TLDR

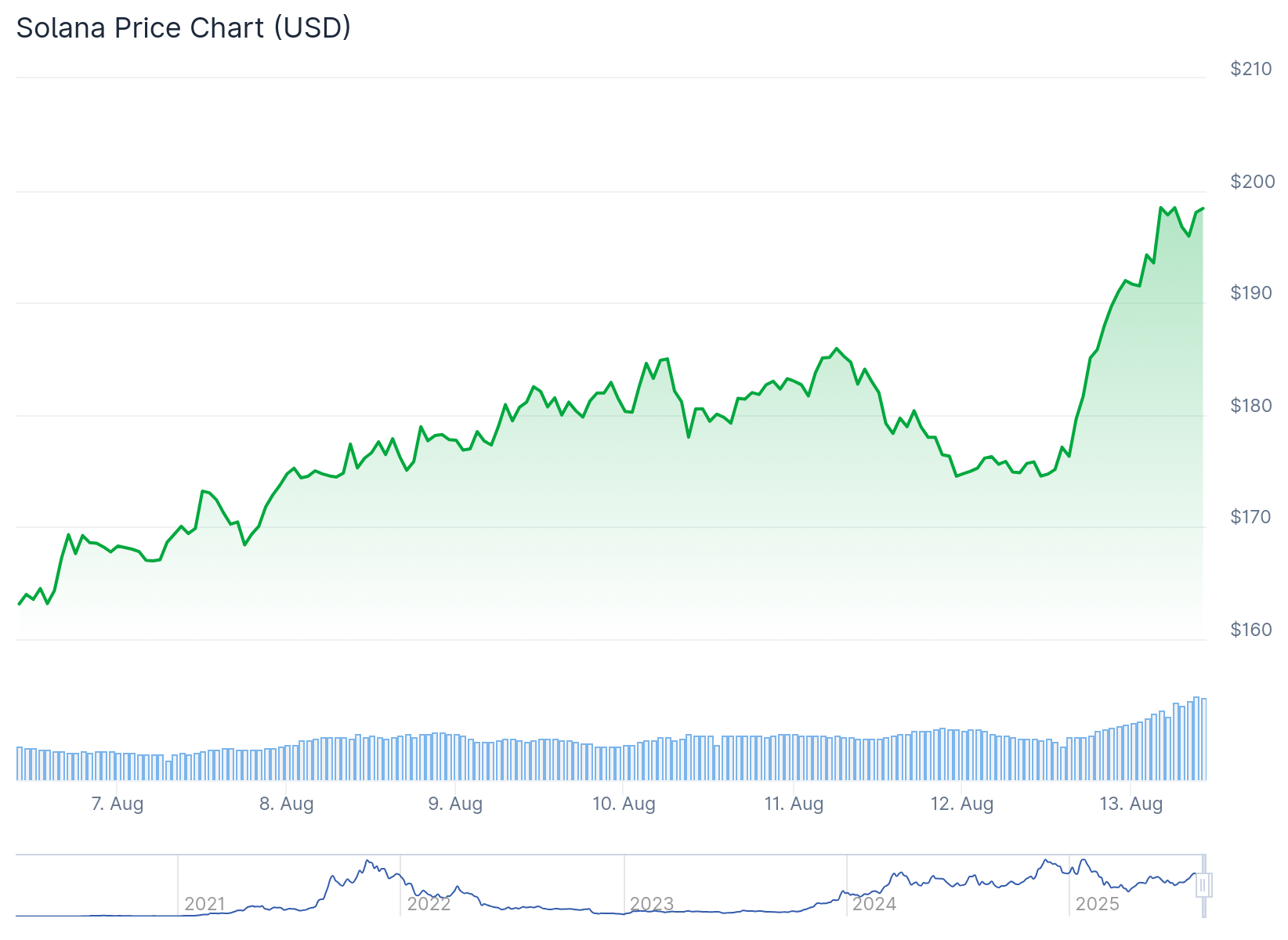

- SOL price jumped nearly 10% from the $175 support zone, climbing above $192

- Price broke through a bearish trend line and reached a high of $199 before consolidating

- Major resistance sits at $200 level with next targets at $202 and $205

- Alameda Research unstaked $35 million worth of SOL tokens that were locked since 2020

- Key support level at $170 remains crucial as whale selling pressure increases

Solana price started a fresh upward move after finding support near the $175 zone. The cryptocurrency climbed above the $185 and $190 levels against the US Dollar.

SOL is now trading above $192 and the 100-hourly simple moving average. The price broke above a bearish trend line with resistance at $178 on the hourly chart.

Bulls pushed the price above the $195 barrier during the rally. A high was formed at $199 before the price began consolidating gains.

The cryptocurrency is currently holding above the 23.6% Fib retracement level of the upward move from the $173 swing low to the $199 high. This consolidation pattern suggests buyers remain active at current levels.

Resistance Levels Come Into Focus

On the upside, SOL faces resistance near the $200 level. The next major resistance sits at $202, followed by the main resistance zone at $205.

A successful close above the $205 resistance could set the stage for another steady increase. The next key resistance would be at $212, with potential gains extending toward the $220 level.

Technical indicators support the current bullish momentum. The hourly MACD is gaining pace in the bullish zone while the RSI remains above the 50 level.

Whale Activity Creates Uncertainty

Despite the recent price surge, large-scale selling pressure has emerged from major holders. Whales moved over 226,000 SOL tokens to exchanges during recent trading sessions.

One whale’s holdings dropped 71% in under two days, falling from $24 million to $6.8 million. This represents approximately $17.2 million worth of SOL sold by a single player.

Alameda Research unstaked $35 million worth of SOL tokens from a wallet that had been locked since late 2020. These tokens were originally worth around $350,000, representing a 100x gain over the holding period.

The whale sales averaged around $177, aligning with SOL’s technical breakdown below the $185 level. This created a supply wall that contributed to the recent 4% pullback.

SOL’s Net Position remains positive, supporting price consolidation above the $170 level. This marks a departure from previous risk-off periods when Net Position typically flipped negative.

The $170 level has become a critical support zone for bulls to defend. If this support fails to hold, increased downside risk could emerge for Solana.

Initial support on the downside sits near the $194 zone if the current rally stalls. The first major support level is at $186, representing the 50% Fib retracement level of the recent upward move.

A break below $186 could send the price toward the $180 support zone. Further weakness below $180 support might target the $175 level in the near term.