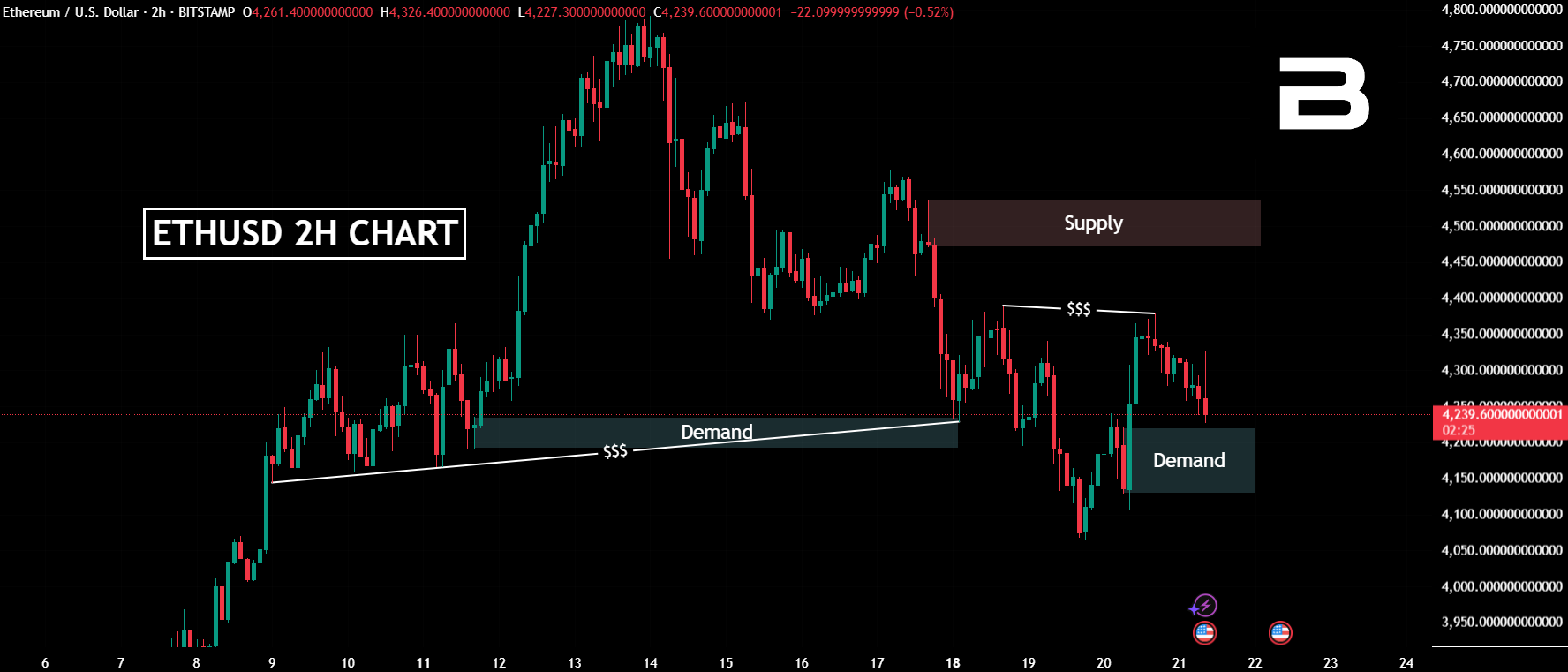

If you’ve been following my recent breakdowns, you’ll remember that last time we marked a clean H2 demand zone on Ethereum.

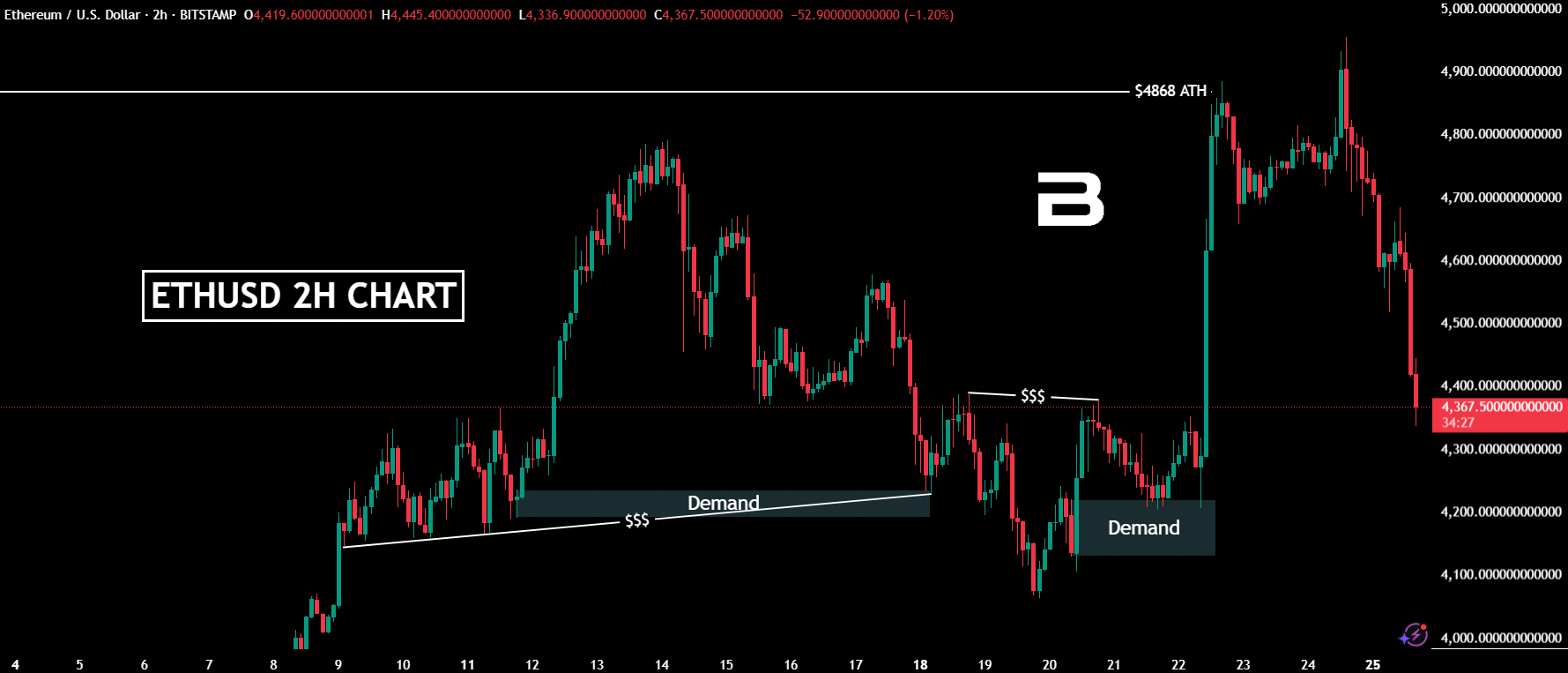

Well, that zone didn’t just hold—it helped push ETH into a brand-new all-time high of $4,955. Almost $5K.

Well, that zone didn’t just hold—it helped push ETH into a brand-new all-time high of $4,955. Almost $5K.

At first, ETH touched $4,885, and I’m sure many traders thought, “That’s it, the top is in.”

At first, ETH touched $4,885, and I’m sure many traders thought, “That’s it, the top is in.”

But then, like it always does, the market played its little game. It swept the liquidity from those who jumped in too early on shorts, manipulated one last leg up, and spiked to $4,955.

Only after that move did price finally roll over.

Only after that move did price finally roll over.

And roll over it did. ETH is now sitting around $4,356, which feels like a completely different world compared to the excitement of the highs.

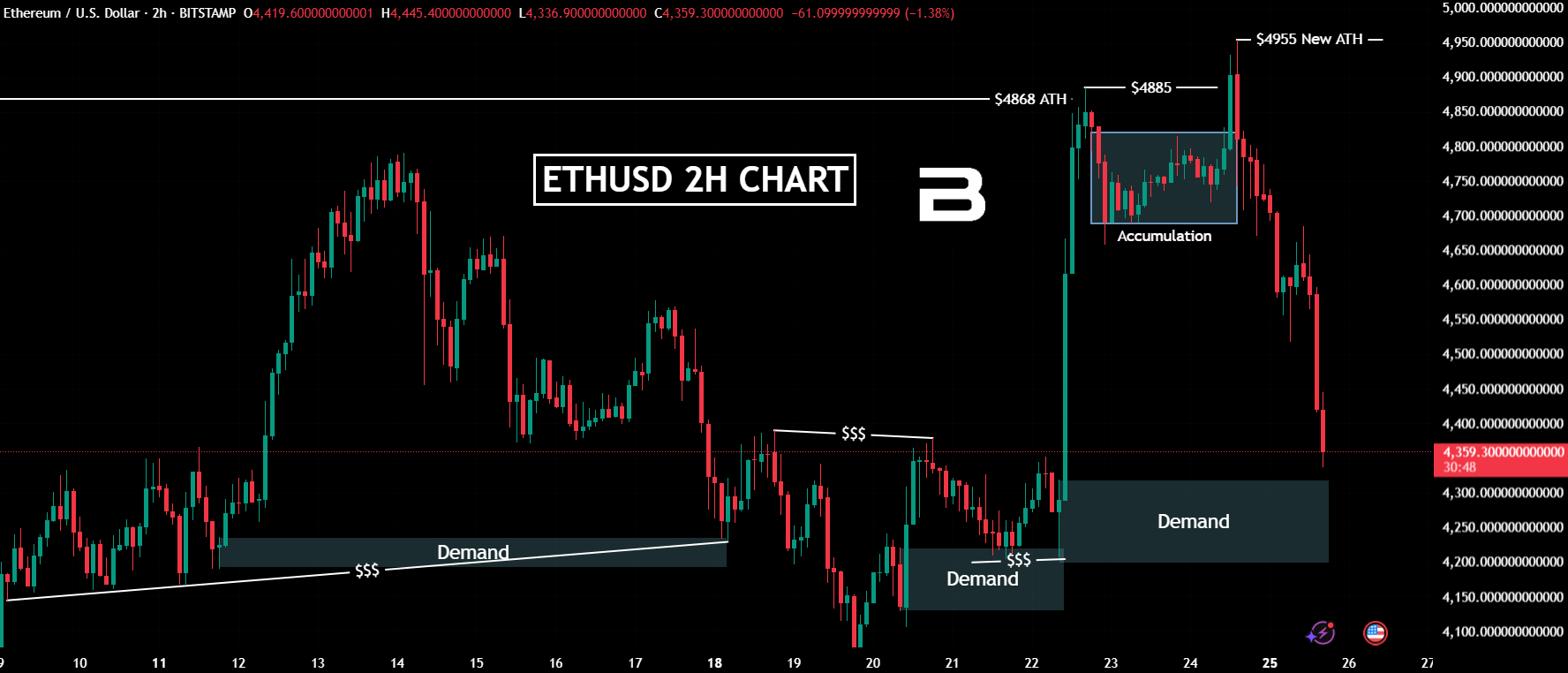

Now here’s the big question: will this H2 demand hold? Honestly, I’m not fully convinced.

Why? Because above us, there isn’t much liquidity left to grab.

Why? Because above us, there isn’t much liquidity left to grab.

That makes it less attractive for the market to push up immediately. Instead, below, we’ve got two clean lows just waiting to be taken out. And if you’ve traded long enough, you know what usually happens in these cases.

Still, let’s keep it real—nothing is guaranteed.

Ethereum could hold here and rally without even dipping lower, or it could sweep those lows before making another move higher. The market doesn’t care what we expect, and that’s the beauty and the pain of it.

So, my Ethereum price prediction here is not about certainty but about probabilities.

Right now, ETH looks like it could dip deeper before attempting another run up. But if this demand hold, don’t be surprised to see a strong bounce sooner than expected.

Either way, buckle up—Ethereum isn’t done with its tricks.