Solana is holding firm above key support with rising ETF inflows, as participants watch for a breakout toward the $250–$260 range.

Solana is once again catching participants’ attention as both institutional flows and on-chain activity show strong momentum. The recently launched Solana staking ETF just hit record demand, while price action continues to defend key levels around $175 to $180.

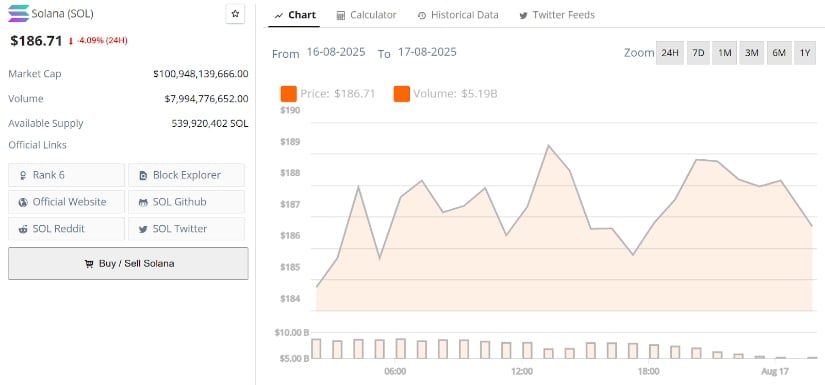

Solana is trading at around $186.71, down -4.09% in the last 24 hours. Source: Brave New Coin

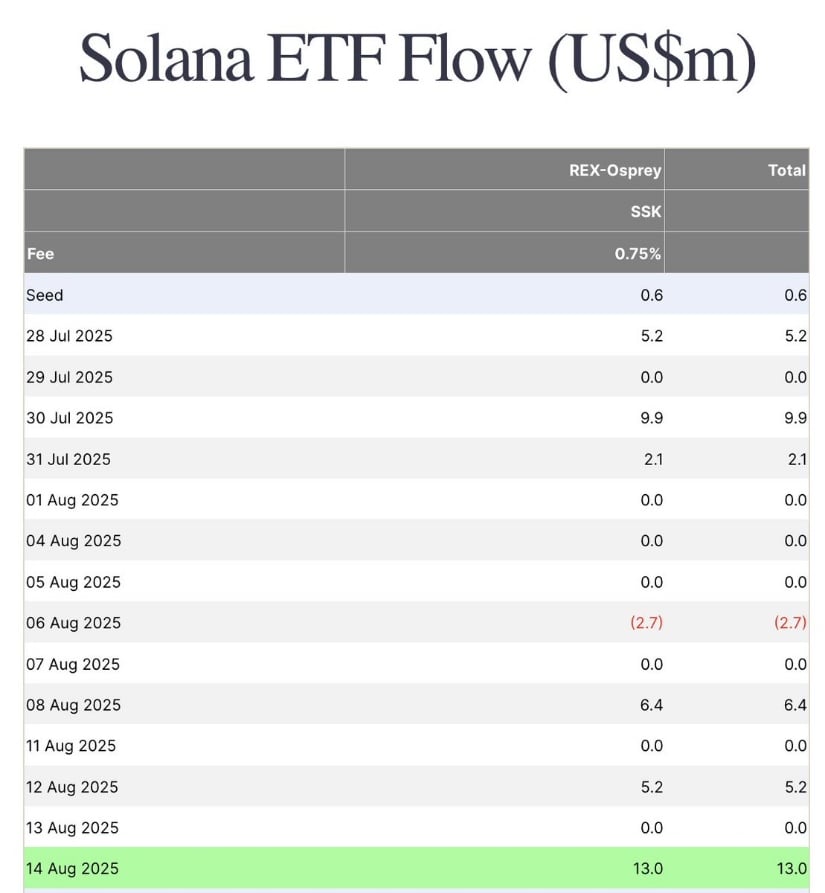

Solana ETF Sees Record Demand

The newly launched U.S. Solana staking ETF ($SSK) just recorded its strongest trading day to date, with $13 million in fresh inflows and over $60 million in volume. This marks the single largest daily trading activity since its debut, signaling a sharp uptick in investor interest

Solana’s inflows are consistently growing after each dip, and the structure suggests that appetite for Solana as a regulated product is expanding steadily.

Solana staking ETF hits record $13M inflows and $60M volume in a single day. Source: SolanaFloor via X

The positive momentum in ETF demand reflects Solana’s broader market performance, where the network continues to attract liquidity and recognition as one of the leading Layer 1 assets. Strong volume inflows like these not only validate the ETF’s positioning but also indicate a potential shift in how investors want to gain exposure to Solana.

Solana Technical Structure Holds Firm

Solana has held above the $175 demand zone after a clean bounce, showing that buyers remain firmly in control of the short-term trend. The chart from Skull highlights a clear defense of this level, where prior consolidation provided a strong base for accumulation. As long as this zone continues to hold, the higher-low structure remains intact, keeping the broader uptrend alive. The $175 to $180 range now serves as a critical pivot, with market participants closely watching for confirmation of sustained strength above these levels.

Solana defends the $175 demand zone as buyers maintain control, with momentum building for a potential breakout above $180. Source: Skull via X

A breakout above $180 would be a key trigger, as it would invalidate the recent consolidation and open the door to fresh highs. Momentum indicators align with this view, suggesting that Solana still has room to expand after cooling off from overbought conditions.

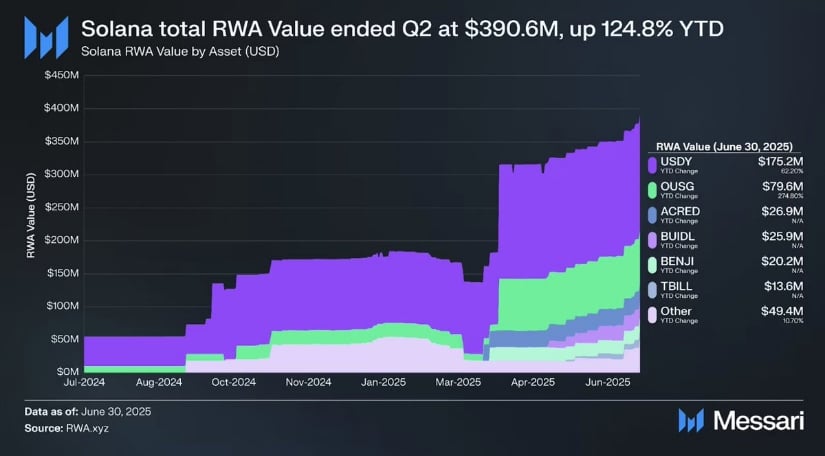

Solana Fundamentals Show Strong Growth

Beyond ETF inflows and technical momentum, Solana’s core fundamentals are also gaining significant traction. Messari’s Q2 report highlights major improvements across the ecosystem, led by a 30.4% jump in DeFi TVL and a 211% surge in app revenue capture ratio. The total Real-World Asset (RWA) value on Solana climbed to nearly $391M, reflecting how the network is increasingly being used to tokenize and secure real-world assets.

Solana’s DeFi TVL jumps 30% and RWA value nears $391M, highlighting rapid ecosystem growth. Source: Messari via X

This aligns with Solana’s ongoing push to position itself not just as a high-performance blockchain but as an infrastructure layer capable of supporting scalable, revenue-generating applications.

With on-chain adoption and protocol upgrades moving in sync, Solana is entering the next phase of growth with both technical resilience and a broader utility base backing its momentum.

Solana Technical Outlook: Key Levels in Focus

Analyst Lennaert Snyder notes that Solana is showing resilience despite its recent pullback, with the $184 zone now attempting to flip from resistance into support. The broader structure remains bullish as long as the $175 level holds, making it a critical anchor for sustaining the uptrend. Snyder highlights that reclaiming $205.54 resistance would be a decisive trigger for continuation, setting the stage for a potential rally.

Solana holds $184 as new support, with analyst Snyder eyeing $205.54 breakout toward $250–$260 targets. Source: Lennaert Snyder via X

The chart further outlines a series of horizontal levels acting as resistance and take-profit zones. If momentum follows through, the next upside targets lie in the $250 to $260 region, where prior supply clusters converge with Fibonacci extensions.

Final Thoughts: Can Solana Extend the Breakout?

Solana’s story right now is one of resilience backed by momentum on multiple fronts. ETF inflows are surging, technical structures remain intact above the $175 to $180 zone, and fundamentals such as DeFi growth and real-world asset adoption are showing impressive progress.

This mix of regulated demand and on-chain strength suggests that the network isn’t just riding short-term hype, it’s positioning for a much larger move if buyers can sustain the pressure.

A clean flip of $184 into support and a decisive reclaim of the $205.54 resistance could shift sentiment toward a stronger continuation phase. Should momentum align, the $250 to $260 region comes into focus as the next logical target range.