Ethereum (ETH) is only a few percentage points away from setting a new all-time high. Institutional demand for ETH accumulation is stronger than ever. But is buying ETH at this price a wise move for investors?

Data shows that buying Ethereum at $4,700 is a bet against historical patterns. This article explains why.

The most important question for Ethereum investors now is: “Will this time be different?”

Historical data remains the main reference for analysts when they issue warnings and forecast the future. Not every prediction proves correct. However, investors have a few more reliable tools than past market lessons to identify the risks they face clearly.

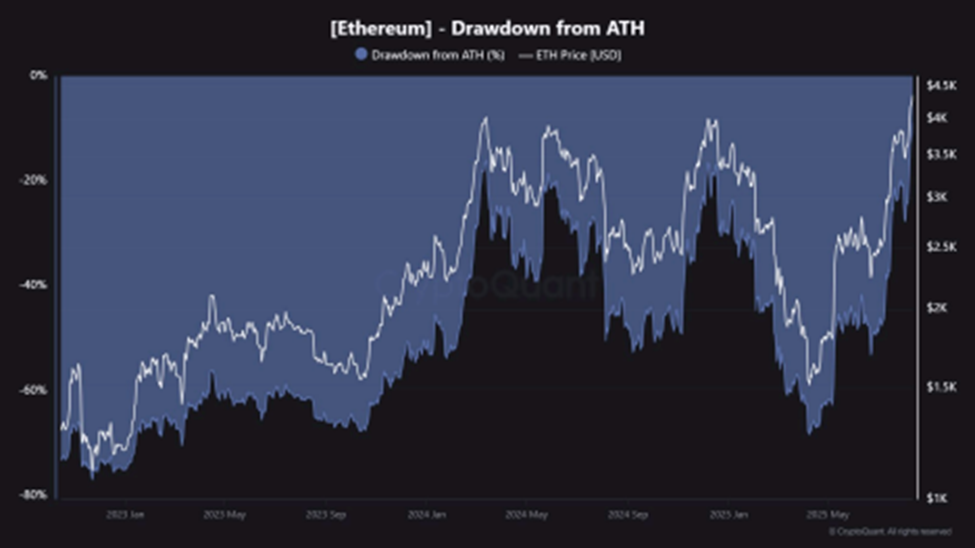

The first historical data Ethereum investors should consider is that the drawdown from the ATH (all-time high) has narrowed significantly. This suggests a high risk of correction, similar to previous cycles.

Ethereum Drawdown from ATH. Source: CryptoQuant.

From 2024 until now, ETH has made four attempts to close its drawdown gap. The first three failed. With ETH trading around $4,775 in this fourth attempt, the drawdown line (in blue) is approaching 0%.

Even if ETH sets a new ATH, the chance of a short-term correction from profit-taking remains high.

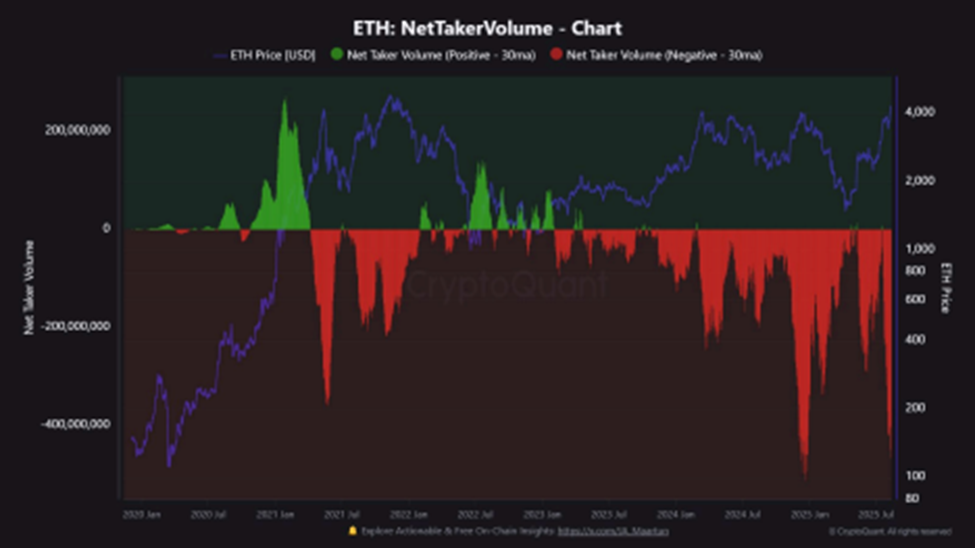

Next, Net Taker Volume is negative at -$464 million, showing sellers dominate the market. Net Taker Volume measures the difference between aggressive buy and sell volume on derivatives exchanges. A negative reading indicates that sellers are more active.

Ethereum Net Taker Vokume. Source: CryptoQuant.

According to Maartunn, an analyst from CryptoQuant, this is similar to previous market tops — such as in May 2021 and December 2024 — when sellers dominated and caused rapid price collapses.

In addition, the ETH futures bubble map shows that the overheated phase has persisted over the past month, reflecting high buying risk. Each bubble represents trading volume, while its color shows the volume change rate.

August recorded large trading volumes, with red dominating the map — a sign of overheating that has historically led to sharp crashes.

Ethereum Future Volume Bubble Map. Source: CryptoQuant

Glassnode data also shows that ETH’s open interest in the future has reached a new ATH of about $35.5 billion, as the spot price climbed to around $4,590.

This sets the stage for potential large-scale liquidations in August.

“ETH futures open interest has reached a new all-time high of about $35.5 billion as spot prices rose to around $4,590. Leverage has been rebuilt across exchanges, creating the conditions for larger market swings as positions concentrate,” Glassnode reported.

For these reasons, buying ETH now — and counting on profits — means accepting high volatility, risking large-scale liquidations, and ignoring the effectiveness of these historical warning signals.

“Will this time be different?” — Investors may find out soon in August.