The mood in crypto has been far from dull this year, but the next leg of the market may just be forming while many remain cautious. Despite recent pullbacks, the belief that this bull run could stretch to the end of the year is gaining weight. It is not simply a matter of sentiment.

Large wallets have been quietly buying Bitcoin and Ethereum at levels they see as undervalued, and institutional players have kept their flows steady. This renewed demand comes at a time when prices are still trading at a discount after the correction, sparking fresh speculation. Traders are now scanning the market for projects with strong potential at lower entry points, hoping to ride the next wave when momentum returns.

Whale Wallet Growth Shows Renewed Strength

Institutional flows have been steady, but the more telling story is in the wallets that matter most. In the past few weeks, data shows 13 new Bitcoin addresses have accumulated over 1,000 BTC each. On Ethereum, 48 fresh addresses have crossed the 10,000 ETH mark.

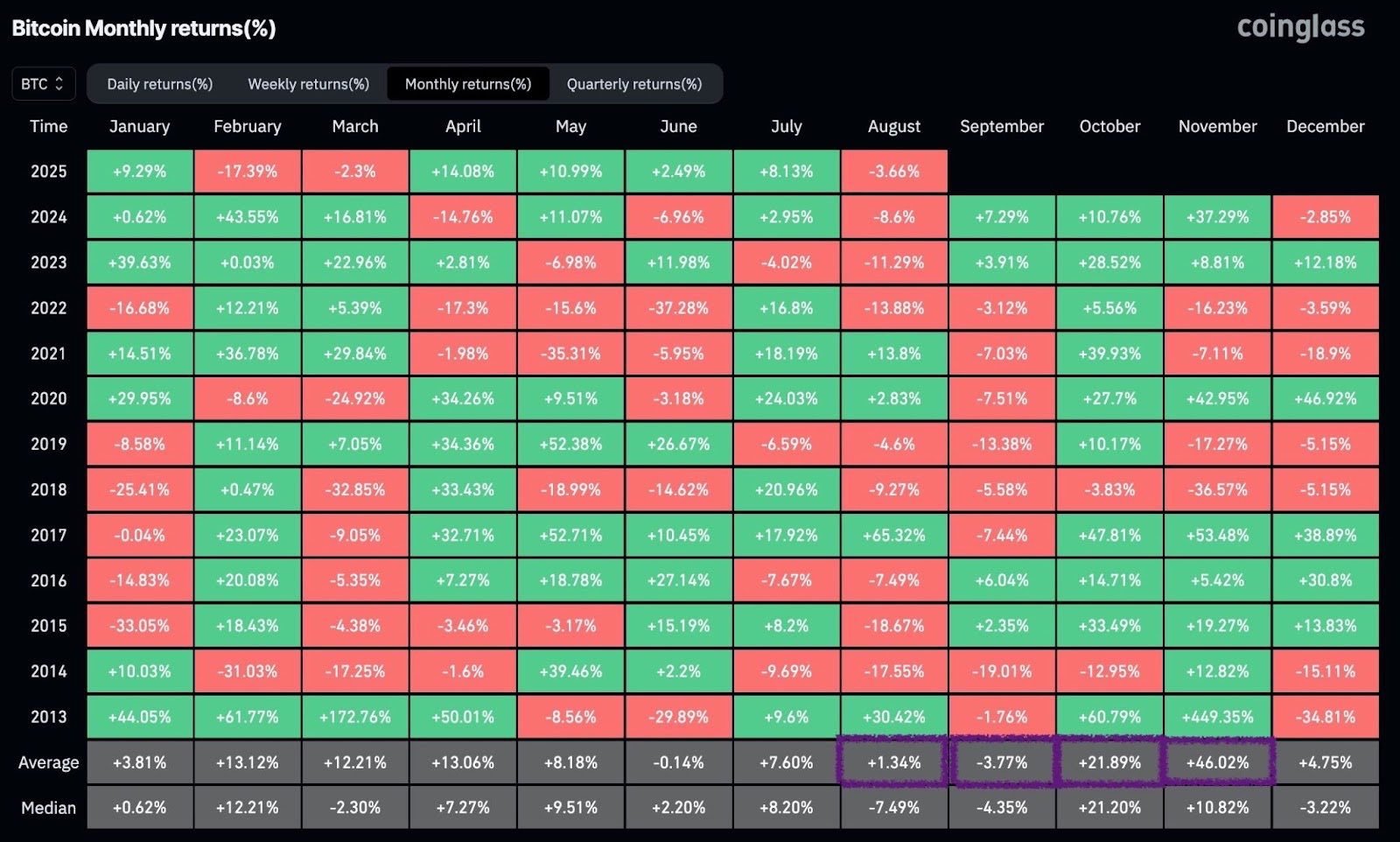

These are not traders chasing price spikes; they are large holders quietly building positions while prices remain attractive after the recent pullback. Historically, this kind of movement tends to occur when the wider market is uncertain. September is known for weakness, with Bitcoin averaging negative monthly returns around -3.7%.

Retail investors often reduce exposure at this stage, fearing a deeper correction. Yet, those with longer horizons see it differently. They step in when prices soften, and history suggests they are usually early.

October and November have delivered some of Bitcoin’s best months, with average gains of 21.8% and 46% respectively. That timing is not accidental. Strong hands prefer to build when volatility has pushed weaker hands out.

The current accumulation shows conviction, not hesitation, and it sends a clear signal: value is being recognized now, not later. For those watching, this could be one of the most strategic times to prepare.

Averaging in gradually, rather than waiting for confirmation, has often been the better play when markets move from caution to momentum. If this pattern holds, the quiet accumulation today could fuel the runs that define the last quarter of the year.

Best Crypto to Buy Now As Funds Flow Into the Market

Best Wallet Token

Best Wallet Token continues to prove why it has become a leading name in the Web3 wallet space. The platform has made consistent upgrades that appeal to both seasoned crypto holders and new entrants. Its latest update, which added Solana integration alongside its existing support for Bitcoin and Ethereum, shows a clear focus on flexibility and broad asset coverage.

For investors, this matters because usability and security drive adoption. A wallet that can seamlessly connect multiple ecosystems and still maintain a clean user experience has a real chance to stand out.

Best Wallet Token also serves as the engine for its rewards and governance features, giving it value beyond being a simple utility. With markets still in a consolidation phase, having exposure to infrastructure tokens that benefit directly from higher transaction activity can be strategic.

Large holders are buying Bitcoin and Ethereum, and every new phase of accumulation tends to push users back to reliable tools for storing and managing assets. Best Wallet Token’s ability to improve speed, add chains, and stay relevant in a competitive space could make it one of the quieter but stronger names to watch.

🔥 Over $15M Raised! 🔥

Best Wallet is setting a new standard for speed, access, and control:

✅ Trade new tokens early, directly in-app

✅ Swap across chains seamlessly

✅ Sleek design paired with full control📲 Download Best Wallet today: https://t.co/Ykt3PTrPG0 pic.twitter.com/qIZ8kY96L1

— Best Wallet (@BestWalletHQ) August 21, 2025

Its token value benefits as the wallet gains more users and attracts new flows, and the fact that it is still at accessible price levels gives investors room to build positions before the broader market activity increases later in the year.

Snorter

Snorter is not trying to be just another meme token; it has found a way to pair humor with genuine utility. The project is built around a Telegram-based AI bot that can provide real-time insights, track wallets, and help users stay on top of their holdings without leaving the messaging app they already use daily.

This direct integration into Telegram is important because it lowers the barrier for new users and keeps advanced users engaged. It is one thing to buy and hold tokens; it is another to have tools that make interaction simple and fast. Snorter delivers this. The aardvark mascot and community-driven tone keep it fun, but the bot’s functions like alerts on trades and market moves and wallet analysis are what make it practical.

These are features that appeal to a wide spectrum of traders who want quick access to data without relying on multiple platforms. Given that whales are actively accumulating assets like Bitcoin and Ethereum, tools that provide better visibility into movements and holdings are in demand.

Cilinix Crypto, a popular crypto YouTuber, also highlighted and talked about the project with bullish speculation, only furthering the potential of the project on his channel.

Snorter’s approach is lighthearted, but the underlying idea is serious: make crypto management frictionless. As more users test it and talk about it, the token gains recognition. That mix of entertainment and function gives Snorter room to expand. It is still early, and the upside could be significant if its tools become common in trading groups and communities across Telegram.

Chainlink

Chainlink has long been considered an essential infrastructure for crypto, and recent developments have only reinforced its position. Its network secures data feeds that are critical for everything from DeFi to enterprise integrations. The latest signal of market confidence came when Bitwise filed for a Chainlink ETF in the United States.

While approval is uncertain, the fact that a major asset manager is seeking regulated exposure is telling. It points to Chainlink’s role as a building block rather than a passing trend. The token’s price, currently in the $24 range, has been steady, but history suggests that institutional interest often leads to stronger market recognition.

With whales building positions in Bitcoin and Ethereum, infrastructure tokens often benefit next because they serve the systems that those large holdings need. Chainlink’s oracles have become the default choice for many protocols, and every new integration adds to the case for long-term value.

The ETF news also helps because it can expand access to investors who prefer traditional vehicles but want crypto exposure. Chainlink has already proven resilience across cycles. For those looking at the current period of discounted prices as a time to prepare, it stands out as one of the rare projects with both proven use and clear demand.

Its role in connecting data and assets across blockchains is likely to remain essential as crypto markets grow more complex and layered.

TOKEN6900

TOKEN6900 is a clear expression of the degen meme coin culture, but it is not without thought in its design. The project thrives on unpredictability and theatrical branding, which has been a consistent driver of engagement in the meme coin sector.

It does not rely on complex mechanics or utility promises; instead, it focuses on creating a highly active community that feeds off the humor and spontaneity that gave early meme coins their power.

Its liquidity is community-driven, and its market moves can be sudden, but that is part of the appeal. While whales are quietly accumulating large caps, smaller traders often look for high-risk, high-reward plays, and tokens like TOKEN6900 give them that outlet. It has carved out an identity that feels distinct, leaning into a mix of absurdity and cleverness that keeps it visible on social platforms.

Investors should view it for what it is, which is a speculative asset that can run fast when the market sentiment improves. When larger assets start moving, capital often trickles down to projects like this, where a loyal holder base is ready to amplify every small gain.

TOKEN6900 may not have the infrastructure use case of others, but its growth potential comes from its people and the tempo of its trading activity.

For those willing to risk small positions, it is a play that fits the current environment, especially as attention starts to return to smaller market caps after large holders reenter the market.

Wall Street Pepe

Wall Street Pepe brings humor and finance together, creating a meme coin that is more organized than many in its category. It takes inspiration from trading culture and community investing themes, using its branding to tap into a shared sense of market playfulness. The project has worked to develop a recognizable mascot and a voice that appeals to both traders and casual buyers.

While it is a meme coin at heart, it has invested time in building a holder base that is active and vocal. This matters because community-driven assets often rise fastest when market interest increases, and this one has a group that stays engaged even during quiet periods. The token’s potential lies in that consistency.

As whales continue to load up on Bitcoin and Ethereum, the risk appetite for smaller names tends to return. Historically, meme coins that have a strong community identity see capital flow in when the larger market starts moving because they offer leverage to sentiment and often rally faster. Wall Street Pepe fits this profile, especially with new updates and developments within its ecosystem.

Launching on Solana

You can buy early

Every dollar buy on $SOL = burns $WEPE on ETH

Once ETH $WEPE hits $0.001 → $SOL Peg goes 1:1

Sol buy = Eth burn 🔥 🔥 🔥

New site, new plans, the Solana expansion begins

🐸⚔️🐸⚔️🐸⚔️ pic.twitter.com/c3GBYJZliX

— Wall Street Pepe (@WEPEToken) August 19, 2025

Its culture is simple but effective: humor, trading memes, and group activity. The result is a token that can turn small sparks into strong bursts of interest. While it is speculative, it is organized speculation, and that combination could make it one to watch as the market cycle strengthens in the months ahead.

Conclusion

When larger holders are quietly adding to their positions and attention is building around assets still at favorable levels, it signals that the cycle is far from exhausted. The coming months have historically rewarded those who prepare early, like the ones mentioned above for instance, especially when prices have softened and conviction is rising among experienced players.

Selecting assets with clear purpose, strong engagement, or growing technical relevance can position investors to benefit when the market regains strength. This is a window to think strategically and accumulate gradually before confidence returns in full force.