Pudgy Penguins is holding key support levels while trending at the top of memecoin charts, as participants eye a potential breakout toward the $0.10 target.

Pudgy Penguins is quickly becoming one of the most talked-about memecoins, with its price action showing signs of building serious momentum. After climbing to the top of CoinGecko’s trending charts, participants are now watching closely as the PENGU token defends key support levels and gears up for a potential breakout.

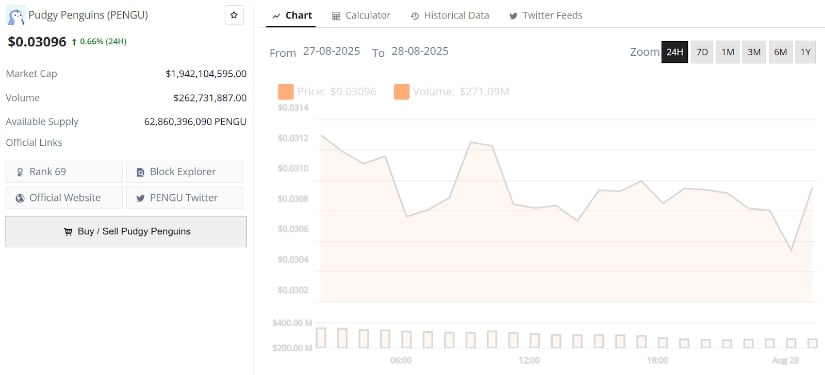

Pudgy Penguins’ current price is $0.03096, up 0.66% in the last 24 hours. Source: Brave New Coin

Trending Status Fuels Bullish Momentum for Pudgy Penguins

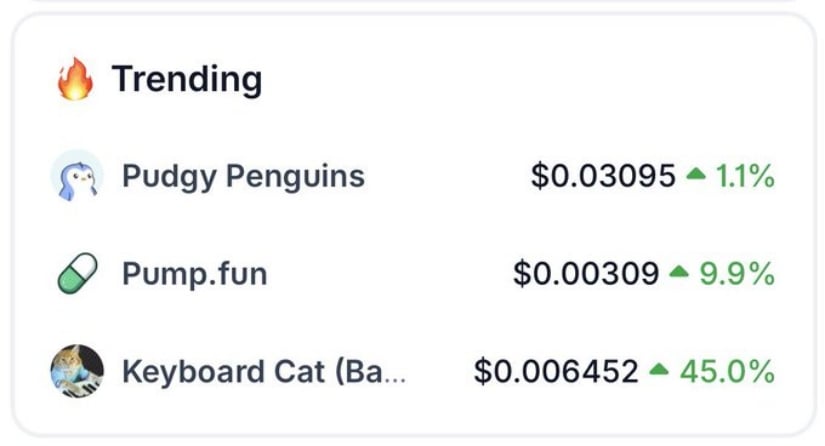

Pudgy Penguins has just claimed the #1 spot on CoinGecko’s trending memecoin charts, a milestone that reflects both growing attention and active community momentum. Moments like these often serve as catalysts in the memecoin space, where visibility fuels participation and participation drives price action.

The fact that PENGU is leading alongside other popular tokens highlights how it’s carving out a dominant position in this cycle.

PENGU tops CoinGecko’s trending charts, signaling rising momentum and strong community traction. Source: pudge nft via X

Technically, PENGU has been holding its ground above key short-term supports, showing resilience even as volatility runs high across the meme sector. With trending momentum now aligning with price stability, the stage looks set for another bullish Pudgy Penguins Price Prediction.

PENGU’s Accumulation Building Towards a Lift-Off

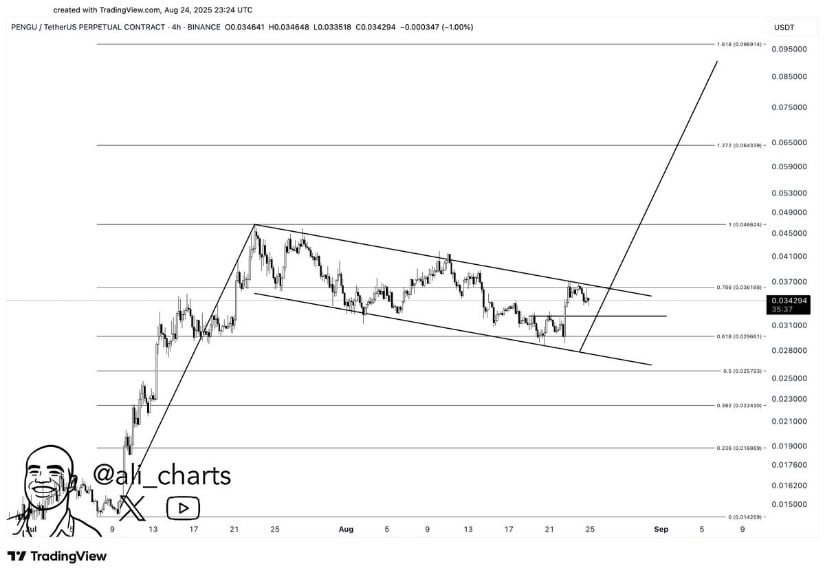

PENGU’s current chart shows a textbook accumulation phase, with price trading in a tight range as volume starts to stabilize. This kind of structure often precedes strong upward moves, as supply gets absorbed before momentum shifts to the upside.

As Jasper Chu notes, the longer this consolidation holds, the more powerful the eventual breakout could be. With PENGU already grabbing trending status, the technical base forming here adds conviction that the next leg higher may not be far off.

PENGU Price Prediction: Chart Points to $0.10 Target

PENGU’s chart is shaping up with a clear bullish structure, bouncing from the lower boundary of its descending channel and reclaiming short-term support levels. Fibonacci extensions outline the path ahead, with analyst Ali Martinez highlighting $0.10 as the next key target. The confluence of channel recovery, fib projections, and steady volume signals that momentum may already be shifting in favor of buyers.

PENGU rebounds from key supports with Fibonacci targets aligning at $0.10, signaling growing bullish momentum. Source: Ali Martinez via X

This technical setup builds directly on the strength shown in recent accumulation phases and trending momentum. As long as price continues to respect its rising base and maintain higher lows, the probability of a breakout leg grows stronger. A clean push through near-term resistance would confirm the move, setting PENGU on course towards the $0.10 zone with conviction.

PENGU Technical Analysis

PENGU continues to defend the $0.030 support level, showing that buyers are still active in holding the line. Analyst Lennaert Snyder points out that a dip toward $0.027 remains possible, but so far the market has reacted positively every time price tests this zone. This steady defense of short-term supports reflects a strong base of demand forming beneath the chart.

PENGU holds firm at $0.030 support as buyers defend the range, with resistance at $0.036 and $0.043 marking the next breakout levels. Source: Lennaert Snyder via X

On the upside, $0.036 stands as the immediate resistance that needs to flip for momentum to pick up again. Clearing this level would open the door for a retest of the $0.043 range highs, where liquidity has previously capped rallies. As long as PENGU maintains higher lows and consolidates above $0.030, the structure favors bulls.

Final Thoughts: Will ETF Be The Bullish Trigger?

The SEC’s delay on the Canary Spot PENGU ETF may frustrate some investors, but for the community, it adds another layer of anticipation. Historically, ETF filings, even with delays, tend to spark renewed attention and conversations that keep a token in the spotlight.

For PENGU, already leading memecoin trend charts and building a strong accumulation base, the extended timeline until October 12, 2025, could act as a countdown that strengthens conviction rather than weakens it.

If approved, the ETF could be the ultimate bullish catalyst, especially with PENGU’s chart holding firm above the $0.030 support zone. Analyst Lennaert Snyder notes that as long as this level holds, upside potential remains intact, with $0.036 as the first resistance to flip. A clean break above this opens the door for a retest of $0.043, while Fibonacci projections line up with analyst Ali Martinez’s $0.10 target.