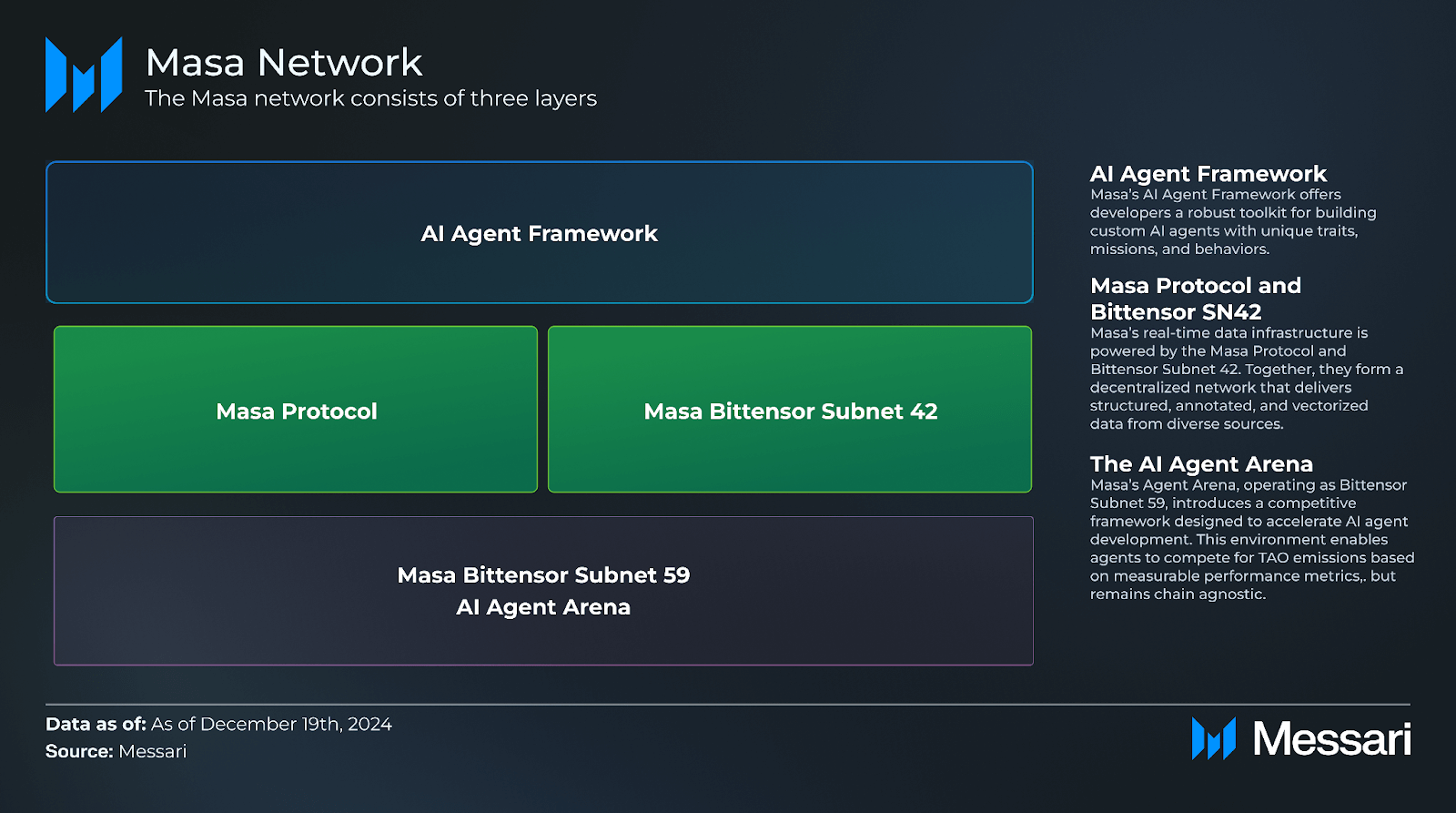

Masa |

MASA |

~$8.1M |

~$22.9M |

~0.74 |

1.5B circulating; real-time AI data network |

|

Ratio1 |

R1 |

~$1.6M |

$7.2M |

~0.21 |

Price and cap shown on Coinbase |

|

A0x |

A0X |

~$4.59M |

~$4.59M |

~1.00 |

Listed on CoinGecko; main liquidity on Aerodrome/Uni v3 (Base) |

|

Rivalz Network |

RIZ |

~$1.91M |

~$8.29M |

~0.23 |

Cross-chain; small cap, big swings |

|

Swan Chain |

SWAN |

~$1.2M |

~$4.58M |

~0.26 |

Calls itself an “AI SuperChain”; very small cap |

|

Mozaic Finance |

MOZ |

~$31.2K |

~$155.7K |

~0.20 |

DeFAI yield |

|

OXAI |

OXAI |

~€20.3K |

~€22.9K |

~0.89 |

Microcap; contracts on Base and app listings |

|

AITV (AgentCoin TV) |

AITV |

$22.5M |

~90M FDV |

~0.25 |

Shows Base network; total supply 1B |

Base AI Projects Have Tokens, and Which Do Not

In the group that already has a token and a public listing, besides the top three, we have MASA, GIZA, A0X, R1, RIZ, SWAN, MOZ, OXAI, AITV. Each has its own data page on CMC/CoinGecko/Coinbase.

In the group that does not have its token (or no CMC/CG listing seen at this time), a key name is Warden Agent Kit. It’s an SDK/CLI to build on-chain AI agents. It is a tool, not a token. If you follow the “Warden” ecosystem, the token you will find is WARP for Warden Protocol (listed on MEXC/Uniswap). That is not a token for Agent Kit. You can read more in docs and GitHub, plus a few Messari notes.

Some logos in the map (for example, OpenCoin AI/COINAI, Innovation Game/TIG, Brian, Elsa, Good CryptoX, MoonLight Pixels, Senpi, Rivo, BlockAI, Bitte Protocol, and OXAI) are very early, meme-like, experimental, or cross-chain. Listings can change fast. If a name does not have a reliable CMC/CG page yet, treat it as not publicly listed or micro-cap.

Community Buzz Based on Followers and Usage Signs

If we rank by community pull (followers, public user claims), Virtuals and Rivalz have very large social reach, while Venice stands out for real user numbers.

- Virtuals Protocol has about 278K followers on X.

- Rivalz Network has about 380K followers on X.

- Venice AI has about 51.6K followers on X and 450,000+ users in the CMC “About” section.

- Masa highlights its data network size: 1.4M+ unique users and 48K node operators (shown in its CMC profile).

These figures are not the same metric (followers ≠ active users), but they help us see share of voice. In media and community chatter, Masa pops up often thanks to staking, data farming, and airdrop events. Virtuals get attention for the fast jump in value and strong FOMO when the token launches. Space and Time wins trust with investors because of its tech and support from Microsoft. The Graph is older but still a core data layer many Base AI projects rely on.

Diversifying from Product Groups

Infrastructure/Engine/Koord AI-Agents

AWE and Warden (Agent Kit) lead the tech side. AWE sits at around a $95.9M market cap and is 100% circulating, so short-term unlock risk is low. Upside will depend on demand for “autonomous worlds.” Warden Agent Kit has no token; if you invest by ecosystem, you would look at WARP for the Warden chain and watch real adoption of the kit (repos, hackathons, integrations).

We just launched the AWEsome Ambassador Program at AWE Network.

If you’re into AI agents, virtual worlds, or building onchain culture, this is your invite to join the movement.

Shape the future of Autonomous Worlds.

Read More → https://t.co/n3uqxM3RyI

Apply now →… pic.twitter.com/pSSfXlpijf— AWE (@awenetwork_ai) May 23, 2025

dApps/Agents & Consumer AI

Virtuals lead by market value (~$744M) and liquidity (about $41M 24h volume). This shows strong community pricing plus the AI-agent story. Venice (VVV) sits around the $100M range with the idea of private AI inference and a model where you stake VVV to get inference capacity. This ties the token to compute access.

Data/Privacy & DeFAI

Masa (data + LLM network) is near a $17M cap, with Mcap/FDV ~0.74, so the remaining issuance overhang is not huge. The story “real-time data for AI agents” fits the Base-AI theme and the project shows big user numbers (1.4M+). Giza aims at self-running market infrastructure with high FDV ($283M) but low market cap ($38M) because only about 13% is circulating, so unlock timing matters.

Source: Messari

Conclusion

The Base AI Ecosystem is shaping up with strong infrastructure and fast-moving agent apps. Masa, Virtuals, AWE, and Warden look like anchors thanks to clear token designs, larger caps, and solid tech. Many other teams in the map have not launched tokens yet but are watched closely by the community and could spark new waves when they list.

The long-term view is positive. Base is backed by Coinbase, has low fees, and scales well. As AI and blockchain come together, the Base AI Ecosystem is a promising place for builders and investors to explore through 2025–2026.