This makes Bitcoin Hyper ($HYPER) one of the fastest-growing presales of 2025 and, if things continue at the same pace, the most successful too. But what is Bitcoin Hyper?

Bitcoin Hyper is Bitcoin’s official Layer-2 upgrade that aims to solve Bitcoin’s performance limitations that keep the network stuck at seven transactions per second (TPS).

This places Bitcoin in 27th position on the list of the fastest blockchains by TPS capacity. For a quick comparison, Solana has a max theoretical TPS of 65K; TRON’s is 2.5K; and BNB Chain’s is 2.2K.

Bitcoin’s Problems and Lightning Network’s Failures

The unreasonably low TPS causes several problems for Bitcoin.

The first is the lack of scalability. Because the Bitcoin network can process roughly just seven transactions per second, the throughput is very low, making the network vulnerable to congestion.

This limited capacity is also what’s holding Bitcoin back from permeating the institutional sphere, because it’s simply too slow. In the context of mainstream and institutional adoption, banking entities, for instance, would process thousands, or more, transactions per second globally.

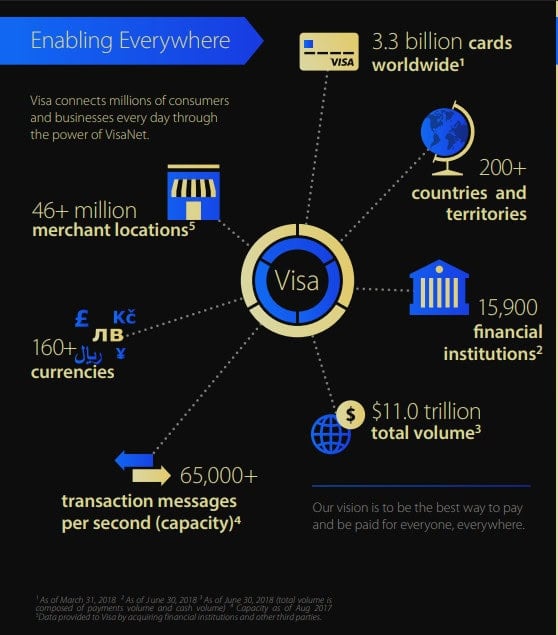

For context, Visa alone can process up to 65K transactions per second in max theoretical TPS, serving 15.9K+ financial institutions in more than 200 locations worldwide.

Source: Visa

Bitcoin couldn’t handle that.

This leads us to the second problem: slow confirmation times. Due to Bitcoin’s limited throughput, many users will inevitably experience long queues, sometimes for hours. This, again, renders Bitcoin unfeasible for big institutional players for whom speed is vital.

That leads straight into the third problem: the fee-based priority system. Because of Bitcoin’s limited network capacity, transactions are slow, so there must be a system to prioritize some transactions over others. And that system is based on fees.

Simply put, the highest fees go first, while the lowest ones remain last, which explains why smaller transactions often experience queue times of hours.

Calling In The Lightning Network Cavalry

The Lightning Network was the most advanced attempt to solve these problems, but it failed.

The fact that the network’s nodes had to remain online at all times was the primary issue, because it exposed users to a higher risk of malicious attacks.

It also gave birth to the Fraudulent Channel Close scam, once bad-faith actors learned that closing the node mid-transaction would allow them to steal the other party’s funds.

Then we have the fact that the Lightning Network also failed to lower the transaction fees or address Bitcoin’s volatility issues.

So, what will Bitcoin Hyper do differently?

How Bitcoin Hyper Succeeds Where the Lightning Network Failed

Bitcoin Hyper essentially has one role – to circumvent Bitcoin’s seven-TPS limitation and bring its performance to modern-day standards.

This aims to achieve several things:

- Improve scalability drastically, allowing for vastly more transactions at once without congesting the network

- Remove the fee-based priority system

- Reduce confirmation times from hours to seconds

- Lower transaction costs

- Make Bitcoin feasible for large institutional players thanks to its increased capacity and performance.

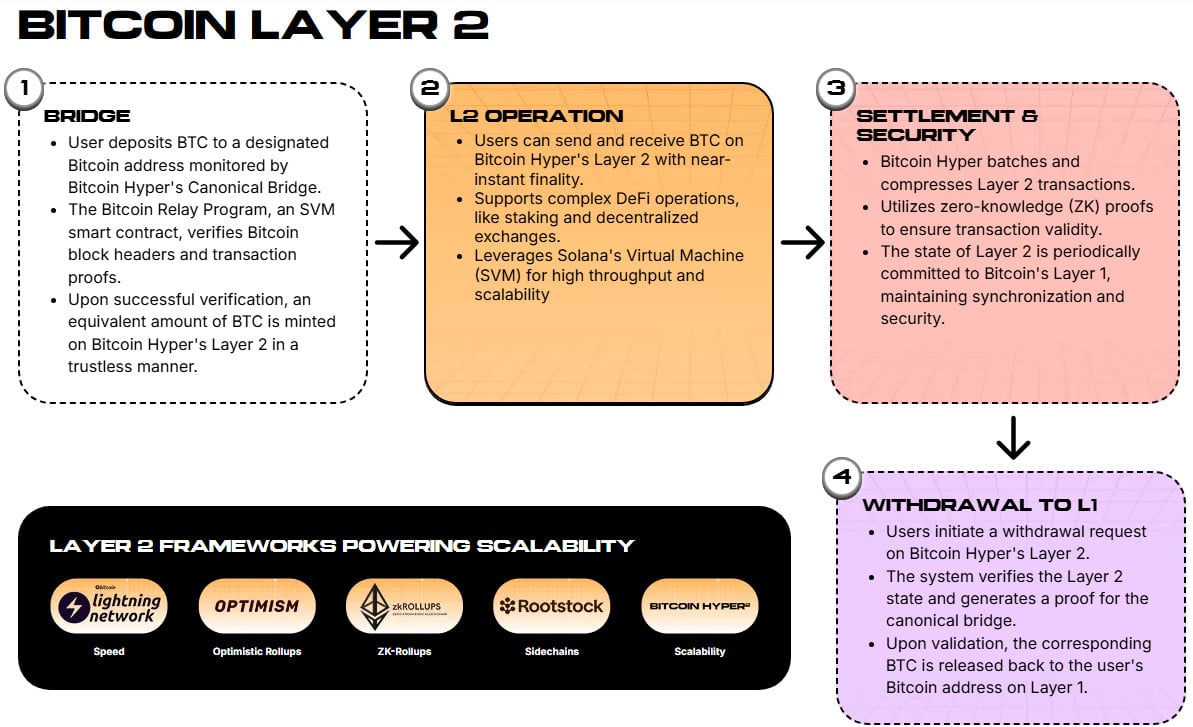

Hyper’s Canonical Bridge is one of the primary tools to help it do that. The Canonical Bridge will link Hyper’s Layer-2 to the Bitcoin network and rely on the Bitcoin Relay Program to confirm incoming transactions.

With the details confirmed, the bridge will then mint the corresponding number of $BTC onto the Layer-2. Those will then be available for use within the Hyper ecosystem. And you can withdraw it back to Bitcoin’s native layer at any time.

Thanks to the way it works, the Canonical Bridge will decongest the native Bitcoin network and lower confirmation times to mere seconds. More transactions per second means higher scalability, which translates into lower fees.

On top of the Canonical Bridge, Hyper will also integrate the Solana Virtual Machine to enable ultra-fast, low-latency execution of DeFi apps and smart contracts.

Together, these tools will bring Bitcoin’s performance to modern standards, turning it faster, cheaper, and better.

Hyper’s $12M Presale Takes the Market By Storm

The $HYPER presale has now raised $12.5M+ – just three months after it started – with the token currently valued at $0.012815.

Whales are circling the presale, too. This month alone has seen two whale buys of $161.3K and $100.6K.

By 2030, $HYPER could reach $1.2 or higher, for an ROI of 9,264%.

These are conservative predictions based on the project’s stated goals, but Bitcoin Hyper could exceed expectations, which could push $HYPER to unexpected heights.

So, if you want to invest, now may be the perfect time, as $HYPER is still selling at its presale price. Plus, you can stake it for 89% APY.

Discover how to buy $HYPER here, then go to the official Bitcoin Hyper presale website and get your tokens today.

Should You Buy Into the Bitcoin Hyper Frenzy?

Bitcoin Hyper could represent a turning point for Bitcoin. If implemented successfully, the Layer-2 could catapult Bitcoin up to among the most prolific and performant ecosystems in the crypto world.

For this reason, Bitcoin Hyper ($HYPER) makes a compelling investment case, especially in its presale phase, where even small purchases could prove to be wealth-building moves years later.

However, don’t take this as financial advice. Always do your own research and invest wisely.

Disclaimer: This content has been supplied by a third party contributor. Brave New Coin does not endorse or promote any products or services mentioned herein. Readers are encouraged to conduct independent research before making any financial decisions. The information provided is for informational and educational purposes only and should not be interpreted as investment advice.