Key Insights

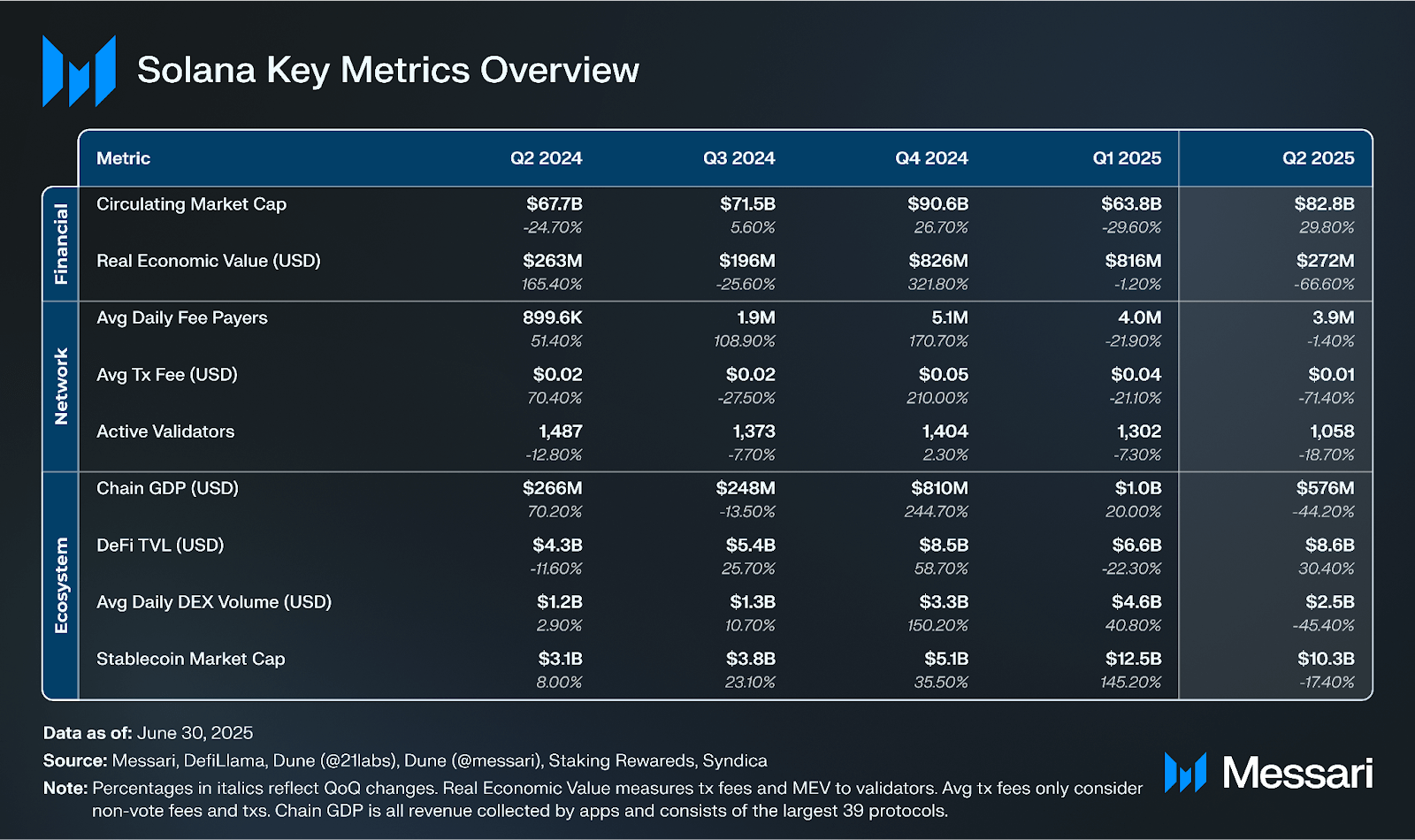

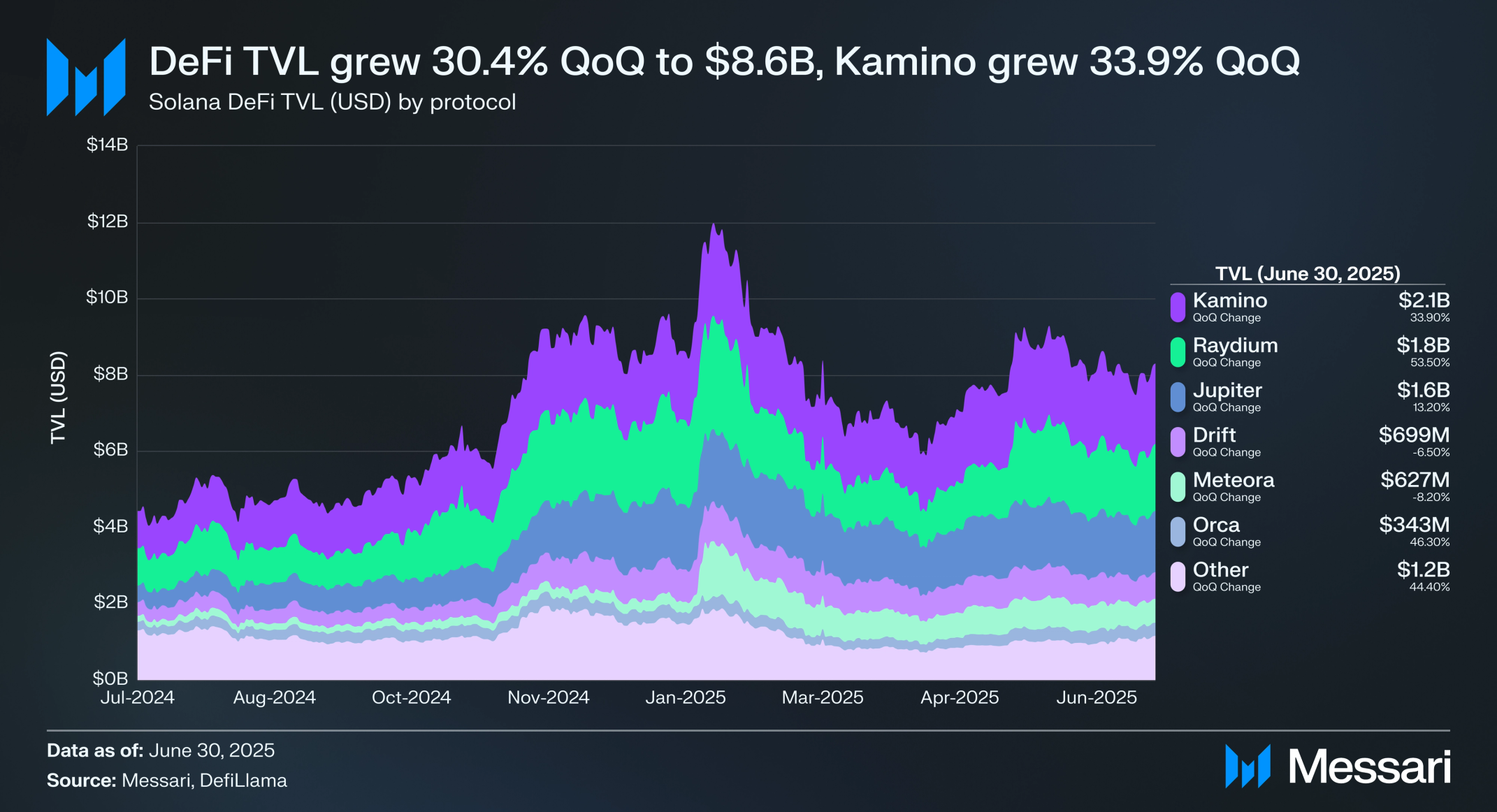

- Solana DeFi TVL increased 30.4% QoQ to $8.6 billion. Kamino grew 33.9% QoQ to maintain its lead in DeFi TVL (USD).

- The Application Revenue Capture Ratio (Chain GDP divided by Real Economic Value) grew from 126.5% to 211.6%. Real Economic Value (REV) is defined as the sum of base transaction fees, priority fees, and MEV tips paid to validators.

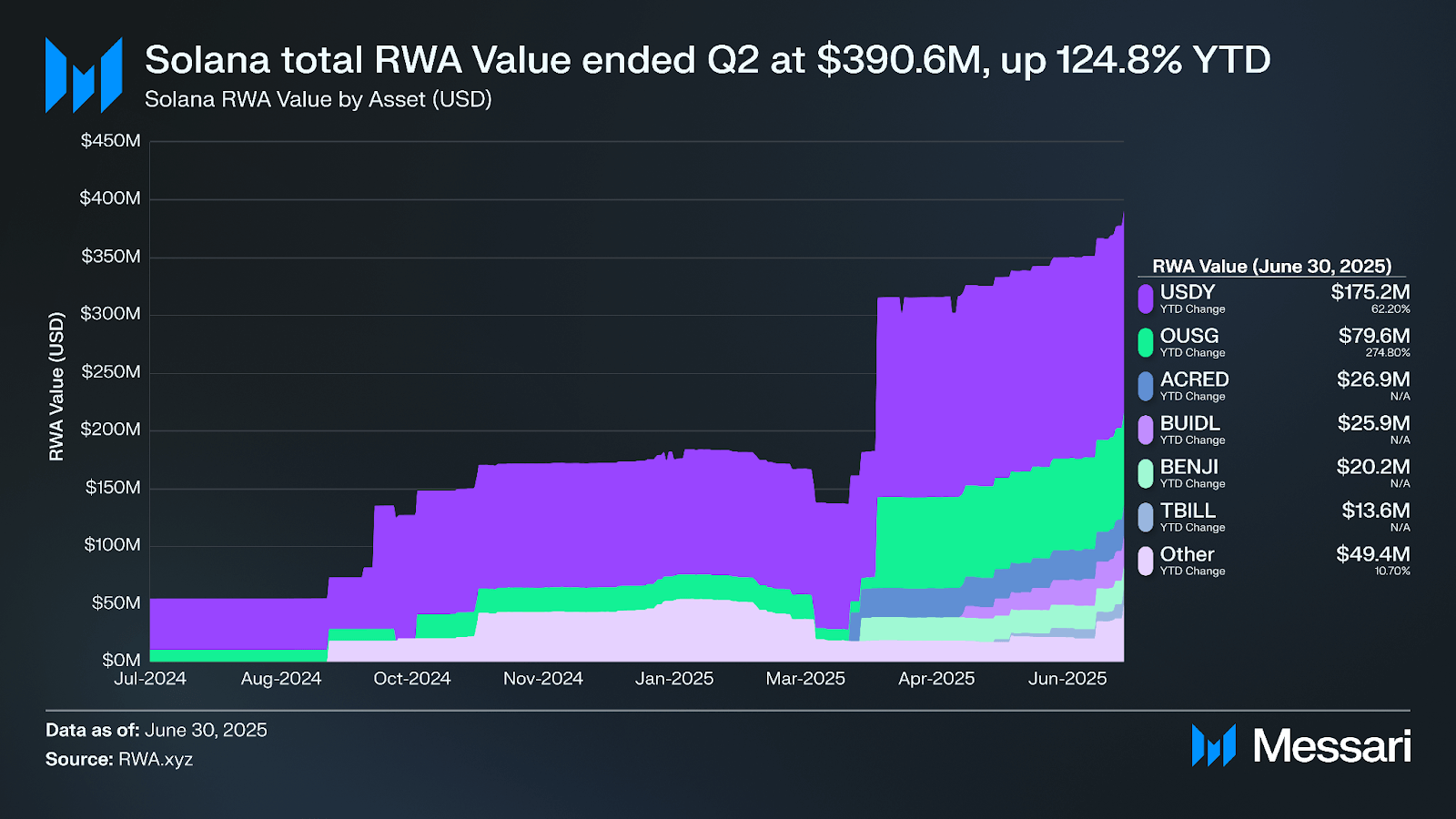

- Real-world Asset value on Solana grew 23.9% QoQ to $390.6 million. Ondo Finance’s USDY and OUSG were the two largest assets with $175.2 million and $79.6 million, respectively.

- Anza introduced Alpenglow, a complete overhaul to Solana’s consensus mechanism. The upgrade is projected to dramatically reduce finality latency from roughly 12.8 seconds to 100–150 milliseconds.

- The Rex-Osprey Solana Staking ETF went live in June. This is the first staking crypto ETF to be approved in the U.S.

Primer

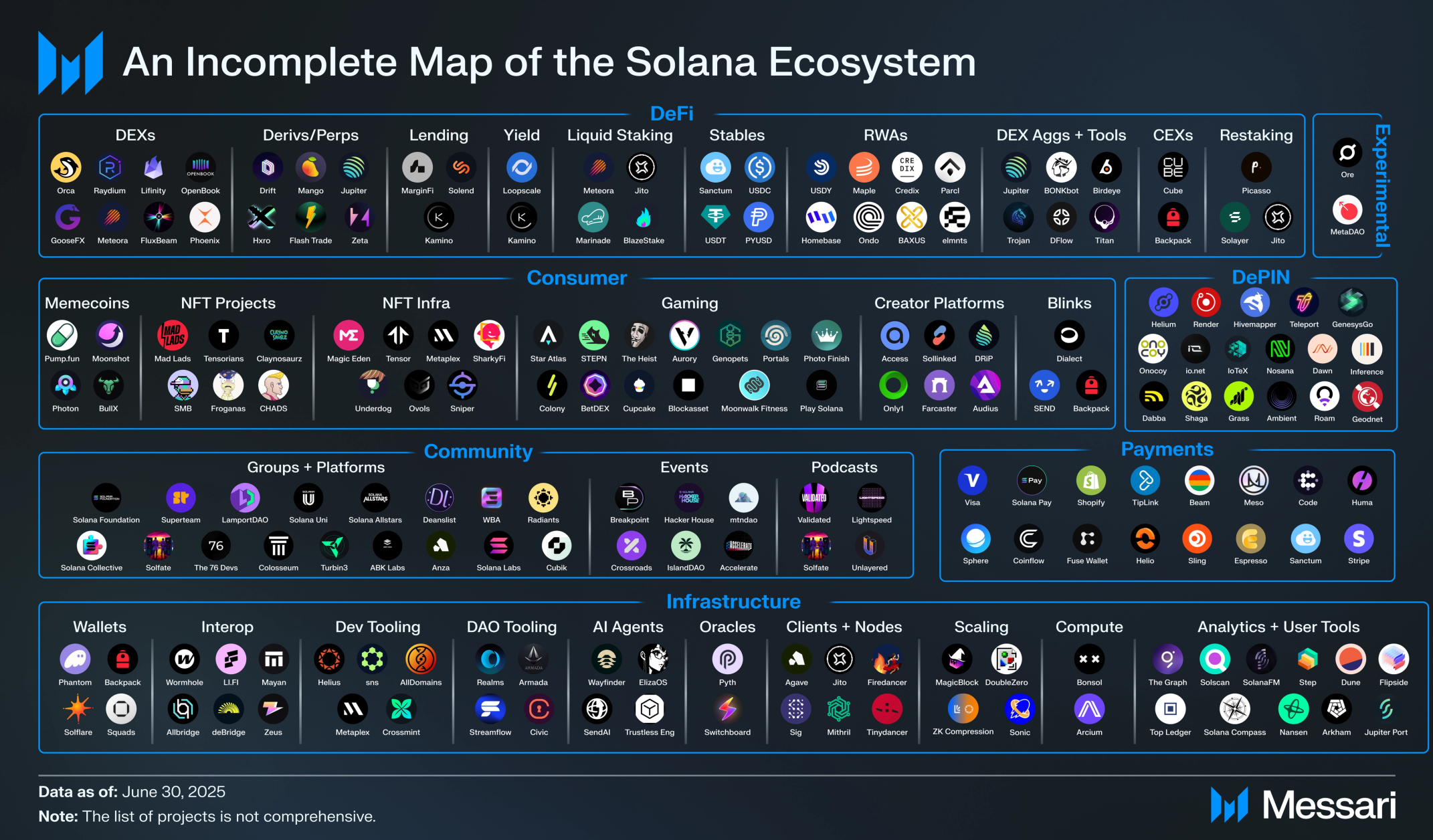

Solana (SOL) is an integrated, open-source Layer-1 network with the goal of synchronizing global information at the speed of light. Solana optimizes for increasing bandwidth and reducing latency. It accomplishes this through features such as its novel timestamp mechanism called Proof-of-History (PoH), a block propagation protocol called Turbine, and parallel transaction processing. Since mainnet launch in March 2020, several network upgrades have brought further network performance and resilience, including QUIC, stake-weighted Quality of Service (QoS), and local fee markets.

The network’s development and growth, and its ecosystem are supported by the non-profit Solana Foundation, for-profit Solana Labs, and various third-party organizations, including Anza, Colosseum, Helius, Superteam and many others. Solana Labs has raised over $335 million in private and public token sales. Solana features a growing ecosystem of projects across many sectors, including DeFi, consumer, DePIN, and payments. To stay up-to-date with all things Solana, visit the Solana Portal.

Key Metrics

Ecosystem Analysis

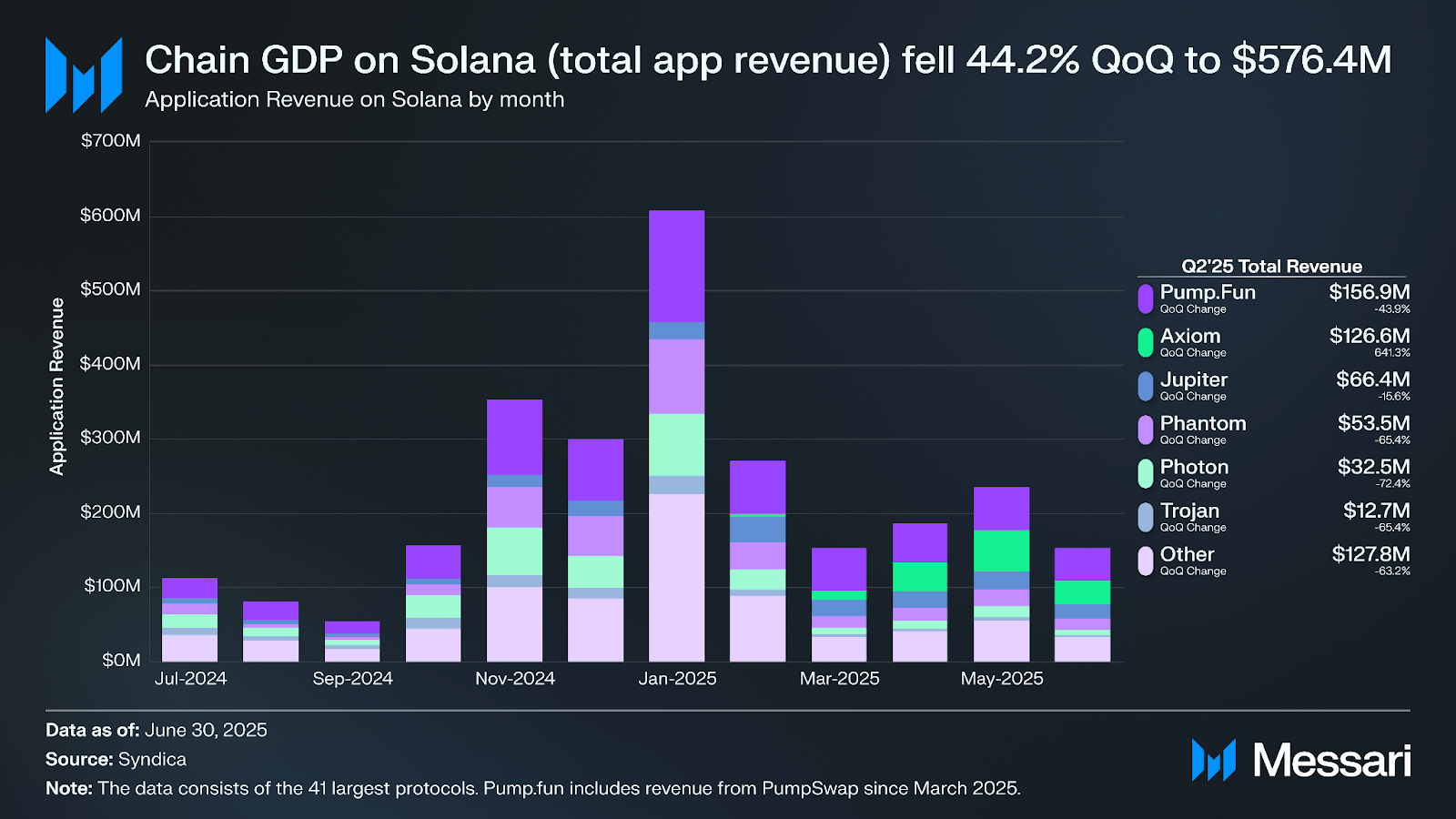

Application Revenue

Chain GDP is defined as the total application revenue generated on a network. In Q2 2025, Solana’s Chain GDP fell 44.2% QoQ from $1.0 billion to $576.4 million. The leaders by application revenue in Q2’25 were as follows:

- PumpFun: $156.9 million (43.9% QoQ decrease)

- Axiom: $126.6 million (641.3% QoQ increase)

- Jupiter: $66.4 million (15.6% QoQ decrease)

- Phantom: $53.5 million (65.4% QoQ decrease)

- Photon: $32.5 million (72.4% QoQ decrease)

These applications’ revenue is directly correlated to decreases in speculation as they facilitate the trading of assets. Although most apps fell, Axiom finished Q2 with a record quarter. Launching in January, Axiom is a Y Combinator-backed trading platform on Solana. Axiom gained popularity amongst memecoin traders due to its reward system. Depending on the volume that a user trades, they are rewarded with SOL for each trade, as well as being rewarded for the volume that their referral trades.

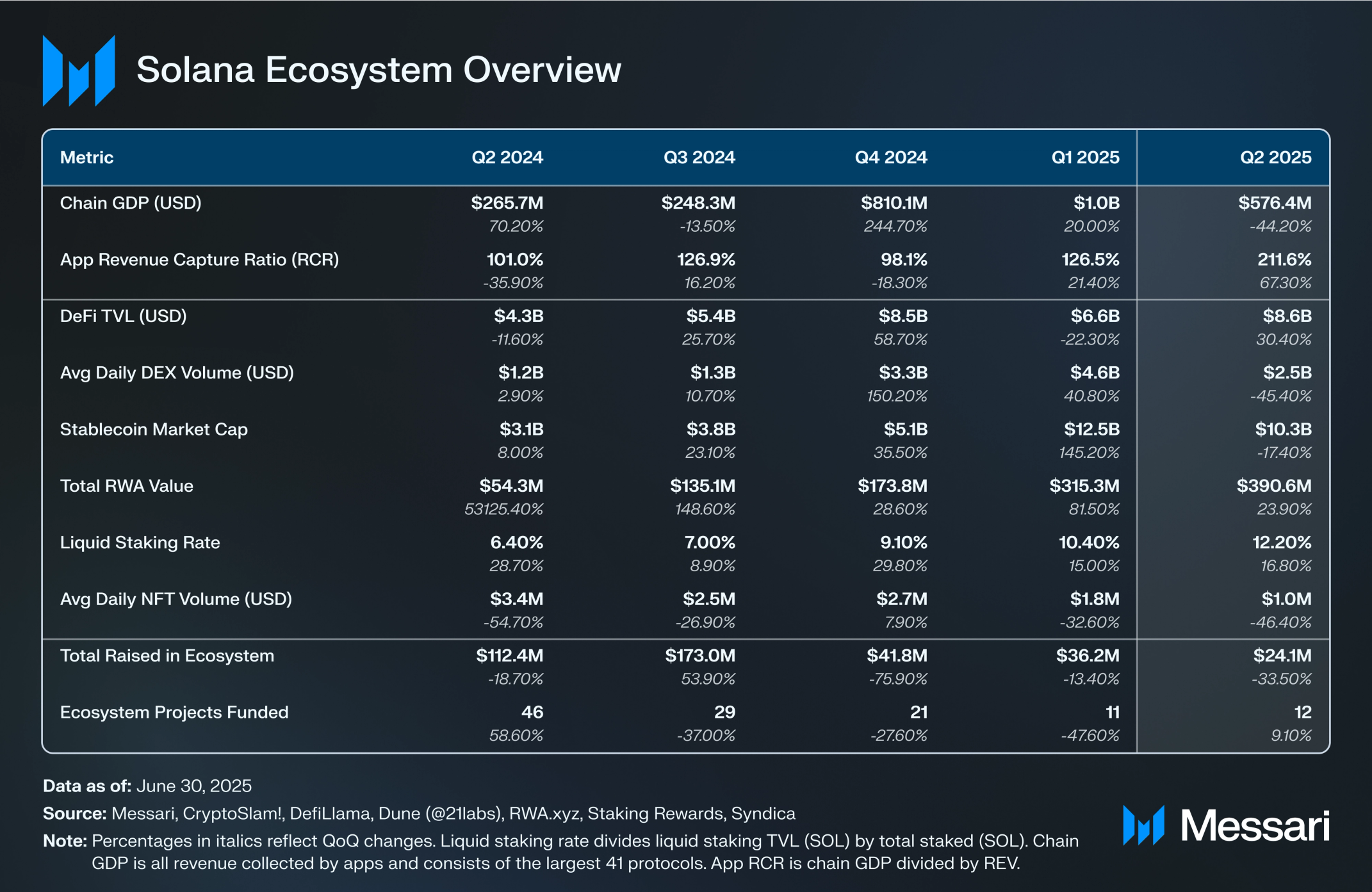

App Revenue Capture Ratio (App RCR)

A network’s App Revenue Capture Ratio (RCR) is the ratio of revenue generated by its apps to its Real Economic Value (REV). REV is defined as the sum of base transaction fees, priority fees, and MEV tips paid to validators. App RCR reflects the efficiency with which applications capitalize on the economic activity taking place on the network. The higher the app RCR, the more effectively apps capture the economic activity being generated on the network, suggesting a mature ecosystem with monetizable applications. A low App RCR may signal untapped potential for app developers or inefficiencies in revenue capture. Alternatively, it may signal a nascent ecosystem not yet ready for monetization.

If App RCR equals 20%, this implies that for every $1 of REV generated by the network, $0.20 is captured as revenue by apps. In Q2 2025, App RCR on Solana was 211.6%, a 67.3% QoQ increase from 126.5% in Q1’25. This can be interpreted as when $100 is spent in transaction fees (and/or Jito tips) to interact with Solana, applications earn $211.60 in revenue.

A network’s App RCR can be greater than one when its applications are successful in monetizing activity, driving revenue streams for project teams and potentially, tokenholders. Examples of this include DEXs charging swap fees or NFT marketplaces imposing marketplace fees in excess of transaction fees paid to Solana.

DeFi

DeFi TVL (USD) on Solana grew 30.4% QoQ to $8.6 billion. This performance allowed Solana to maintain its rank of second among networks in DeFi TVL after surpassing TRON in November 2024. The leading protocols on Solana, ranked according to DeFi TVL in Q2, were:

- Kamino: Maintaining its lead in TVL, ending with $2.1 billion and a market share of 25.3% with its TVL growing 33.9% QoQ. Kamino launched Kamino Lend V2 in May 2025, and within three weeks, it surpassed $200 million in deposits, with over $80 million in loans.

- Raydium: Reclaimed the second spot with its TVL increasing 53.5% QoQ to $1.8 billion, and a 21.1% market share.

- Jupiter: Fell to the third spot, though its TVL increased 13.2% QoQ, ending with $1.6 billion and a 19.4% market share. At Accelerate 2025 in May, the Jupiter team announced Jupiter Lend, powered by Fluid. The product is expected to launch in August 2025, and there are already over 2.4 million wallets registered for early access.

DEXs

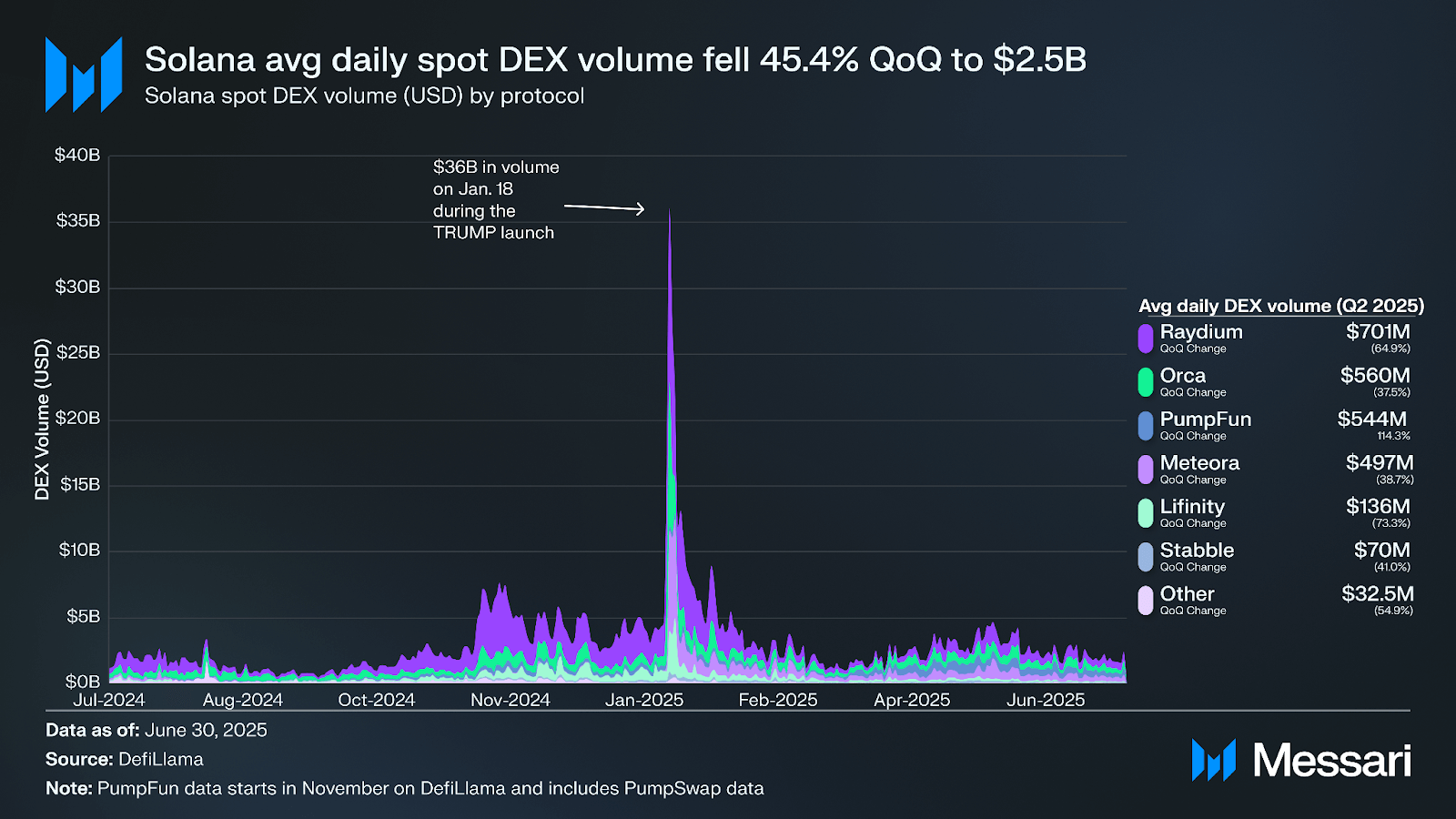

Average daily spot DEX volume (USD) fell 45.4% QoQ to $2.5 billion in Q2 2025. The total volume for H1 2025 was $1.2 trillion. This slowdown can be attributed to the memecoin craze slowing down after all-time highs in volume in Q1.

- Raydium: Average daily volume decreased 64.9% QoQ to $701.1 million with a 27.6% market share. Read more about Raydium’s recent developments in our State of Raydium Q1 2025 report.

- Orca: Saw a 37.5% decrease ($560.5 million) QoQ in average daily volume, with a market share of 22.1%. In March 2025, the Orca team shipped Phases 1 and 2 of their Liquidity Terminal, with Phase 3 scheduled for later this year. The upgrades include real-time price charts, position ranges of the user’s portfolio, the ability to create new positions without having to navigate away, and more. The Orca team also joined Solana Policy Institute and SuperState to submit Project Open to the SEC to develop regulatory frameworks to enable the compliant issuance, trading, and settlement of securities on public blockchains.

- PumpFun: Climbed to the third-largest DEX by quarterly volume on Solana after increasing 124.3% QoQ in Q2 to $544 million. The biggest reason for the jump was when the team launched PumpSwap on March 20, 2025. PumpSwap replaced Raydium as the sole trading venue of PumpFun tokens that graduate past their bonding curve.

LaunchPad Wars and PUMP Launch

Over the quarter, many teams launched competitors to PumpFun. While most failed to capture any meaningful market share for longer than a week, at the end of the quarter, Bonk’s launchpad quickly began gaining momentum and fully overtook PumpFun as the market leader during the second week of July. This coincided with PUMP’s ICO that occurred on July 12, 2025. The team sold 150 billion tokens at a price of $0.004, representing an FDV of $4 billion and a raise of $600 million. The token began trading on July 14.

DEX Aggregators

On April 29, 2025, 1inch announced their support for Solana. 1inch brings over 1 million tokens and $7 billion in liquidity from EVM chains.

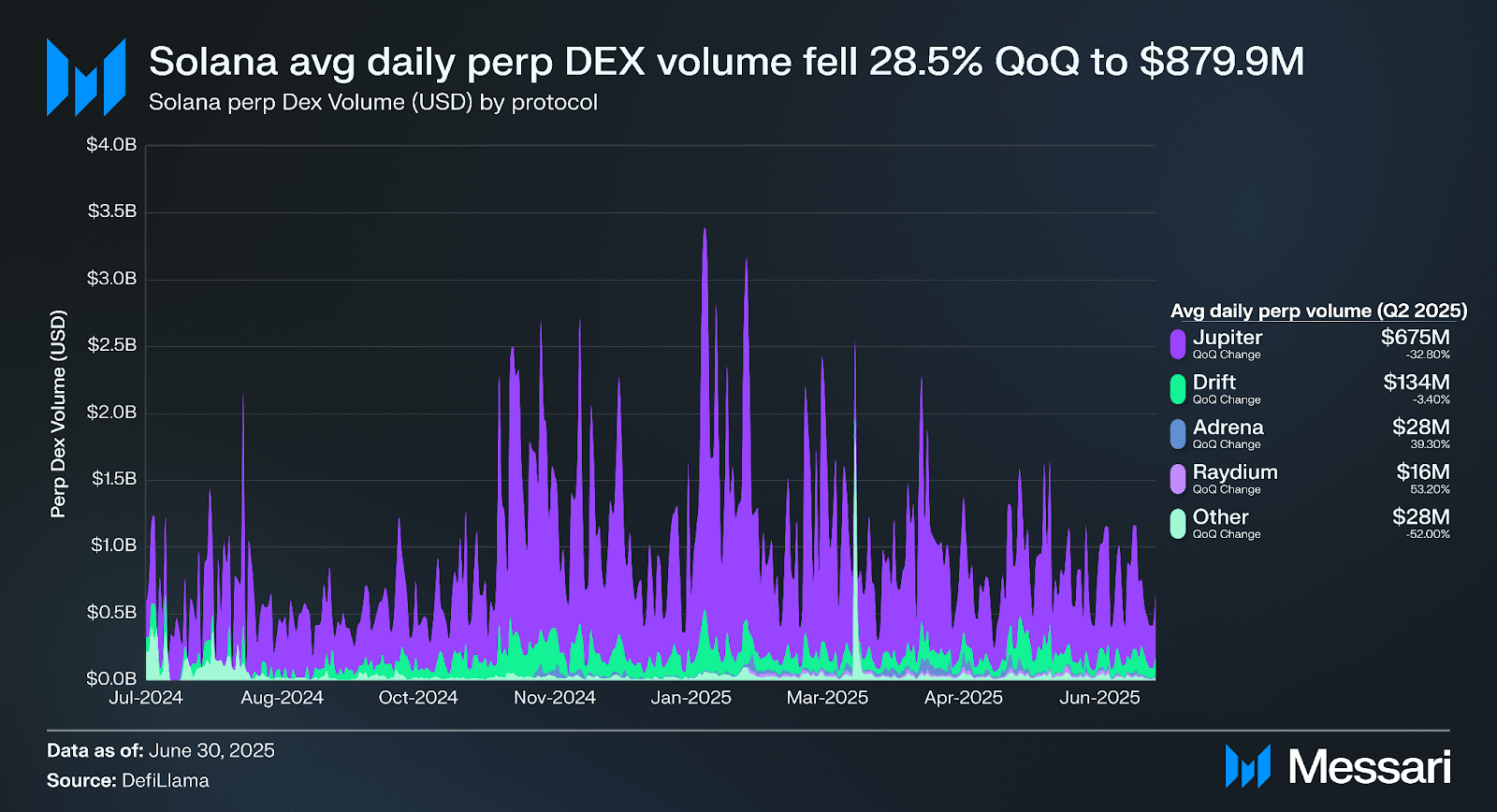

Solana’s average daily perp DEX volume (USD) fell 28.5% QoQ to $879.9 million. The leaders for the quarter are listed below:

- Jupiter averaged $674.9 million in daily perp trading volume (USD), a 32.8% decrease QoQ. It ended the quarter with a 76.7% market share.

- Drift’s average daily perps volume fell 3.4% QoQ to $133.5 million, resulting in a 15.2% market share. In March, the team announced the SWIFT Protocol, which gives users lower-latency and gasless trades.

- Adrena: Adrena’s average daily perps volume grew 39.3% QoQ to $27.6 million, resulting in a 3.1% market share.

- Zeta: In March, the team launched their Network Extension, Bullet, on testnet. Bullet is a Layer-2 rollup on Solana that posts ZK proofs to Solana mainnet. The team has claimed that traders will have 2ms of latency when trading on the platform. The ZEX token will be 1:1 convertible to the BULLET token when mainnet launches in Q3 or Q4 of this year.

Stablecoins

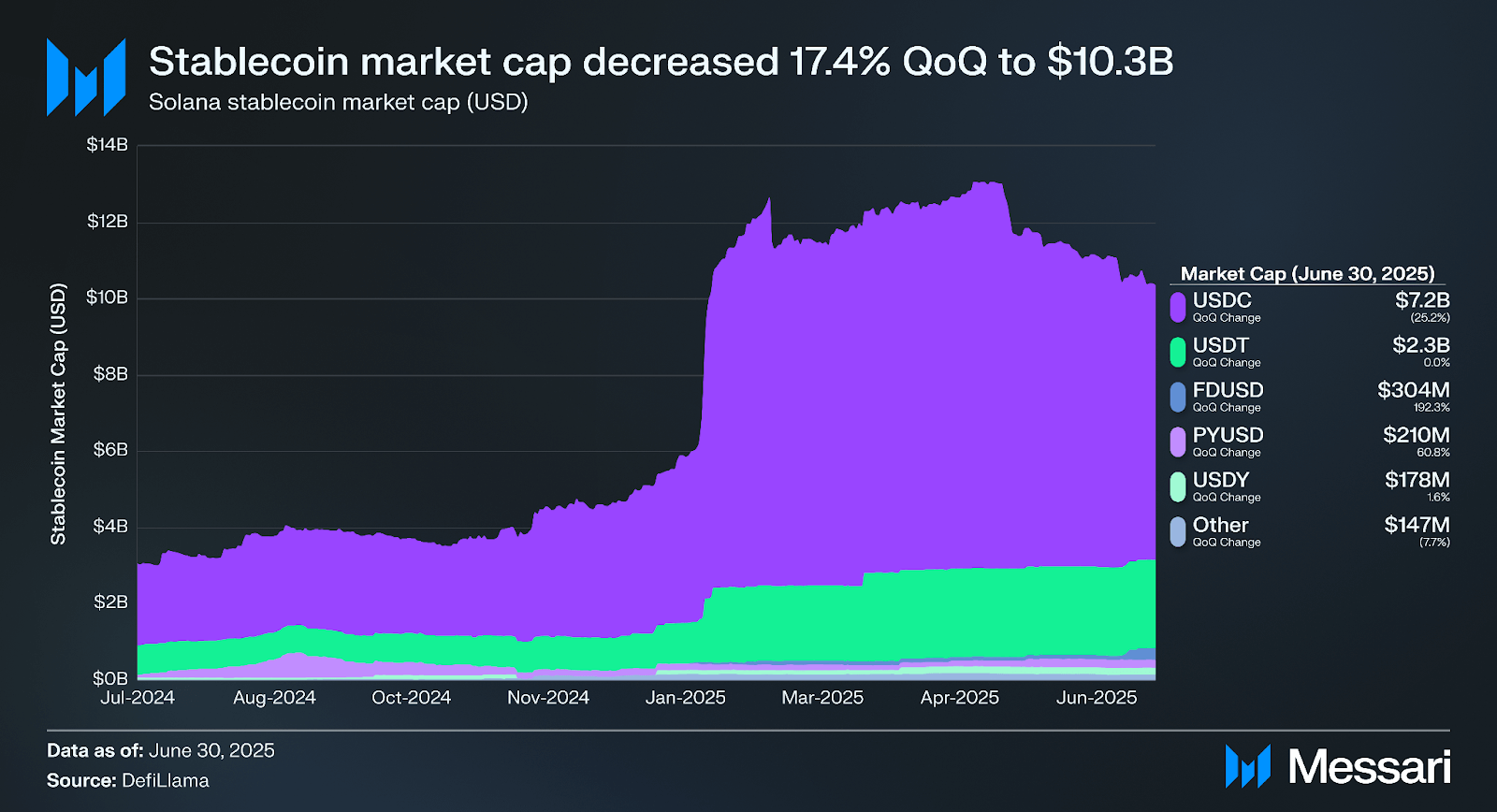

Stablecoin market cap on Solana fell 17.4% QoQ to $10.3 billion, ranking it third among networks. Much of this growth this year came after the TRUMP token launched on Jan. 17, which brought an influx of liquidity to Solana and resulted in various high-liquidity pairs using USDC. The sustained increase in stablecoin market cap indicates much of the new capital remained on the network.

USDC ended the quarter with a market cap of $7.2 billion after falling 25.2% QoQ with a 69.5% market share. USDT was the second largest stablecoin on Solana by the end of Q2’25, with $2.3 billion (a 0% QoQ change) and a 22.4% market share. First Digital’s FDUSD claimed the third spot by ending the quarter with $303.6 million (a 192.3% QoQ increase).

RWA

Total Real-world assets value (USD) on Solana ended Q2 at $390.6 million, a 124.8% YTD increase. The leaders in the RWA category are as follows:

- Ondo Finance’s USDY, launched in August 2023, is a token backed by Treasuries and bank deposits, designed to function as a yield-bearing stablecoin with broad accessibility. USDY appreciates in price as interest accrues. The token is transferable across chains using LayerZero, making it highly composable in DeFi applications. As of July 2025, USDY was the largest yield-bearing RWA by market cap on Solana, with 6,978 holders and a market cap of $175.3 million.

- Ondo Finance’s OUSG, introduced in January 2023, is a tokenized fund initially structured around BlackRock’s BUIDL Fund. It is primarily intended for accredited investors. In July 2025, OUSG was the second-largest yield-bearing asset by market cap on Solana, with seven holders and a market cap of $79.6 million.

- ACRED is a tokenized version of Apollo Global Management’s diversified private credit fund, created in partnership with Securitize and launched on Solana in May 2025. The token represents interests in a portfolio of corporate loans and other private credit instruments and is issued as a regulated sToken under Securitize’s compliance framework. ACRED is accessible to accredited investors and integrates with Solana-native DeFi platforms such as Kamino and Drift Institutional. As of July 2025, ACRED was the third-largest yield-bearing RWA by market cap on Solana with eight holders and a market cap of $26.9 million.

- BUIDL is a tokenized U.S. dollar money market fund developed by BlackRock, holding cash and short-term U.S. Treasuries. Initially launched on Ethereum in March 2024, it expanded to Solana in March 2025, marking one of the first major institutional RWA deployments on the network. As of July 2025, BUIDL was the fourth-largest yield-bearing RWA by market cap on Solana with three holders and a market cap of $25.2.3 million.

Other RWA Related Events

- In May 2025, R3, a UK-based company behind Corda, a permissioned distributed ledger technology (DLT) platform for capital markets, payments, and central bank digital currency (CBDC) projects, announced support for Solana, bringing its regulated assets onto the public blockchain. Built for regulated environments, Corda enables direct transactions with a focus on privacy and compliance. R3’s clients include leading financial institutions such as HSBC, Bank of America, and the Bank of Italy. As of June 2025, the platform supports over $10 billion in tokenized assets across multiple asset classes.

- xStocks is a suite of tokenized U.S. equities and ETFs offered by Backed, a regulated Swiss issuer, in partnership with Kraken. Announced in May 2025 and released on June 30, 2025, with over 60 products ranging from Apple and Tesla to broad index funds, and will be available to non-U.S. clients. These tokens will be issued on Solana as fully collateralized representations of the underlying shares and held in regulated custody. Kraken users will be able to trade the assets on-exchange or withdraw them to be used onchain within DeFi protocols. As of July 7, 2025 (one week after launch), there were over 45,700 holders of xStocks, with a total market cap of $51.7 million. SPYx, S&P500 xStock, was the largest by value with 9,692 holders and a market cap of $6.8 million. TSLAx, Tesla xStock, was the second largest by value with 9,914 holders and a market cap of $6.2 million.

- syrupUSDC is Maple Finance’s onchain yield-bearing stablecoin, launched on Solana in June 2025. The token represents deposits into Maple’s credit pools, which underwrite loans to trading firms, market makers, and fintechs. syrupUSDC targets APYs of 6–7% and is positioned as a higher-yielding alternative to traditional yield-bearing stablecoins. The product is designed for use in DeFi applications and benefits from composability within Solana’s ecosystem, including on DEXs like Orca and lending platforms like Kamino. Maple’s approach combines transparency, rigorous underwriting, and real-time liquidity, turning institutional credit into a stablecoin format that can circulate across the broader DeFi landscape. As of July 2025, over 63.6 million tokens have been issued with a market cap of $70.7 million, with $47 million of that being deposited into Kamino.

Read more about Solana’s RWAs developments in Messari’s State of Solana: Real-world Assets report.

Liquid Staking

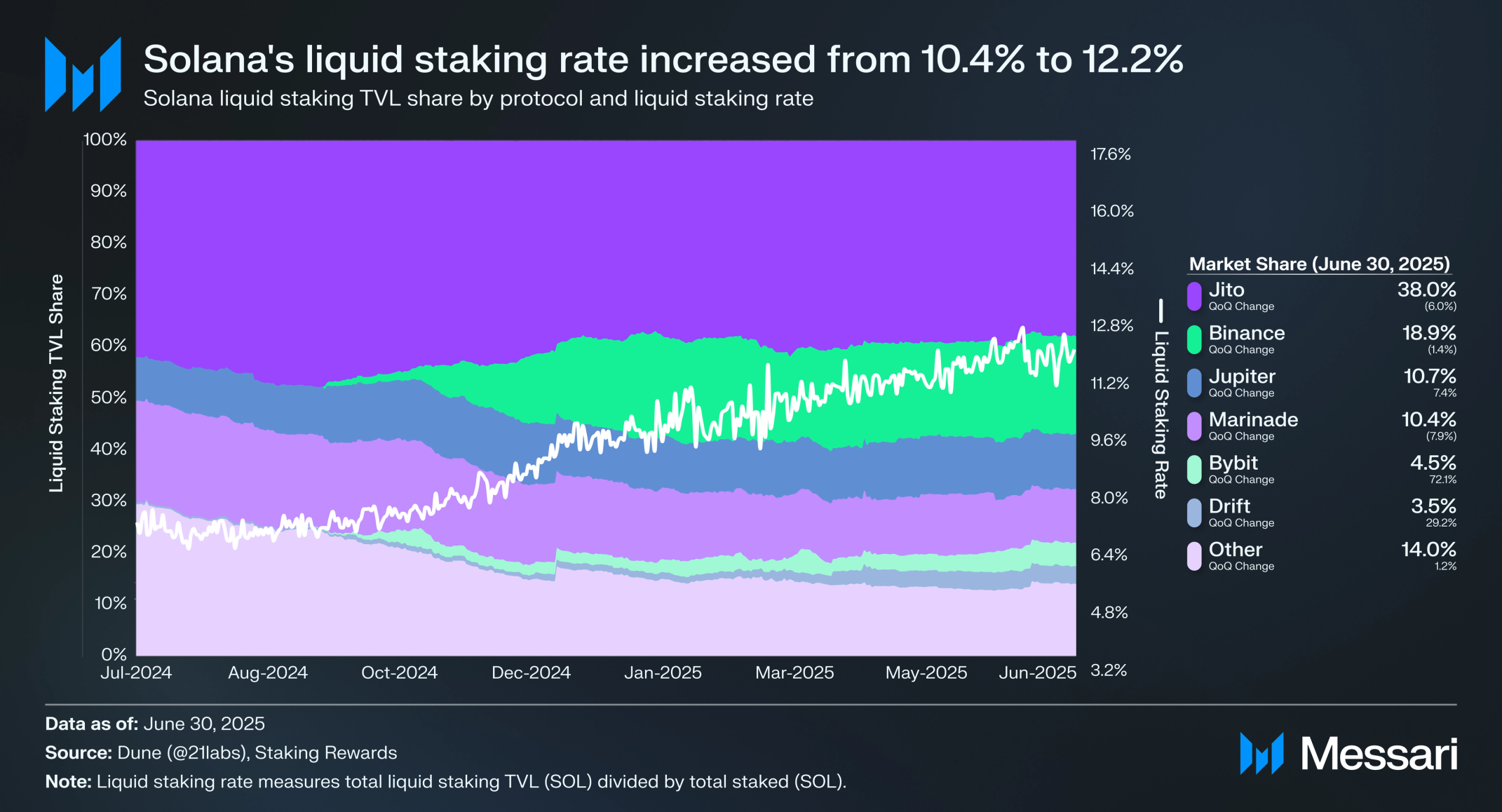

The liquid staking rate on Solana increased 16.8% QoQ, from 10.4% to 12.2%. With 64.8% of SOL’s circulating supply staked, a growing liquid staking rate enables a DeFi ecosystem built on yield-bearing SOL.

- Jito’s jitoSOL remained the liquid staking token (LST) leader on Solana. The token’s liquid staking market share fell 6% QoQ, from 40.5% to 38%, for a total market cap of $2.8 billion.

- Binance’s bnSOL saw its market share fall 1.4% QoQ from 19.1% to 18.9%, for a total market cap of $1.4 billion.

- Jupiter’s jupSOL saw its market share grow 7.4% QoQ from 10% to 10.7%, for a total market cap of $783.6 million.

- Marinade’s mSOL saw its market share fall 7.9% QoQ from 11.3% to 10.4%, for a total market cap of $762.8 million. Read more about Marinade’s recent developments in our State of Marinade Q1 2025 report.

Consumer

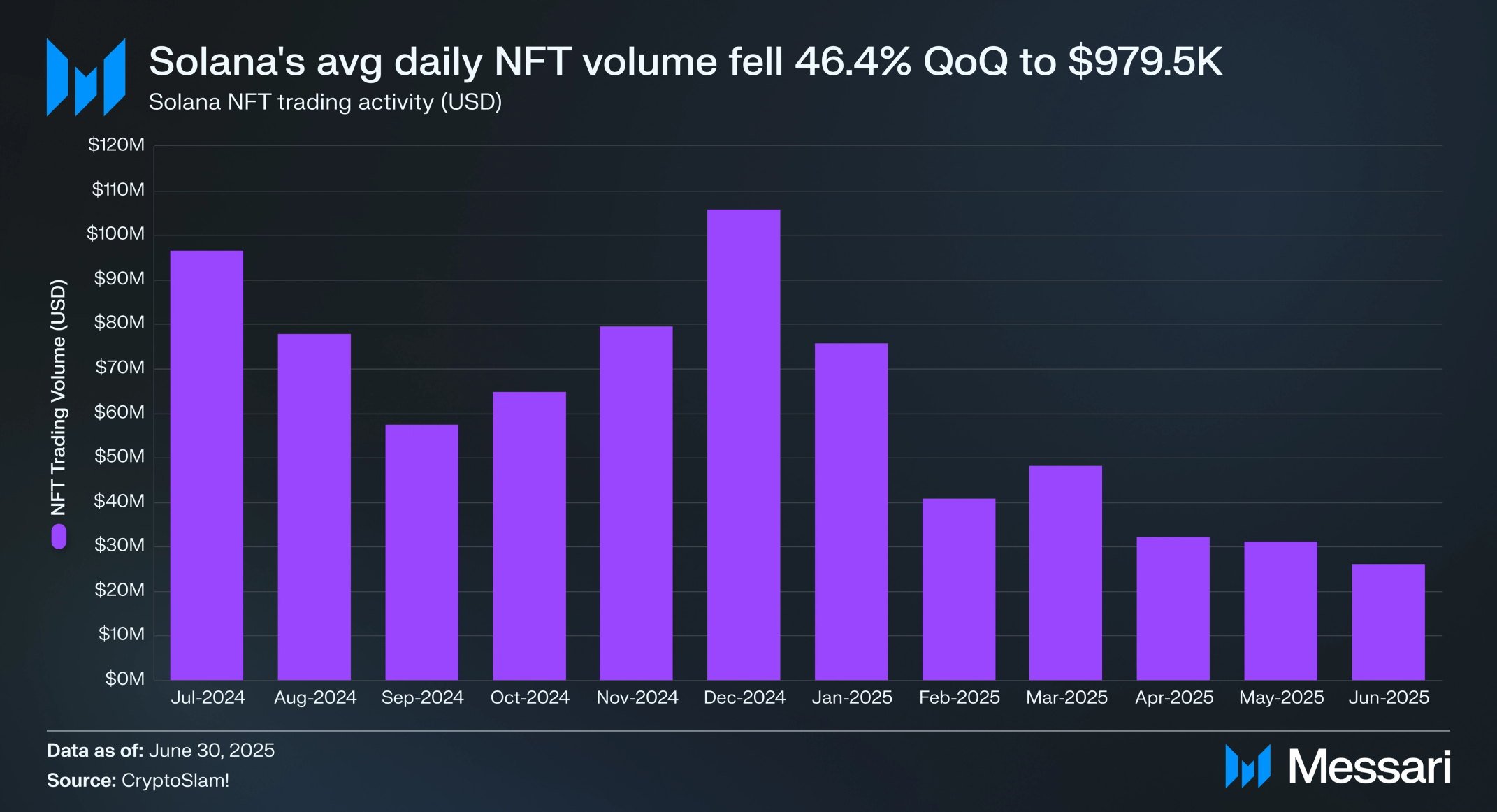

NFTs

Average daily NFT trading volume (USD) on Solana fell 46.4% QoQ to $979,500 million in Q2 2025. While overall volume is down, NFTs on Solana lead in creator royalties.

Gaming

- In April 2025, the Solana Game Pass: Season 0 was minted on Magic Eden. The Game Pass brings access to the web3 gaming ecosystem through raffle tickets for a $15,000 prize pool, NFTs, and in-game items. The NFT collection has over 48,500 holders.

- In May 2025, the Star Atlas team announced a patch update that included dedicated servers for gunplay lobbies, new multiplayer hosting, Co-op dogfighting, and more. The team is preparing for a major mid-year release.

- In May 2025, the Play Solana team brought a pre-release version of their PSG1 device to Accelerate to allow attendees to see the device in person. They also released their second NFT collection in June 2025.

- In June 2025, Shaga, a DePIN cloud gaming platform that transforms idle high-end gaming PCs into a decentralized, low-latency streaming network, released its whitepaper. Read more about Shaga’s recent developments in Messari’s Shaga: The First Fully-Integrated Consumer Compute Network report.

- At GDC 2025, the Solana Foundation hosted a Developer Summit focused on onboarding Web2 game developers through technical keynotes, live demos, and hands-on workshops, showcasing seamless tooling for integrating onchain assets, economies, and decentralized platforms into modern game development.

- DeFi Dungeons brought a huge comeback to the idle gaming genre, with its $GOLD token vault reaching $130 million in deposits, significantly exceeding the vault’s $3 million cap, and highlighting massive demand for the new project from the team behind The Heist.

- Colony, the highly anticipated AI game from the Parallel TCG team, powered by Wayfinder, has started its Alpha test phase and is anticipating a Q3’25 Alpha release.

- MixMob: Racer 1 fully launched on iOS and Android as the world’s first card-racing game built on Solana, and has since outperformed midcore benchmarks in virality, monetization, and retention.

Other Consumer Related News

Announced in May 2025 at Accelerate, the Solana Mobile Seeker phone began shipping the first week of August 2025. The phone will have a better camera, longer battery, and internal hardware wallet built in collaboration with Solflare. The phone will have a 108+32 MP camera, 6.36” display, 128 GB of storage, and 8 GdB of memory. The phone will also have a fingerprint scanner for extra security and 4 free months of Helium Mobile coverage.

DePIN

Solana continues to be a hub for DePIN applications, hosting Helium, Hivemapper, GEODNET, Render, Nosana, Jambo, NATIX, and more. Notable Q2’25 events include:

- Helium Mobile: At the end of Q2’25, Helium had 980,700 daily users and 311,200 Helium Mobile subscribers. Helium also announced its free phone plan with 3 GB of data. Read more about Helium’s recent developments in Messari’s State of Helium Q1 2025 report.

- XNET: At the end of Q2’25, XNET had offloaded over 182 terabytes of data from over 22 million users.

- Hivemapper: By the end of Q2’25, Hivemapper had mapped about 13 million unique miles, 34% of global coverage, or the surface area of the streets within an urban area. Volkswagen and Lyft both announced partnerships with Hivemapper to use mapping data collected in a decentralized way.

- Natix: In May 2025, Natix partnered with Grab, a transportation, delivery, and financial services superapp used primarily in Southeast Asia. Grab has success already building an AI-based mapmaking software stack, through offering fiat incentives for drivers to use cameras they have developed or with their smartphones.

- Fuse: In March 2025, the Fuse team announced that users in the United Kingdom can install EV home chargers. As of July 2025, Fuse has 45,000 customers in the UK, growing 15% month over month.

- Geodnet: At the end of Q2’25, Geodnet surpassed 18,000 active Satelite Miners worldwide, reinforcing its position as the world’s largest RTK network. Read more about Geodnet’s recent developments in Messari’s State of Geodnet Q1 2025 report.

- Ionet announced “Real Time Network Earnings”, providing full transparency into usage of their global GPU network. The network has earned $17m+ so far in 2025.

Payments

With low transaction costs, sub-second finality, and a network of several thousand nodes, Solana aims to power mainstream payment flows. Notable events from Solana-native payments infrastructure companies and applications this quarter include:

- In April 2025, Worldpay joined the Global Dollar Network. Worldpay processes $2.2 trillion annually in traditional payments. Merchants will soon have the option to accept USDG on Solana for settlement.

- In June 2025, payments and financial technology company Fiserv announced a strategic collaboration with Circle to advance stablecoin payment capabilities for its clients. The partnership integrates Circle’s USDC infrastructure with Fiserv’s vast global network, which includes thousands of financial institutions and millions of merchant locations.

- Helio: In early Q1, MoonPay acquired Helio in a strategic acquisition. MoonPay also acquired the stablecoin infrastructure platform Iron for $175 million.

DeSci

DeSci (Decentralized Science) is an emerging movement to reimagine how scientific research is funded, published, reviewed, and accessed, using Web3 models for financing and monetization. Notable events from the Solana DeSci space include:

- Curetopia became the first bioDAO to launch on Solana, leveraging Bio Protocol’s DeSci launchpad. Focused on addressing rare diseases, Curetopia raised $1.77m via auctions across 1,000+ participants. Already using an AI-driven yeast-based drug screening, Curetopia identified multiple lead drug candidates for AARS2 deficiency, a rare disease condition that is on its way to having a DeSci-native cure.

- Bio Protocol kicked off a two-month-long hackathon focused on the intersection of scientific research and AI agents. Solana Foundation was a proud sponsor of this effort, helping fund a $125k prize pool to discover new ways to conduct scientific research at a fraction of traditional costs and timelines.

- Genpulse revolutionizes derma-care with AI agents, smart wearables, onchain security, and data rewards. Announcing its launch on Solana in March, the team’s first flagship product is an AI-powered scalp/hair analyzer that checks hair health across 14+ parameters (e.g., follicle density, hair thickness, oil levels, etc.).

- Starpower is a decentralized energy network that connects over 1 million energy devices and 1 million application users across approximately 792 cities worldwide. In March 2025, Nature Nanotechnology accepted a paper co-authored by the Starpower team, highlighting its DeSci-driven battery research and work on next-generation storage for AI and compute. Read more about Starpower’s recent developments in Messari’s Understanding Starpower: A Comprehensive Overview report.

Infrastructure

Notable infrastructure-related events from Q2 2025 include:

- In May 2025, Chainlink and Metamask announced Solana support.

- In June 2025, about 1.5% of Solana mainnet stake was running on DoubleZero’s testnet. The protocol is a decentralized framework for creating and managing high-performance, permissionless networks.

- In June 2025, Metaplex announced Metaplex CLI, a new command-line tool to help create and manage tokens and NFTs. The team also released their H1 2025 recap, which shows that they brought in $13.7 million in protocol revenue and enabled the creation of 115 million tokens and NFTs. Read more about Metaplex’s recent developments in our State of Metaplex Q1 2025 report.

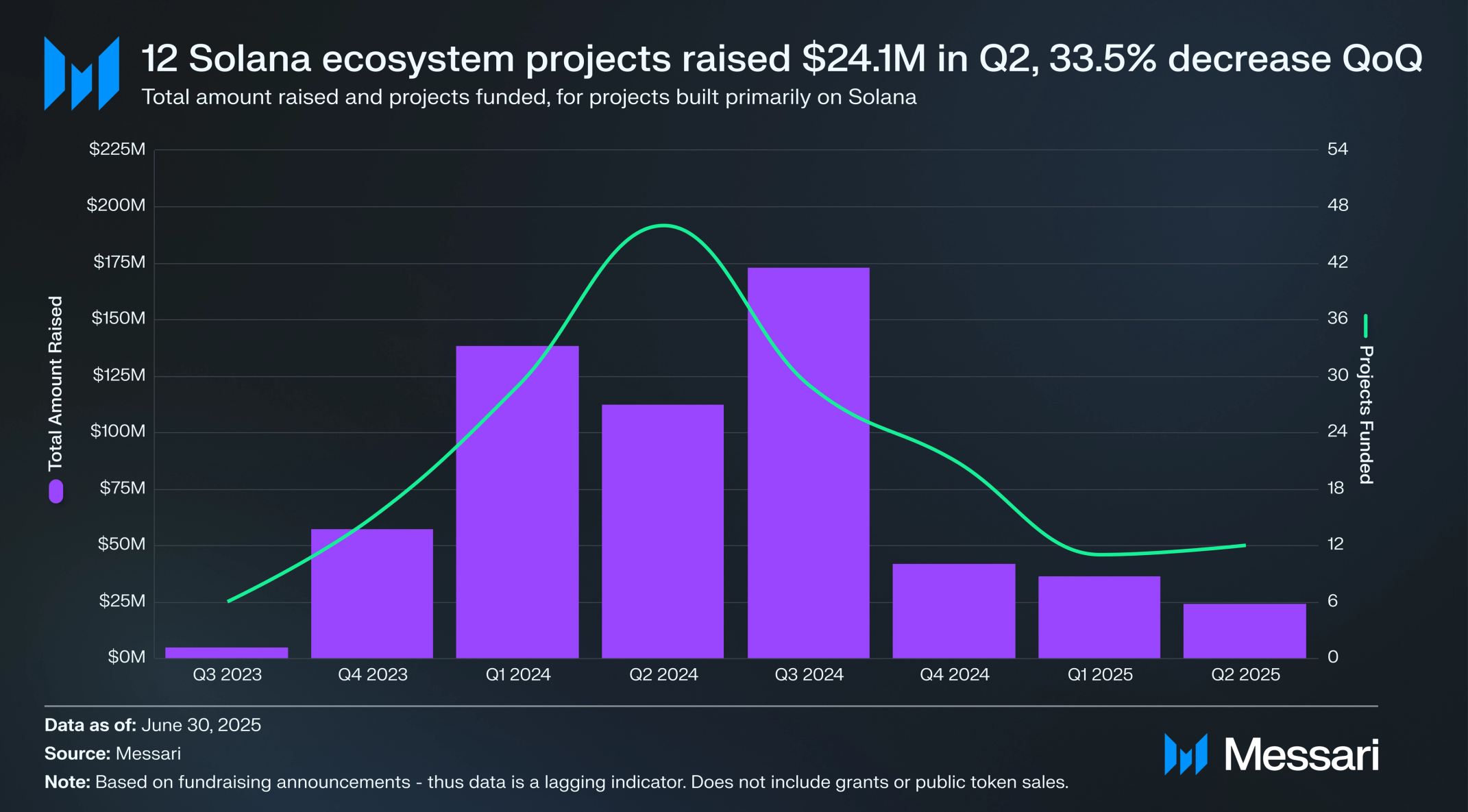

Growth

In Q2 2025, 12 projects announced funding rounds, a 9.1% QoQ increase. These projects raised a combined $34.1 million, a 33.5% QoQ decrease.

- In April 2025, ZAR raised $7 million led by Dragonfly and VanEck. ZAR is a platform that facilitates the conversion of cash into digital dollars via local agents. It offers users the ability to exchange currency and store funds in digital wallets, accessible through virtual and physical debit cards. ZAR supports payments in USD, offers global transaction capabilities, and protects against currency fluctuations.

In November 2024, Messari launched the Solana Portal. Users can use this to keep up to date on all things qualitative and quantitative within the ecosystem.

Network Analysis

Usage

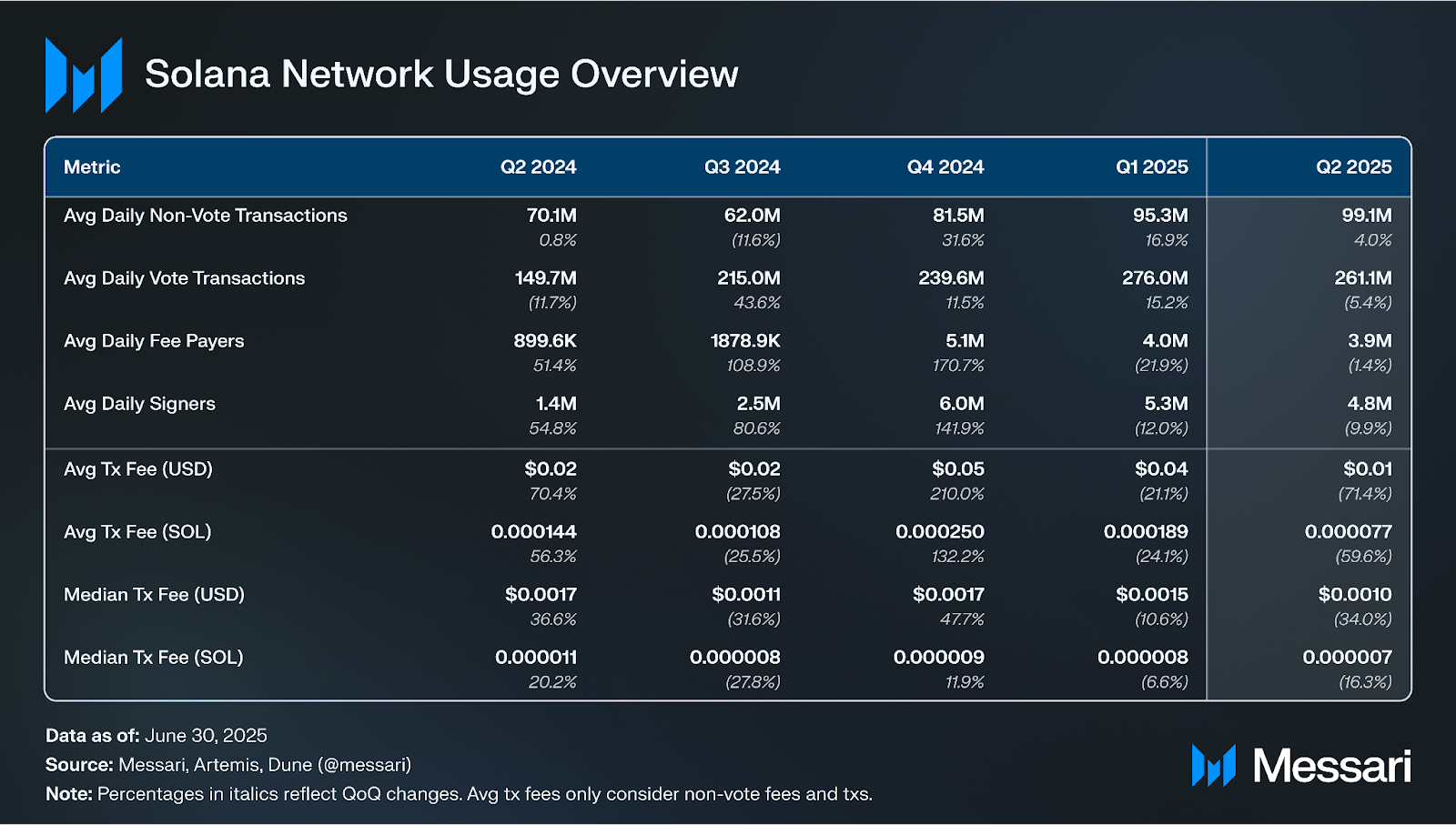

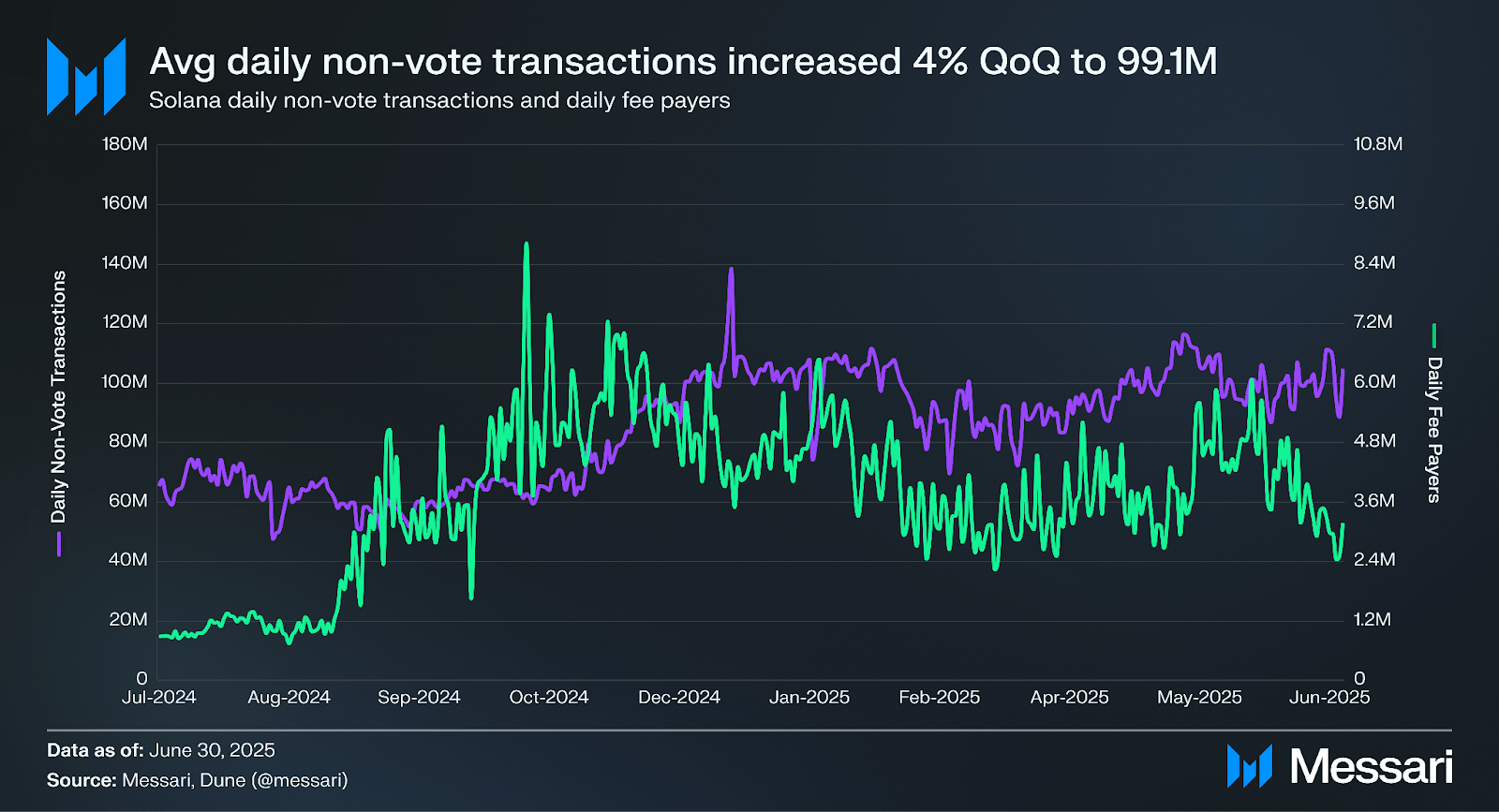

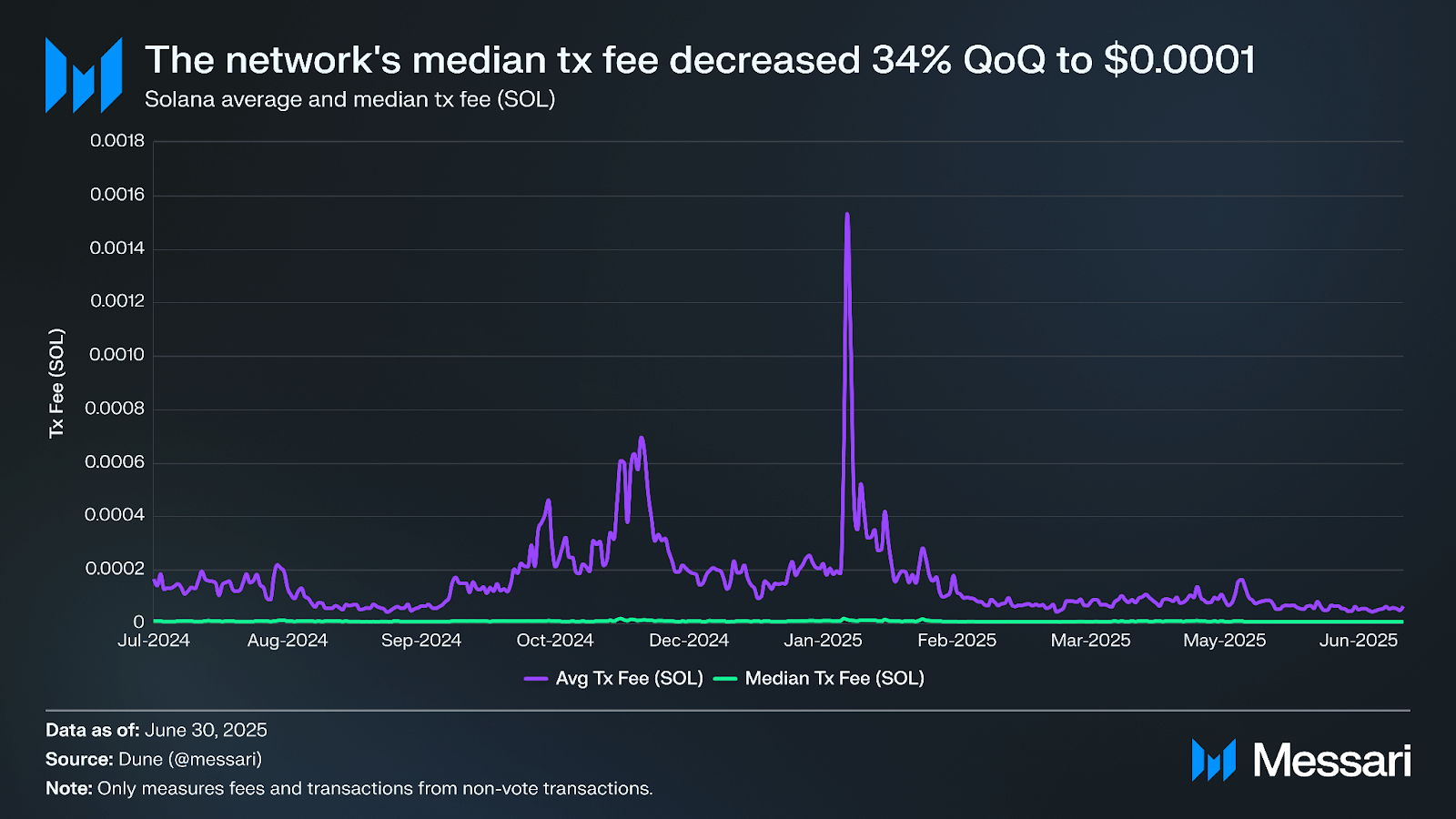

Network activity, measured by non-vote transactions and fee payers, saw relatively flat metrics in Q2 2025. Average daily fee payers decreased 1.4% QoQ to 3.9 million, while average daily non-vote transactions increased 4% to 99.1 million.

The average transaction fee decreased by 59.6% QoQ to 0.000077 SOL ($0.01), and the median transaction fee decreased by 16.3% QoQ to 0.000007 SOL ($0.0010). There was a spike in average transaction fees in January when the TRUMP token launched before President Trump took office. On January 19, the average fee paid was $0.41; however, the median fee paid was $0.003, highlighting the power of local fee markets. Helius was able to consistently land 100% of transactions during this period with fees as low as $0.001.

Security and Decentralization

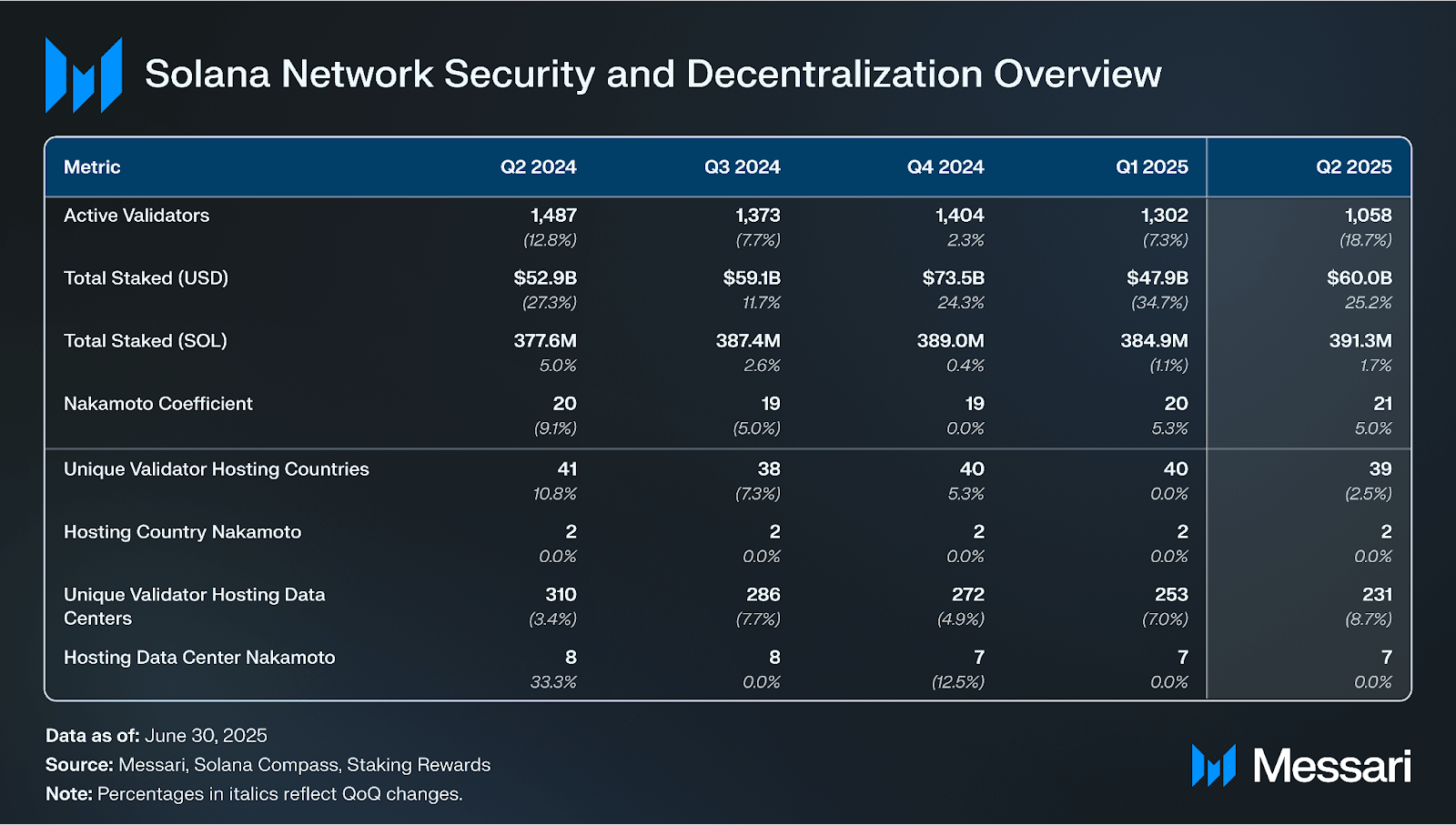

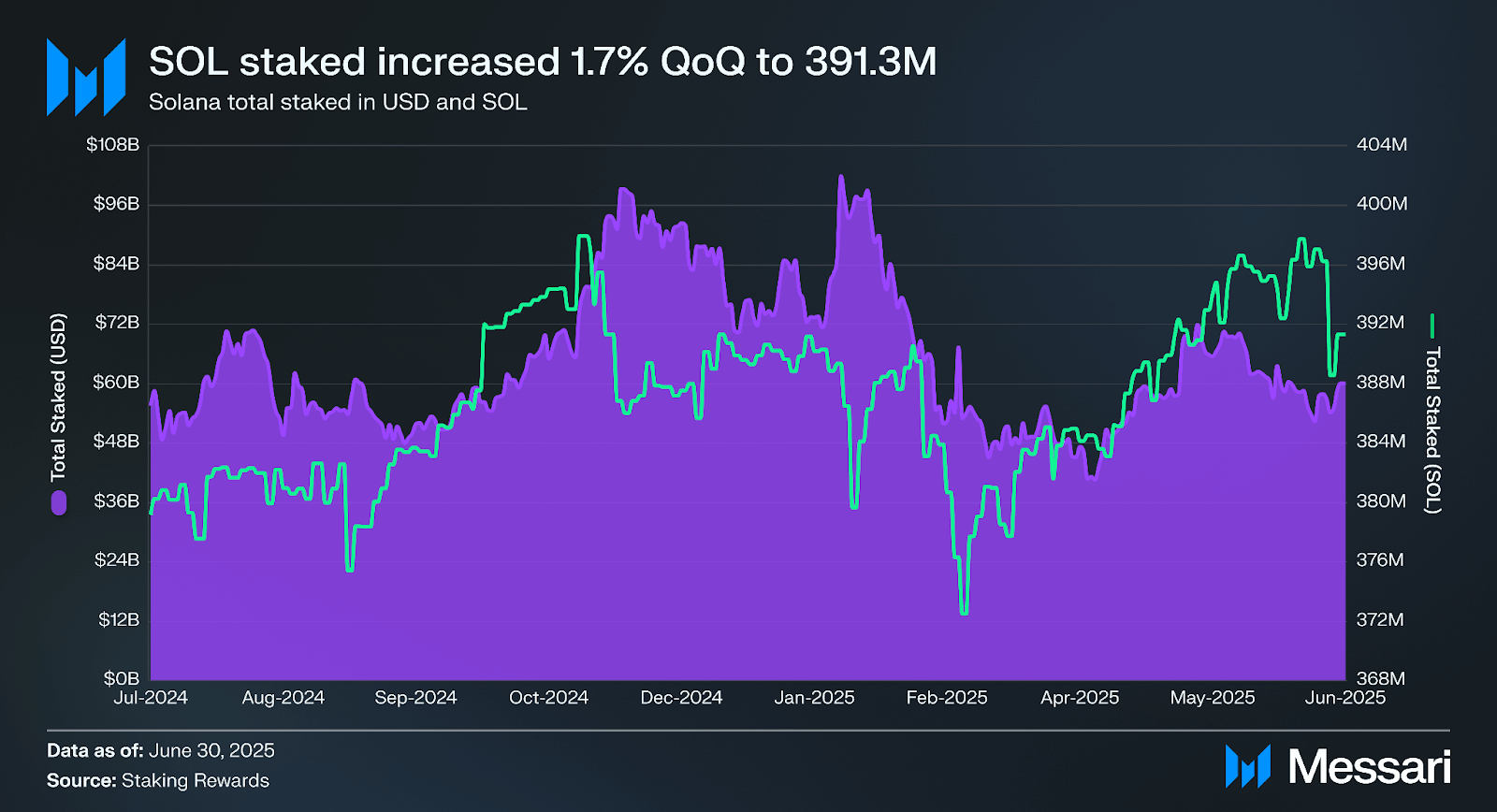

Total stake (USD) hit an all-time high of $102 billion on January 18 when SOL hit an all-time high of approximately $295. Staked SOL (USD) increased 25.2% QoQ to $60 billion in Q2’25, up from $47.9 billion at the end of Q1’25. Total stake (SOL) grew 1.7% QoQ, from 384.9 million to 391.3 million.

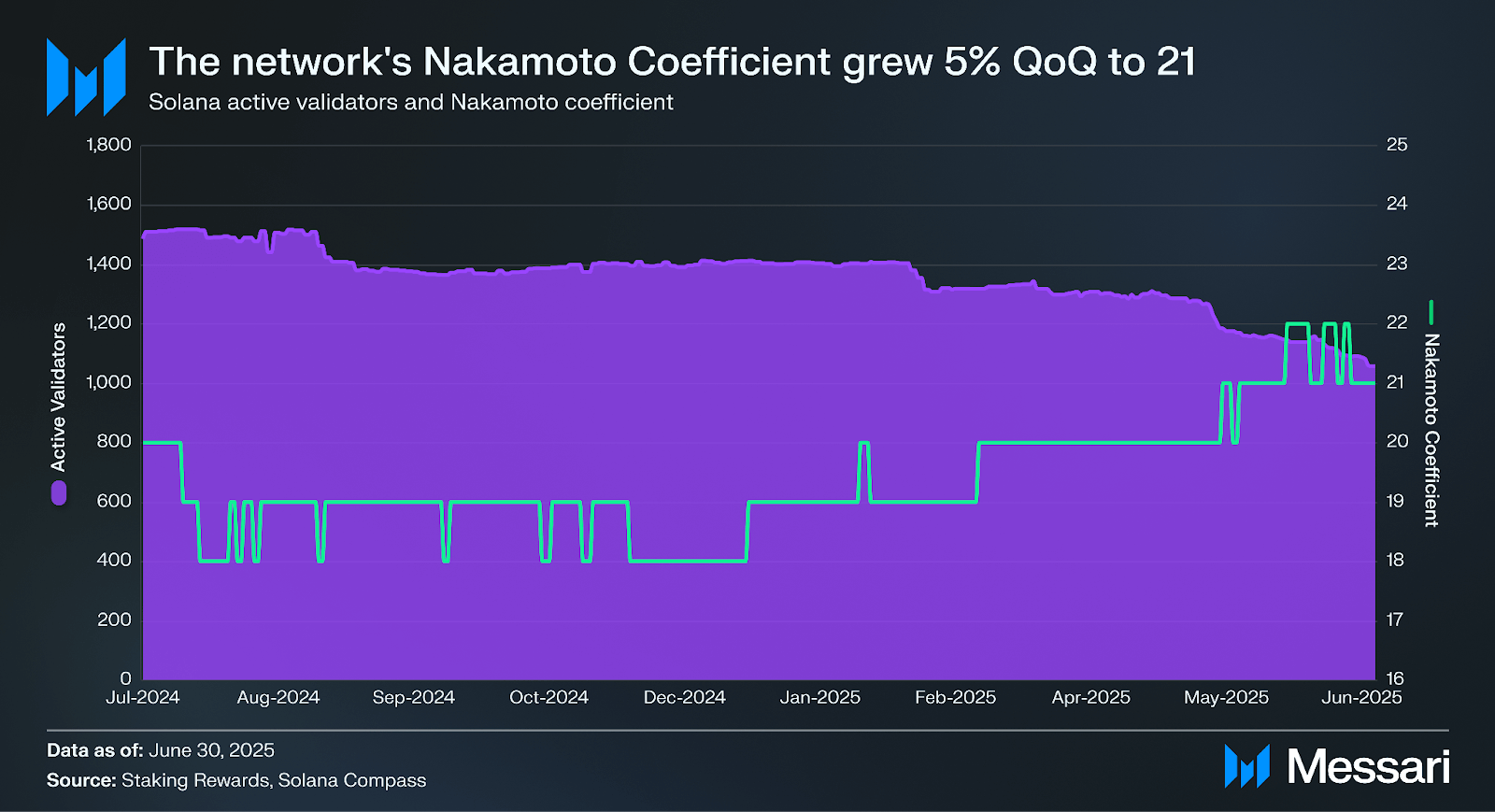

The Nakamoto coefficient is the minimum number of nodes needed to break liveness. The metric can also be measured across other dimensions important to the resilience of a validator network, including distribution of stake by location, hosting provider, and clients.

In H2’24, the Nakamoto coefficient on Solana fell to 18, an all-time low since 2021. However, Solana’s Nakamoto coefficient ended Q2’25 at 21, which is above the median of other networks. Solana’s 1,058 active validators (down 18.7% QoQ) are hosted in 39 countries. Solana validators are hosted in 231 unique data centers, down 8.7% QoQ, and its hosting data center Nakamoto coefficient stayed flat at 7.

Performance, Upgrades, and Roadmap

Agave Updates

At the time of writing, about 90% of validators are running a V2.2 or later version, with about 16% of validators running the most recent release of V2.3. Technically, most of the network stake is running the Jito-Solana client, an Agave fork optimized for MEV.

At the Accelerate event in May 2025, the Anza team announced Alpenglow, a new consensus protocol. Alpenglow is aimed squarely at transforming transaction finality by collapsing core legacy systems, including Proof of History, Tower BFT, and gossip‑based vote propagation, into two streamlined mechanisms: Rotor for data propagation and Votor for offchain voting. By standardizing a fixed 400 ms block time and eliminating per‑slot vote transactions in favor of lightweight BLS‑aggregated certificates anchored onchain, Alpenglow is projected to reduce finality latency dramatically from roughly 12.8 seconds to 100–150 milliseconds, representing a 100× improvement in responsiveness. Simultaneously, the elimination of vote fees and streamlined client logic lowers operational costs, making smaller validators more viable and simplifying ledger growth by shrinking unnecessary onchain data.

Under its new fault‑tolerance model, Alpenglow provides “20 + 20” resilience. Safety is preserved if up to 20 % of stake is adversarial, and liveness is maintained even if an additional, separate 20 % of stake goes offline, offering robust protection in varied network conditions. Because both Rotor and Votor are designed to operate without leader coupling, the protocol naturally supports innovations like multiple concurrent proposers, opening doors to reduced MEV and parallel block proposals. While some protocol details, such as slashing mechanics and relay compensation, remain unresolved, the proposal is scheduled for community review, testnets, and possible mainnet rollout at Breakpoint in December 2025, pending governance and SIMD approval.

Firedancer/Frankendancer Updates

Beyond improvements to the Agave client, the network is set to benefit from upcoming clients being created from scratch. Notably, Jump Crypto is developing Firedancer in C. At Breakpoint 2024 in September 2024, Jump provided an update on the client’s development.

Frankendancer, a version of Firedancer that includes parts of Agave code, has been live on Solana’s mainnet since September 2024. Additionally, Firedancer is fully live on testnet and live on mainnet in a non-voting mode. This means the client can listen to the network and replay blocks in real time. In July 2025, 124 validators, about 11% of the stake, ran Frankendancer or Frankendancer-Jito.

SIMDs

Financial Analysis

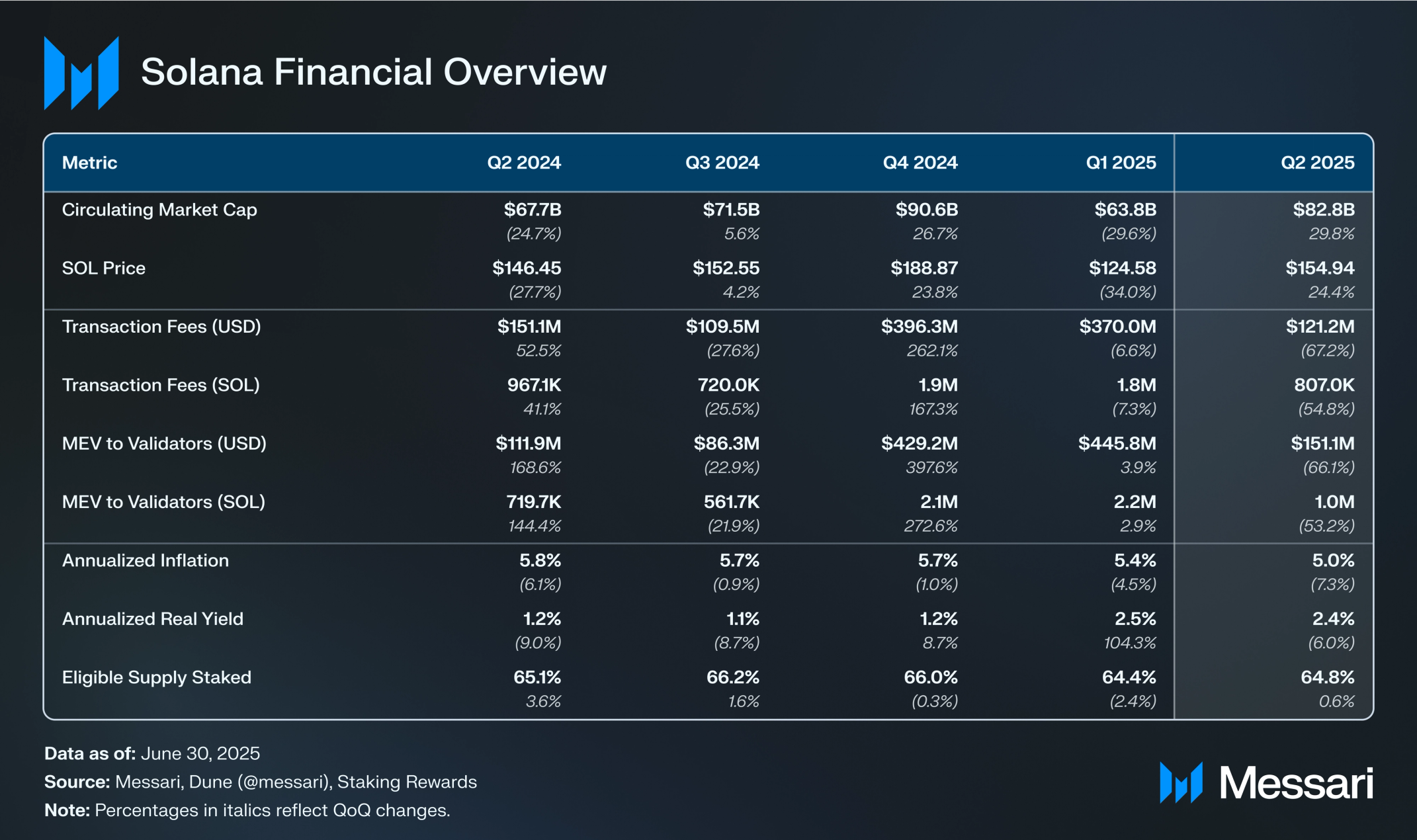

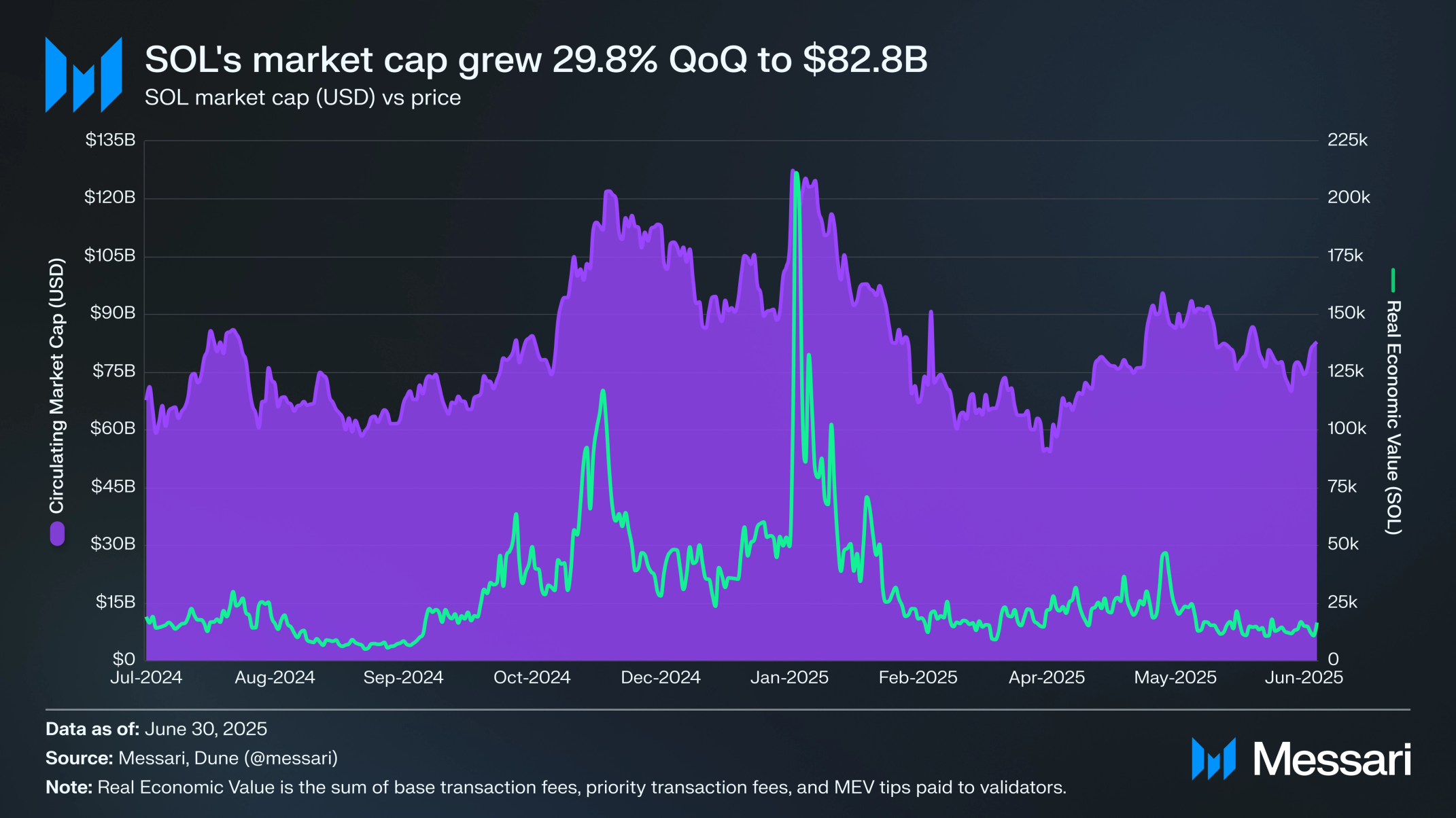

SOL’s circulating market cap grew 29.8% QoQ to $82.8 billion. At the end of Q2 2025, SOL remained at 6th among all cryptocurrencies by circulating market cap, behind BTC, ETH, USDT, XRP, and BNB.

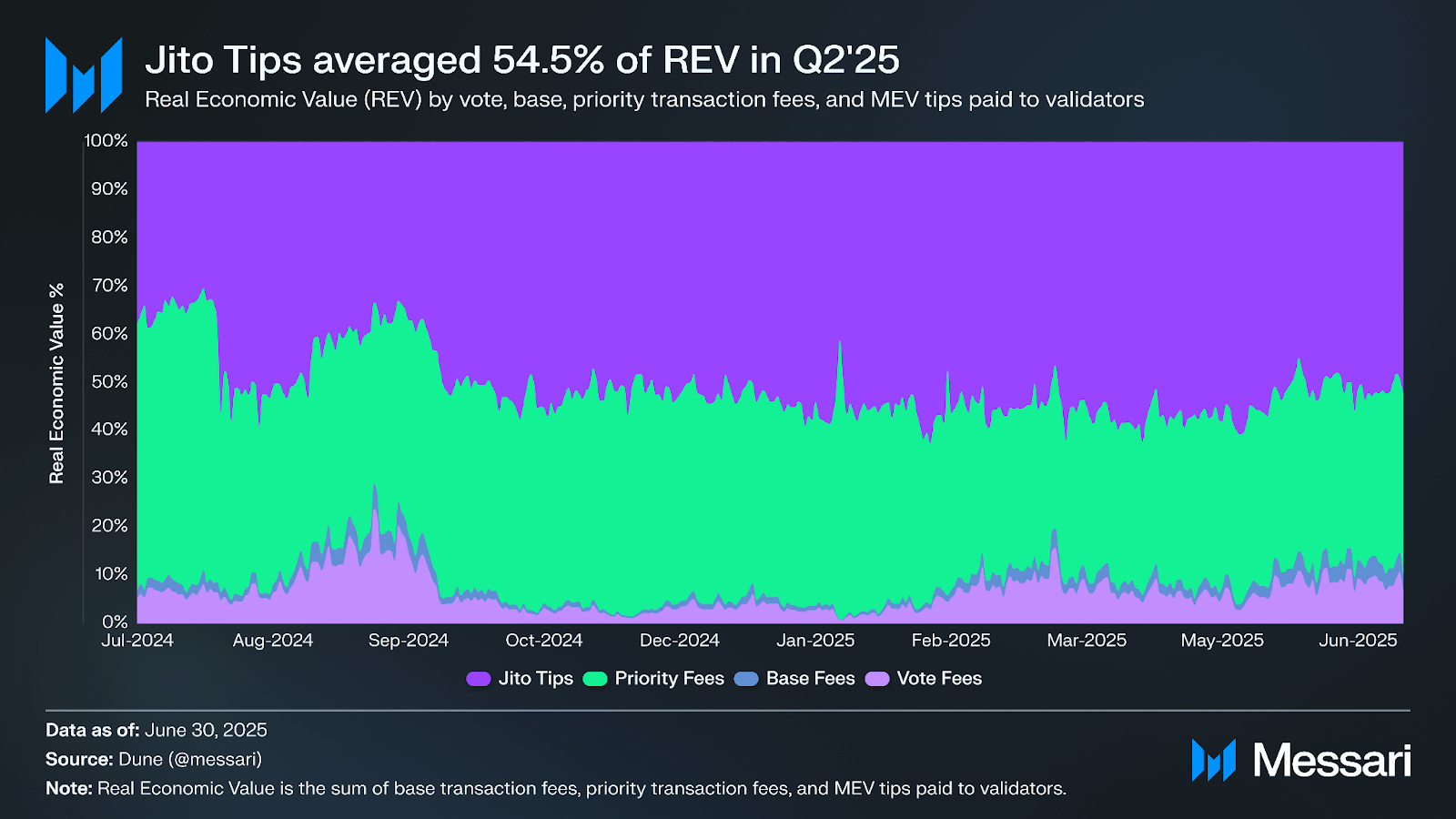

Real Economic Value (REV), which is the sum of vote transaction fees, base transaction fees, priority transaction fees, and MEV tips paid to validators, decreased 53.9% QoQ in SOL terms to 1.8 million ($272.3 million). Of this, 54.5% came from MEV tips, with the rest coming from transaction fees.

SOL ETF

The SEC allowed Rex Osprey to launch their Solana Staking ETF, with the ticker SSK, on June 27, 2025, with trading beginning on July 2, 2025. The fund will invest “a small amount” of the ETF’s assets into JitoSOL. This is the first staking crypto ETF to be approved in the U.S. To view up-to-date flows, view Farside’s ETF dashboard.

Nine other issuers have also filed for a Solana Spot ETF and are still waiting for approval, with the most recent filings coming from Invesco and Galaxy. Most of these applications have an approval decision expected to be announced by October 2025.

Digital Asset Treasury Companies

On Sept. 12, 2024, the Canadian-traded company Cypherpunk Holdings rebranded to SOL Strategies, representing its bet on the Solana ecosystem. SOL Strategies’ strategy is similar to Microstrategy’s; however, it is going a step further by staking its SOL tokens and investing in projects in the ecosystem. This strategy has gained momentum as multiple other firms have followed suit with many announcements in April 2025, including DeFi Development Company (previously Janover), Upexi, GSR, and Galaxy Digital.

As of June 2, 2025, SOL Strategies held 420,707 SOL. In March 2025, SOL Strategies acquired three validators, including the Laine validator, which ran the popular site stakewiz.com. As of July 5, 2025, DeFi Development Company (DFDV) held 621,313 SOL.

Closing Summary

Solana’s infrastructure and financial indicators showed strength this quarter. Liquid staking penetration rose to 12.2% of SOL supply, led by jitoSOL and jupSOL. Validator decentralization improved modestly, and staking value increased 25.2% QoQ to $60 billion. Firedancer gained traction on mainnet, and Anza introduced the Alpenglow protocol targeting sub-second finality. SOL’s market cap rose 29.8% to $82.8 billion, supported by the launch of the first U.S.-approved SOL staking ETF. While Real Economic Value declined 53.9% to $272.3 million, MEV tips made up 54.5% of validator rewards, underscoring evolving revenue dynamics.

Solana’s ecosystem metrics saw a broad cooldown in Q2 2025 as speculative activity slowed down. Chain GDP fell 44.2% QoQ to $576.4 million, while average daily spot and perp DEX volumes declined 45.4% and 28.5%, respectively. Despite this, DeFi TVL in USD rose 30.4% to $8.6 billion, and the App Revenue Capture Ratio increased to 211.6%, suggesting strong monetization relative to onchain economic activity. Stablecoin market cap dropped 17.4% to $10.3 billion, though FDUSD grew 192.3% QoQ. Network usage remained steady with a 4% increase in non-vote transactions and a 1.4% decline in fee payers. To stay up-to-date with all things Solana, visit Messari’s Solana Portal.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by the Solana Foundation. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization may have input on the content of the report, but Messari maintains editorial control over the final report to retain data accuracy and objectivity. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.