Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

At $180.74, 10.49% down, the drawdown of Solana has added portfolio risk to Layer-1 ecosystems. In response, money is being redirected towards differentiated value propositions either liquidity-driven tokens such as Shiba Inu or emerging platforms such as Unilabs Finance (UNIL).

The key question for investors is this: following Solana’s price correction, which offers the stronger risk-reward profile, Shiba Inu with its volatility-driven cycles, or Unilabs with its yield-backed model?

Shiba Inu: Can Memecoin Hype Still Deliver Big Gains?

Presently, Shiba Inu is trading at $0.00001230, a sharp 11.91% decline for the day. Nevertheless, it has a $7.24 billion market capitalization and a 24-hour volume of $206.49 million, up 10.46%.

Source: TradingView

Even with new tools like Shibarium (its layer-2 scaling solution), Shiba Inu still leans too much on hype. When big tokens like Solana drop, many retail traders quickly move to memecoins for fast gains, but how long those gains last is unclear.

The latest update from Doggy DAO, adding fairer voting systems to give smaller holders more say, is meant to cut down whale control and boost community trust. This could help Shiba Inu look stronger, but it’s still not clear if these changes will support steady growth or just spark short-term excitement.

Solana Price Crash: How It Affects Market Rotation

The sharp drop in the Solana price to $180.74 is a snapshot of an overall market readjustment. Solana’s capitalization dropped to $97.92 billion as its trade volume increased by 13.86% to $5.83 billion. This is a sign of heavy trading activity as investors rotate their funds, either accumulating at depressed prices or seeking alternatives.

Source: TradingView

Traditionally, Solana price decline has been a trigger for a rotation into smaller-cap stocks where investors seek to capture unreasonably large returns. This opens a window for altcoins like Shiba Inu to find their way back into the limelight, but concurrently also provides an opportunity for innovative players like Unilabs Finance to find their way.

Why Unilabs Could Be the Smart Investor’s Hedge Against Solana Price Risks

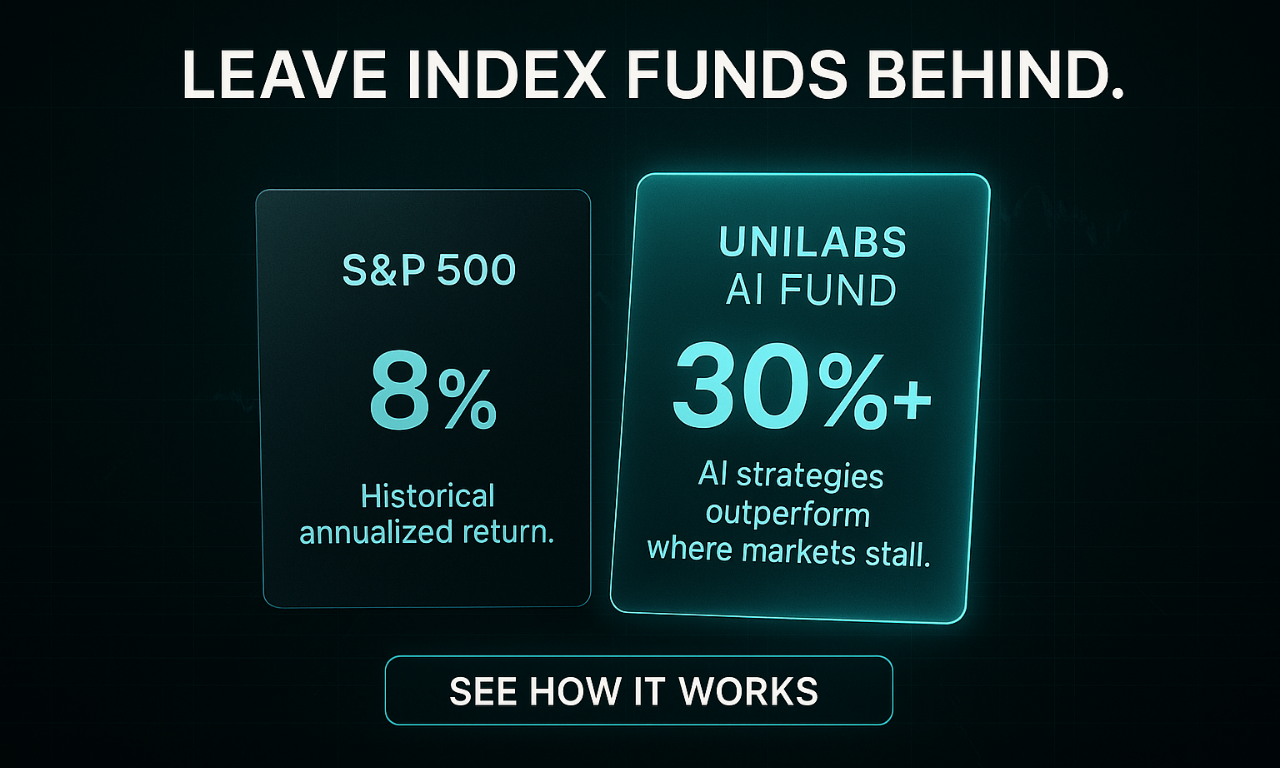

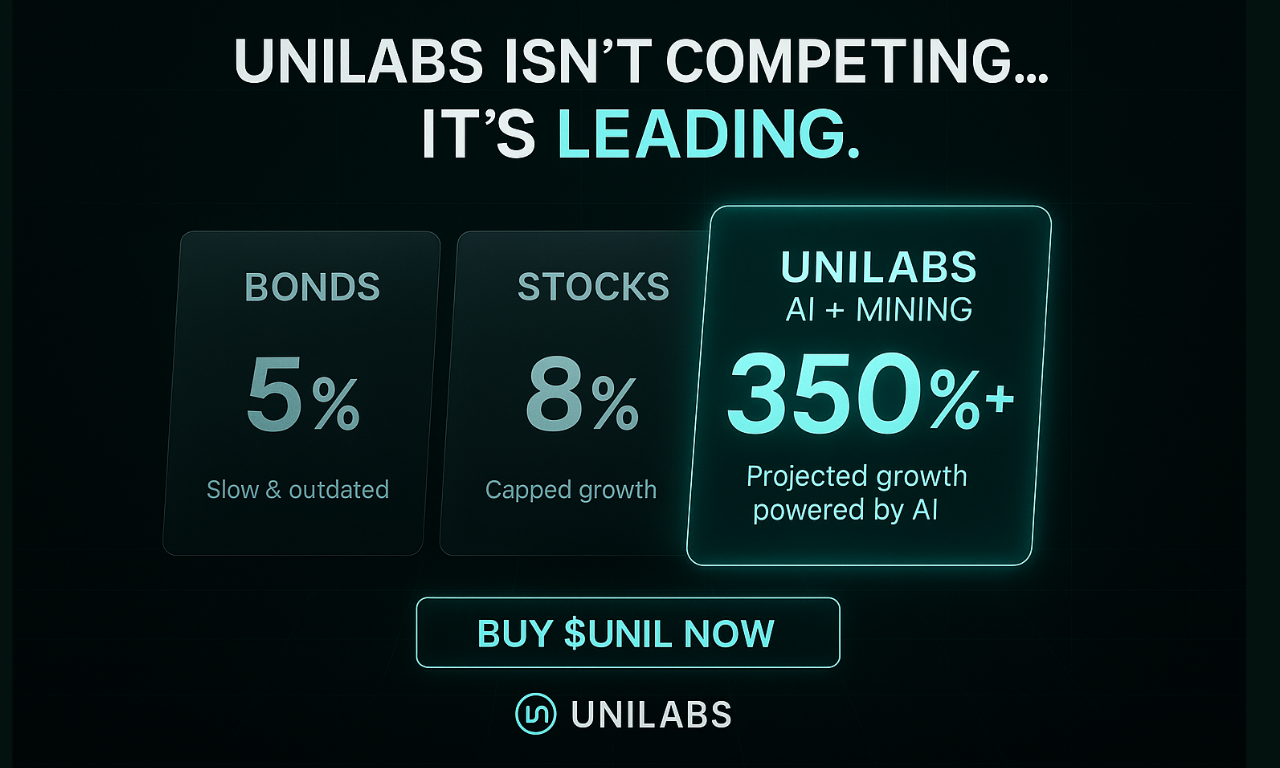

As the Solana price stumbles and investors search for sustainable alternatives, Unilabs Finance remains positioned with $30 million in assets under management (AUM) as of Q2 2025. Its edge is the four AI-powered funds, the AI Fund, BTC Fund, RWA Fund, and Mining Fund that diversify exposure across digital assets and real-world revenue streams.

Unilabs is the first to bridge DeFi and TradFi by creating asset baskets that balance crypto-native assets with traditional allocation rationale. The UNIL token itself is yield-backed, with real-time NAV tracking to enable transparency of portfolio value for holders.

Beyond transparency, staking opens up passive income avenues while supporting ecosystem liquidity. The platform’s multi-strategy AI models adapt across different market cycles, whether memecoin pumps, RWA performance, or BTC cycles.

Its referral layer encourages growth by incentivizing users to bring in new participants into the ecosystem, adding another community-driven growth channel.

Yield-Backed Growth in an Era of Volatility

Currently in presale stage 7 and trading at $0.0108, Unilabs has already raised $14.67 million USDT and sold over 2.02 billion tokens demonstrating high demand from investors. The initiative has included the discount code UNIL40, which provides a substantial 40% bonus on the subsequent purchase, as an additional incentive for participation.

Where Shiba Inu is banked on market trends and community fad, Unilabs is built upon RWA financial performance. This positions it optimally amid times like the current Solana price drop when investors are looking for projects grounded in real utility and long-term growth potential.

Shiba Inu vs. Unilabs Finance: Striking a Balance Between Hype and Real Utility

For investors suffering the impact of the Solana price crash, Unilabs Finance and Shiba Inu present alternative prospects. Shiba Inu is a volatility magnet and has been one of the most liquid memecoins available, so it would be tempting for short-term players who exploit pump-driven rallies.

But for longer-term appreciation of the portfolio, Unilabs Finance stands a solid case. With AI-managed funds, real yield generation, and rising presale demand, it has utility that can weather sentiment reversals.

The Solana price drop has reminded investors of the importance of diversification. Investing in both Shiba Inu for meme-driven spikes and Unilabs for structured growth may be a well-balanced move to ride this rollercoaster cycle.

Discover the Unilabs Finance (UNIL) presale:

Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

/div>